Chainalysis: Nearly $100b Of Dirty Crypto Sent To Exchanges Since 2019

Nearly 30% of all crypto traced from illicit addresses since 2019 ended up at sanctioned services like Russia’s crypto exchange Garantex, according to Chainalysis.

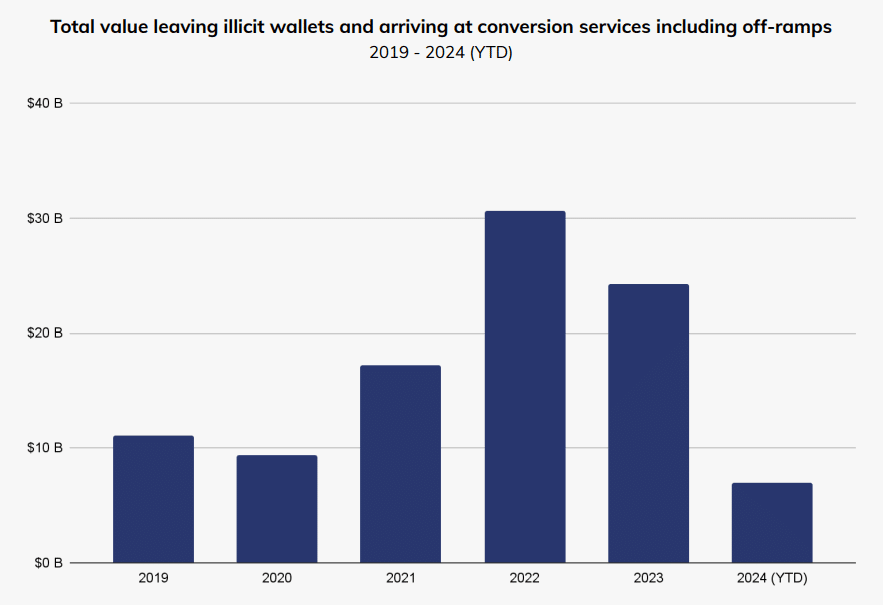

Cryptocurrency exchanges have received nearly $100 billion worth of crypto from well-known illicit addresses since 2019, highlighting a growing lack of international cooperation on anti-money laundering measures.

According to blockchain forensic firm Chainalysis, nearly 30% of all crypto from illicit addresses eventually ended up at sanctioned services such as Russia‘s crypto exchange Garantex. The highest amount was recorded in 2022 when $30 billion of identified “dirty crypto” interacted with sanctioned services.

The data includes only the totals moved from illicit sources to crypto exchange services, Chainalysis points out, adding that it doesn’t include the value “sent and received among intermediaries,” which can involve “tens or hundreds of individual transactions.”

The New York-headquartered firm says an “increasing portion” of illicit funds passing through intermediary wallets is concentrated not in traditional crypto like Bitcoin (BTC) or Ethereum (ETH), but in stablecoins, which now account for “the majority of all illicit transaction volume.”

Despite the rise of stablecoin usage, their issuers have the ability to freeze funds, with Tether, the largest stablecoin issuer, having frozen an estimated 1,600 addresses holding funds worth approximately $1.5 billion worth of USDT, Chainalysis revealed. The amount of assets frozen in other stablecoins isn’t specified.

Stablecoins have become a popular tool for sanction evaders looking to bypass restrictions. In late May, crypto.news reported that Russia’s two largest unsanctioned metal producers started using Tether’s USDT stablecoin for cross-border transactions with Chinese clients and suppliers after the U.S. Treasury Department made it clear it would impose secondary sanctions on lenders facilitating sanctions evasion.

That development came shortly after Venezuela’s state-run oil company PDVSA increased its use of USDT in crude and fuel exports amid tightening U.S. sanctions. Venezuelan oil minister Pedro Tellechea noted at the time that the country uses “different currencies, according to what is stated in contracts,” with some contracts preferring cryptocurrency as a payment method.

Following Tellechea’s statement, Tether publicly reiterated its commitment to adhere to the OFAC SDN list and announced plans to ensure sanctioned addresses are promptly frozen.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more