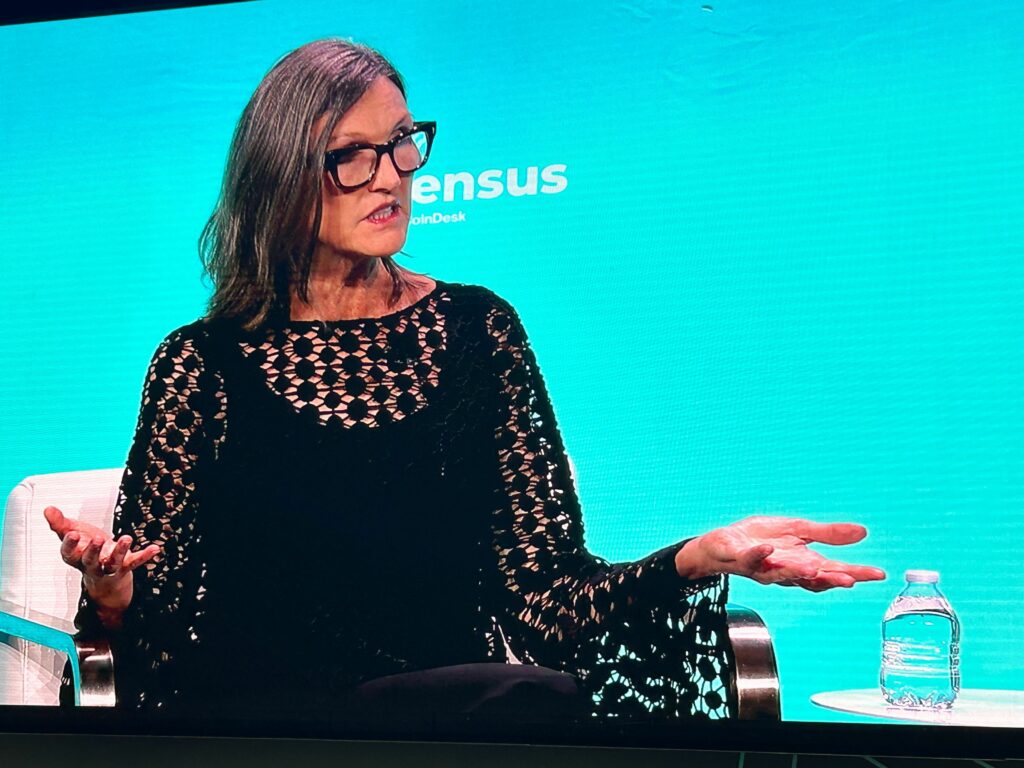

Cathie Wood At Consensus 2024: Bitcoin Is Unstoppable

Speaking at Consensus 2024, Cathie Wood chimed in on her crypto preferences, indicating a partiality to Bitcoin.

During a panel discussion at Consensus 2024, Cathie Wood, CEO of ARK Invest, made her stance clear, expressing strong support for Bitcoin (BTC) over all other coins.

“It is a big idea and unstoppable,” Wood said of Bitcoin, “There’s no throat to choke. When Facebook launched Libra, there was a throat to choke, but there’s no such vulnerability with Bitcoin.”

Wood argued that no other crypto comes close to Bitcoin’s potential and significance. She addressed the importance of maintaining Bitcoin’s principles, like decentralization and self-custody.

“The heat is on because Bitcoin is a new asset class. It’s a monetary system, but it also represents a new asset class,” Wood said at the conference in reference to the recent spot Bitcoin ETF approval.

Cathie Wood on the spot ethereum ETF

Wood called the recent spot Ethereum ETF approval “shocking” and credited the ETF’s quick and seamless approval with pro-crypto momentum in the U.S. government.

“The read was that [the ETF] was not going to be approved. It was absolutely not going to be approved,” Wood said.

Wood referenced the passing of FIT21 and Former President Donald Trump’s “coziness” to crypto, indicating that cryptocurrency policy is an election issue.

“We were sure it was going to be denied,” Wood said.

Cryptocurrency’s emergence as a significant election issue in the United States is prompting candidates and legislators to clarify their stances on regulation, potentially shaping future financial and technological landscapes.

Wood emphasized that voters concerned with finance and economic stability may sway policymakers to adopt clearer guidelines, balancing growth and security in the crypto market.

The Federal Reserve

When asked about the Fed’s utility, Wood expressed the sentiment that it should be discontinued or toned down as Bitcoin and the power of money grow.

“It is time to dial it down dramatically and let market forces prevail,” Wood said.

Wood has criticized the Federal Reserve, echoing themes that it is archaic due to its outdated approach to monetary policy in the face of global asset classes, like Bitcoin.

Bitcoin over Ethereum

When asked if she could only invest in either Bitcoin or Ethereum (ETH), Wood state she would strongly choose Bitcoin.

“Bitcoin, hands down. No question,” Wood said.

Wood once again highlighted Bitcoin’s usability and global monetary value when discussing its popularity over all other crypto options.

Ark’s price target for Bitcoin is based on the assumption that Bitcoin will capture over 3% of the global money supply outside the big four (US, UK, Japan, and Europe). Wood said that this prediction is conservative.

Wood also voiced positive sentiment towards El Salvador’s embrace of Bitcoin, further solidifying her position.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more