Can XLM Price Hit $1 As DeFi TVL And Open Interest Soars?

Stellar price went parabolic on Friday, Nov. 29, as its DeFi ecosystem boomed and its futures open interest reached a record high.

Stellar Lumens (XLM) surged to an intraday high of $0.5510, marking its highest level since Monday. This represents a 27% increase from its weekly low, bringing its market cap to over $16 billion.

Stellar’s rally mirrored that of Ripple (XRP), which jumped by over 20% as its demand jumped. The two coins have a close correlation because of their role in the cross-border payment industry.

Its most recent quarterly report showed that Stellar handled 103 million payment transactions, making it the second-biggest blockchain after Solana (SOL). This popularity is because of its substantially low fees compared to its competitors. Its average fee is $0.000014 compared to Solana’s $0.004473. Stellar’s network is also fast, with its time to finality being about zero seconds.

Meanwhile, data shows that Stellar’s total value locked in the Decentralized Finance industry has jumped to a record high of $60.6 million. With Franklin Templeton’s fund assets included, Stellar has over $300 million in assets.

The network’s assets in DeFi are much lower than in other chains like Base and Sui because it is a relatively new project. Soroban, its layer-1 network was launched a few months ago and is seeing strong growth.

Stellar’s futures open interest has also surged, reaching $371 million, just below its weekly high of nearly $400 million.

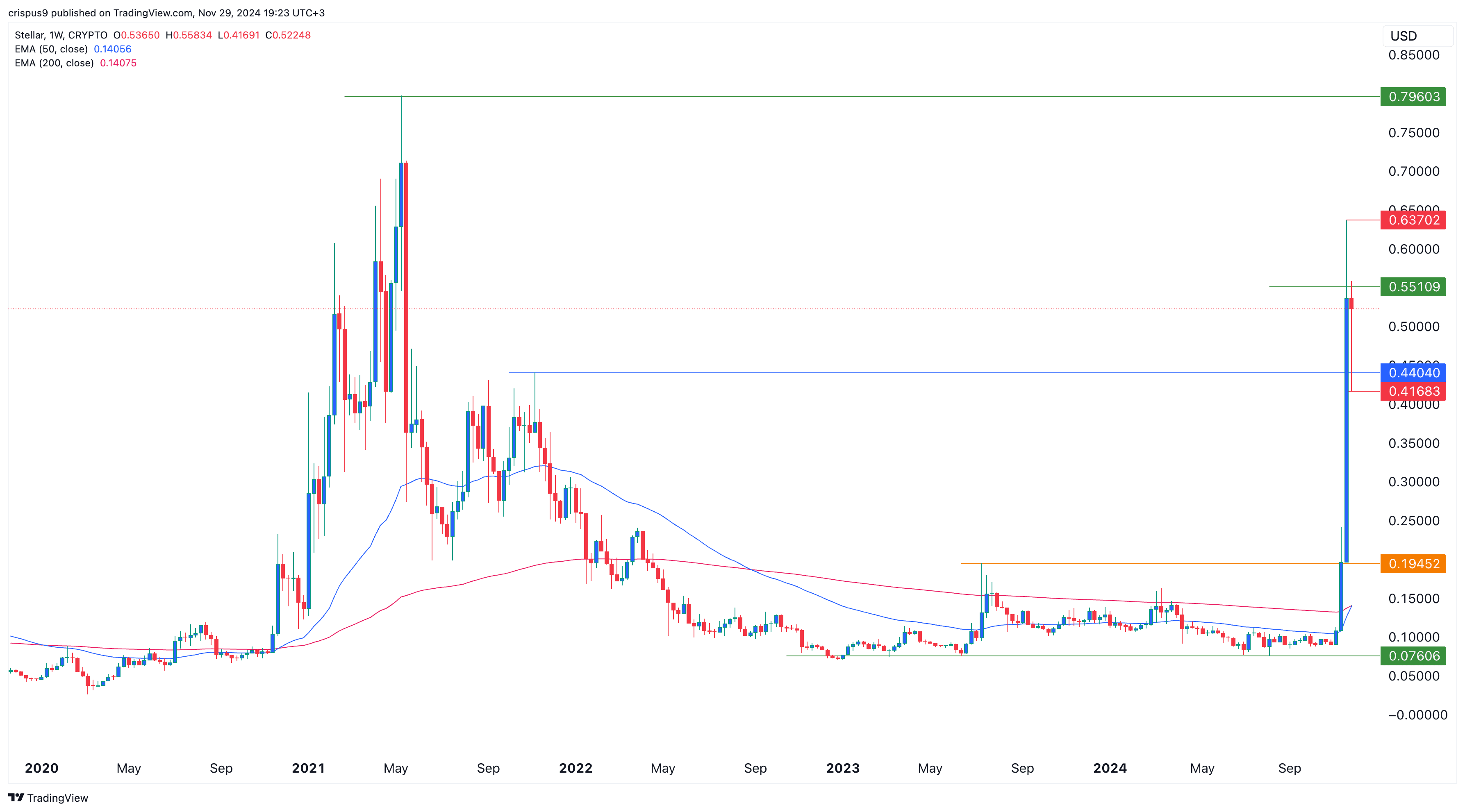

The weekly chart shows that the Stellar Lumens price has jumped sharply in the past few weeks. It has crossed the important resistance level at $0.1945, its highest point on June 10. Moving above that level was important because it was the neckline of the double-bottom pattern at $0.076.

The coin has also jumped above the key resistance at $0.4400, its highest swing in November 2021. Also, it has moved above all moving averages, meaning that bulls are in control for now.

Therefore, with Stellar being highly overbought, there is a risk that it could reverse soon. However, a move above the key resistance level at $0.6370, its highest level last week, will point to more gains, potentially to its all-time high of $0.7960. If it crosses that level, it will jump to $1, doubling from the current level.

This bullish view will depend on whether Bitcoin continues its strong uptrend and crosses the key level at $100,000.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more