BNB Reaches New ATH Amid Highly Volatile Trading

Binance Coin (BNB) has reached a new all-time high for the first time in over three years. However, the asset could witness high volatility.

BNB is up by 12% in the past 24 hours and is trading at $705.8 at the time of writing. Earlier today, the asset touched an ATH of $711.56 — hitting a new ATH for the first time since May 12, 2021.

Thanks to the price rally, BNB’s market cap surpassed the $100 billion mark, last witnessed in December 2021. Moreover, the Binance-native token’s daily trading volume increased by 62%, reaching $4.18 billion.

Notably, the largest centralized cryptocurrency exchange, Binance, burned 1.94 million BNB tokens, worth roughly $1.17 billion on April 24 — bringing bullish momentum to the asset. BNB currently has around 147.58 million tokens in circulation.

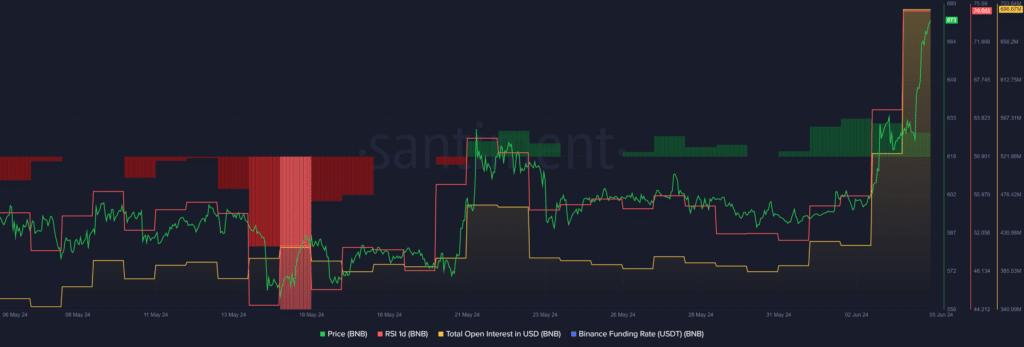

According to data provided by Santiment, the BNB total open interest surged by 32.5% over the past 24 hours — rising from $525.66 million to $696.67 million. The sudden increase in the open interest shows signs of highly volatile trading since some traders are still betting on a further price rally for the token.

Moreover, data from the market intelligence platform shows that the BNB Binance funding rate dropped from 0.02% to 0.01% in the past 24 hours. The downward momentum in the funding rate shows that the amount of traders betting on the BNB price drop has increased.

In addition, the BNB Relative Strength Index (RSI) is currently sitting at the 74 mark, per Santiment data. The indicator shows that BNB is overbought at this price point and some investors could shift to short-term gains.

For BNB to remain in the bullish zone, its RSI would need to cool down below the 50 mark.

It’s important to note that high price volatility would be expected for BNB due to the sudden increase in the token’s open interest and declining funding rates — which could ultimately bring a large amount of liquidation.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more