Bitcoin Sinks Below $68k Following US Inflation Data Release

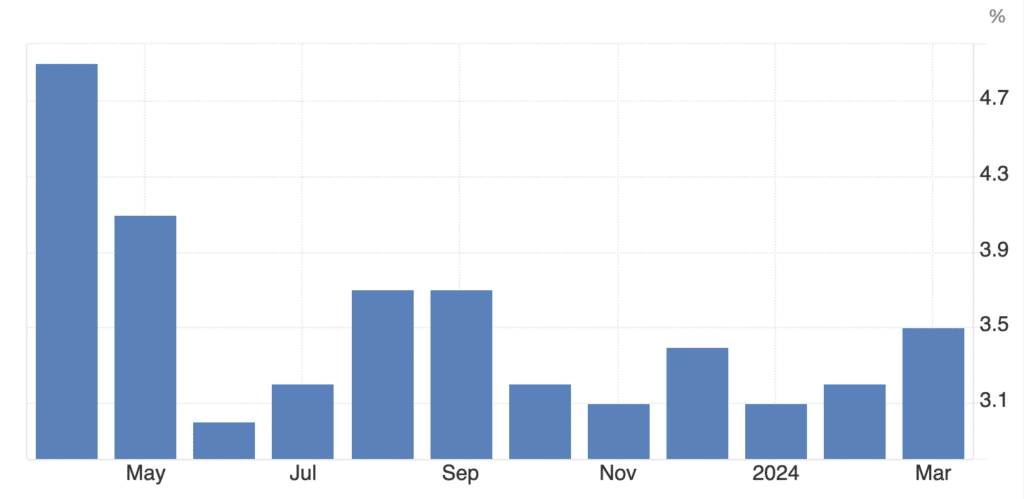

March’s annual consumer price index in the U.S. was 3.5%, and Bitcoin reacted with a decline.

Against this background, Bitcoin (BTC) experienced a sharp decline, reaching about $67,500. In monthly terms, according to the U.S. Department of Labor, inflation accelerated by 0.4% — significantly higher than the value from February. The Inflation Rate figure continued to rise for the third consecutive month since January.

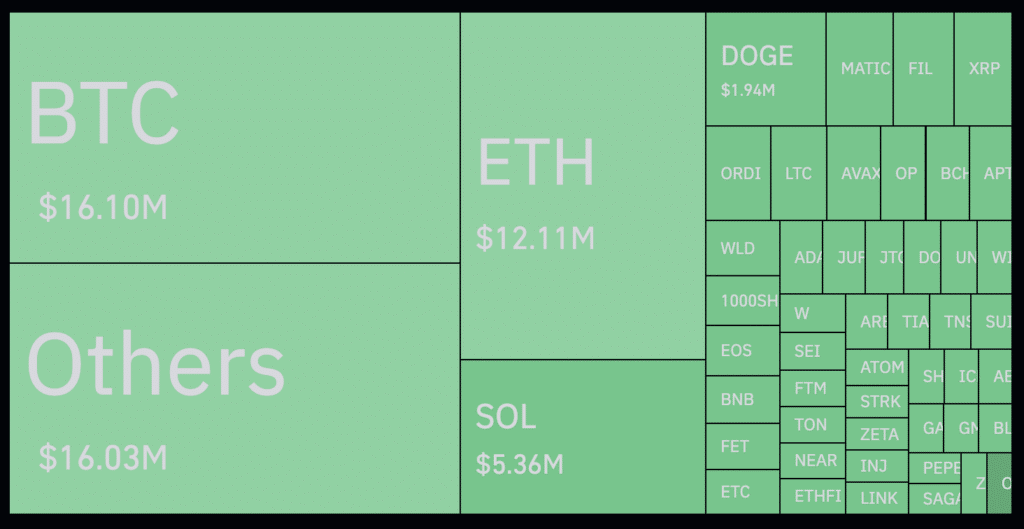

Immediately after the publication of inflation data, Bitcoin’s price fell below $68,000. BTC had already experienced a drawdown, which caused a wave of liquidations in future contracts. According to CoinGlass data, liquidations reached $311 million, with a significant prevalence of long positions.

As of this writing, BTC is trading at around $67,700, recovering slightly from its sharp decline. Trading volumes increased by 7% to $35.6 billion over the past 24 hours.

The consumer price index measures inflation. When CPI reaches high values, fiat currencies like the dollar lose their purchasing power. Some consider Bitcoin a haven for capital, however, in practice, the correlation between CPI and Bitcoin’s price is not always positive and straightforward. The digital asset market is characterized by its volatility.

At the end of March, analysts at QCP Capital stated that BTC could face a correction in the medium term due to rising inflation rates in the United States. In its forecast, QCP analysts pointed to a reduction in capital inflows into the spot Bitcoin ETF sector. The indicator’s transition to the red zone resulted in an ‘inadequate’ drawdown in the asset price below $61,000.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more