Bitcoin Price Analysis: DXY, US Bond Yields Crash, M2 Money Supply Rises

Bitcoin price has remained under pressure in the past few months as it moved into a technical bear market after falling by 20% from its highest level this year.

Bitcoin (BTC) and other altcoins have important catalysts that may push it higher in the next few months. It was trading at $90,000, up by about 15% from the lowest level this month.

First, US bond yields have retreated from their highest levels this year. The benchmark ten-year yield dropped from 4.8% in January to 4.24%. The 30-year and five-year yields have also slipped in the past few weeks.

Falling bond yields is a sign that the market anticipates that the Federal Reserve will deliver more interest rate cuts this year. Economists are pricing in three cuts after the US released a series of weak economic data. Consumer and business confidence has fallen after Donald Trump added tariffs on key US trading partners.

The labor market has also softened, with the unemployment rate rising to 4.1% in February and nonfarm payrolls rising by 151,000, which is lower than the expected 159,000.

US dollar index and bond yields have crashed

Second, the US dollar index or the DXY has moved into a freefall. It has dropped in the last five consecutive days, moving to a low of $103.78, its lowest level since November. It is down by almost 7% from its highest level this year. Bitcoin price often does well when the US dollar and bond yields are slipping because it raises the odds of Fed interest rate cuts.

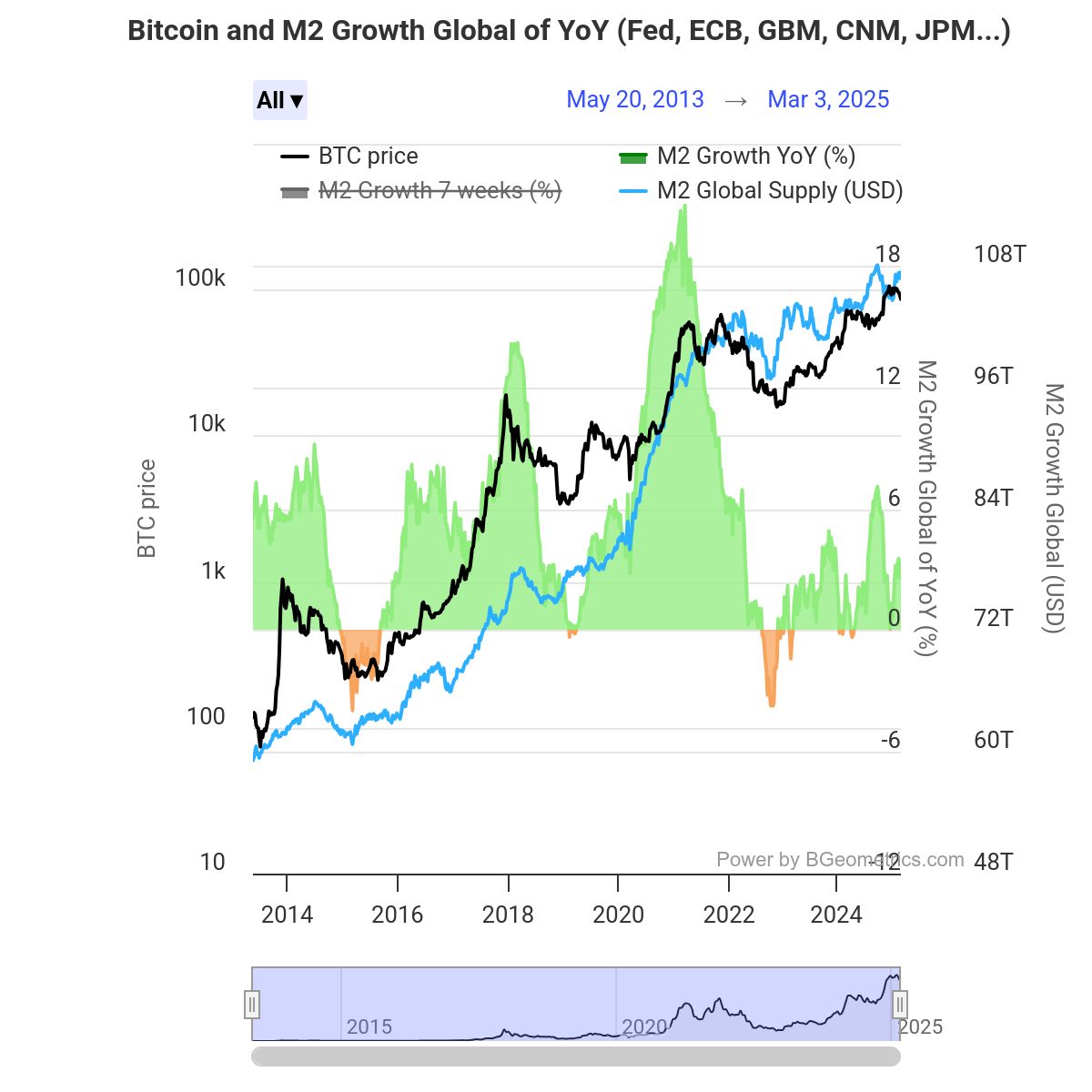

Further, the global money supply is expected to keep rising as governments ramp up their spending. Germany is aiming to spend billions of dollars on its defense, while China has announced plans to boost spending. The chart below shows that Bitcoin has a close correlation with the global M2 money supply.

Bitcoin price technical analysis

The daily chart shows that the BTC price has held steady in the past few days, rising from a low of $78,000 last week to $90,000.

Bitcoin has remained above the ascending trendline, which has connected the lowest swings since August of last year. It has also moved above the 50-day moving average and the weak, stop & reverse point of the Murrey Math Lines.

Therefore, Bitcoin needs to rise above the strong, pivot, and reverse level at $93,750 to confirm the bullish breakout. This price coincides with the highest level this week. A move above that level will point to more gains, potentially to $100,000.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more