Bitcoin Holds Steady Amid Stock Market Crash, Says Unchained Analyst

As the stock market declines due to U.S. tariffs on most of its trading partners, Bitcoin has shown some resilience. An expert at Unchained explains why.

US stocks have seen some of the worst performance in years. However, Bitcoin (BTC) showed relative resilience, which is great news for institutional investment, explains Joe Burnett, Director of Market Research at the crypto financial firm Unchained.

On April 4, the Dow Jones Industrial Average shed more than 2,200 points, adding to Thursday’s decline of 1,679 points. This was the worst two-day performance in history, leaving many equity investors anxious over the weekend.

At the same time, Bitcoin showed relative resilience, even starting to recover, and actually registered a 2.2% gain in the last 24 hours. Burnett suggested that this is a repeat of the pattern from 2020, when Bitcoin prices led the market recovery.

Recalling March 2020, bitcoin rapidly bottomed and recovered first (before U.S. equities), a pattern potentially repeating today as bitcoin hasn’t made new lows since March 11th.

Due to Bitcoin’s high volatility, Burnett said it is often the first asset investors sell when liquidity dries up. However, because the selloff is typically fast and aggressive, Bitcoin often bottoms before equities.

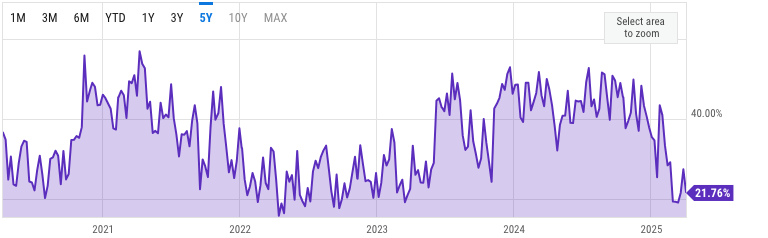

This may also indicate that stocks are nearing a bottom. Supporting this view is the AAII investor sentiment survey, which fell to 19.11% on March 13, the lowest level since the pandemic. This extreme negative outlook could mean that stocks are set for a reversal.

Still, Burnett cautioned that this does not guarantee Bitcoin is out of danger.

Of course, if stocks continue falling aggressively over the coming weeks, it’s reasonable to expect that bitcoin could experience another leg down too.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more