Bitcoin CME Futures Hit $100k, But Spot Price Hasnt Caught Up

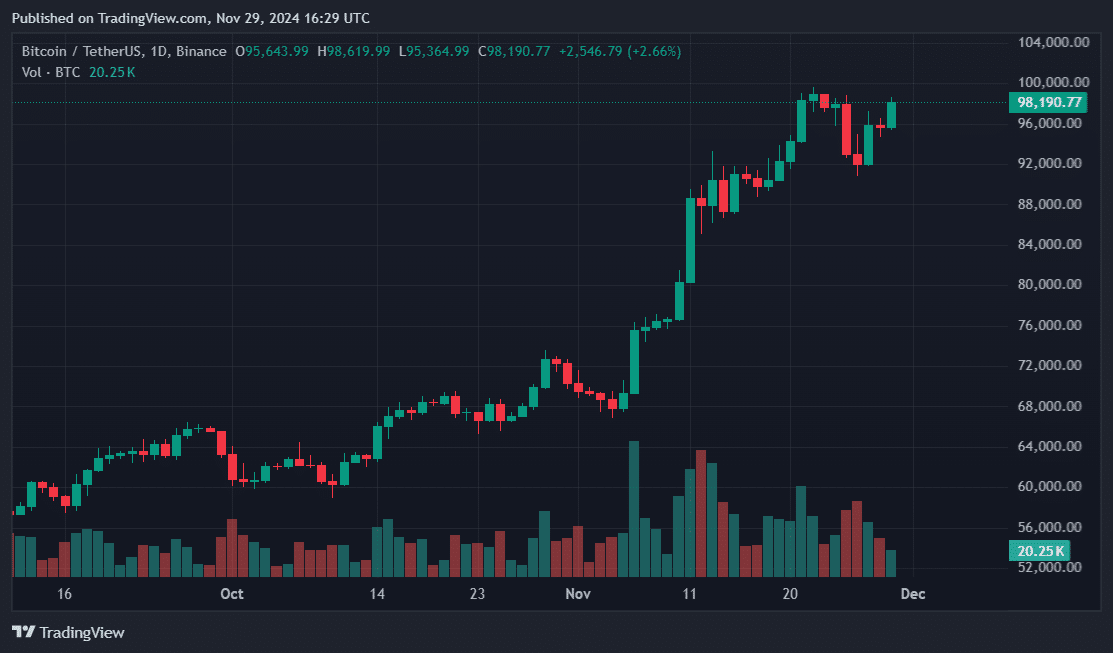

Bitcoin touched $100,000 on the CME Futures platform while the token’s spot price remained slightly lower during Thanksgiving.

TradingView data tracking Bitcoin (BTC) CME Futures showed that the largest cryptocurrency crossed $100,085 on the derivatives marketplace during the late morning hours of Nov. 29.

Meanwhile, BTC’s spot price lingered at $98,285 after reaching its $99,645 all-time high on Nov. 22. The subsequent pullback to $91,000 after hitting ATH prompted experts to comment on a “BTC cool-down.”

CME Futures data suggests Bitcoin could reach new peaks sooner than expected. Coinglass analysis echoed this sentiment, noting BTC Futures open interest surged to $61 billion at the time of writing.

Open interest rose by 50% in just over a month, fueling debates over whether the market will correct or maintain upward momentum.

Whatever the case, institutions and national authorities rushed to acquire Bitcoin for corporate treasuries and government reserves. MicroStrategy led the private firm caucus and held around $35 billion in BTC. Firms like SOS Limited and Metaplanet followed suit, allocating millions of dollars toward buying BTC.

While the U.S. was the largest sovereign BTC holder, the country under President Donald Trump could increase its crypto war chest. Trump’s transition team assessed personnel for a crypto council that could realize his BTC stockpile promise.

Senator Cynthia Lummis from Wyoming also submitted a bill to buy one million BTC over five years as Bitcoin increasingly emerged in geopolitical discussions. More countries like Brazil and jurisdictions such as Vancouver in Canada sought to trod the path paved by El Salvador, which owns around $500 million in BTC since its first buy in 2020. Switzerland also passed legislation to study how BTC could improve its power grid.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more