Binance: Regulatory Uncertainty Clouds Future Of New Crypto ETFs

Analysts at Binance note that regulatory uncertainty is overshadowing the future of new crypto ETFs, raising concerns about their potential approval and market impact.

As regulatory uncertainty looms over new crypto exchange-traded funds linked to assets like Solana (SOL) and XRP (XRP), analysts at Binance emphasize the need for fundamental growth across the broader ecosystem to attract institutional investment and ensure “long-term growth.”

In a Friday research report seen by crypto.news, the analysts raised concerns related to the newly submitted ETFs, noting that these tokens have a limited derivative market size, minimal institutional participation, and ongoing regulatory scrutiny. They suggested that the approval process for these new asset ETFs “will likely be both lengthy and complex.”

“The market may also await the broader success and acceptance of Ethereum ETFs as a precedent before considering further digital asset ETFs.”

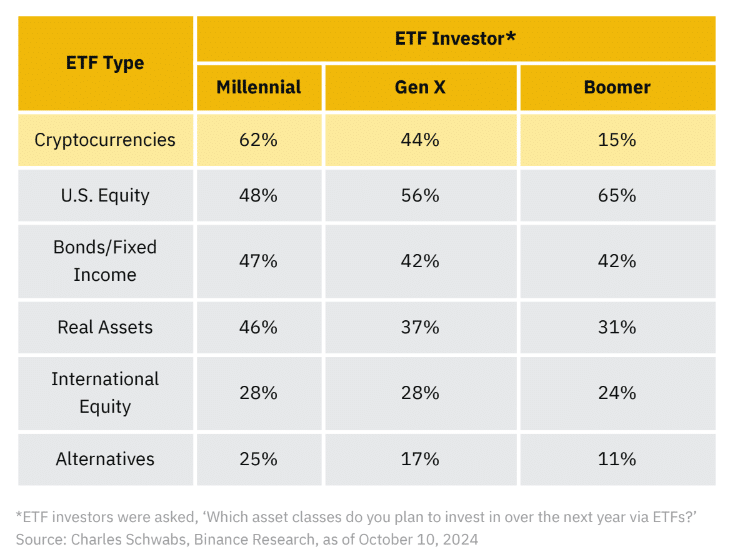

Binance

Still, the analysts noted that the impending election season could influence regulatory perspectives, potentially altering the trajectory for these products. Historically, crypto markets have reacted sharply to new developments and narratives, yet long-term growth will depend on sectors like decentralized finance, tokenization, and stablecoins achieving product-market fit, according to the report.

While spot ETFs have facilitated entry for many investors, they represent “only one piece of the broader market,” Binance says. For sustainable growth in the crypto sector, the analysts argue that capital needs to flow into diverse areas “beyond Bitcoin,” adding that attracting substantial institutional investments will likely require the market to “shift toward fundamentals-driven growth.”

Analysts at Binance concluded that the expansion of blockchain-native products will not only promote on-chain adoption but also attract greater investment into Bitcoin (BTC), Ethereum (ETH), and the broader crypto ecosystem.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more