Banana Gun Goes Parabolic As Futures Open Interest Hits All-time High

Banana Gun, the popular crypto trading bot, surged to its highest point in almost two months as the volume in its ecosystem rose.

Futures open interest surges

Banana Gun (BANANA) token rose for two consecutive days, reaching an intraday high of $55, up 68% from its lowest level in September.

This rally occurred in a high-volume environment, with most of the action happening on Binance, the largest exchange in the industry. Its 24-hour volume increased by 87% to $56 million.

More data shows that Banana Gun’s open interest in the futures market continued rising, reaching a record high of $30 million. That was a big increase since its futures open interest bottomed at $13 million in September.

The rally is likely due to the platform seeing strong volume. In an X post on Monday, the developers noted that the network had over $137 million in volume last week. It recorded an impressive $23 million in volume on Sunday, indicating that its ecosystem is booming.

Banana Gun has become one of the biggest Telegram bot in the crypto industry, handling over $6.7 billion in volume, according to its website. Most of this trading happens on its Ethereum (ETH) ecosystem, followed by Solana (SOL), Blast, and Base.

Data by Dune shows that Banana Gun has had over 294,000 lifetime users who have executed 11 million trades. Another data by DappRadar shows that the number of unique active wallets rose by 22% in the last 30 days, while volume jumped by 72% to $584 million.

Banana Gun price is soaring

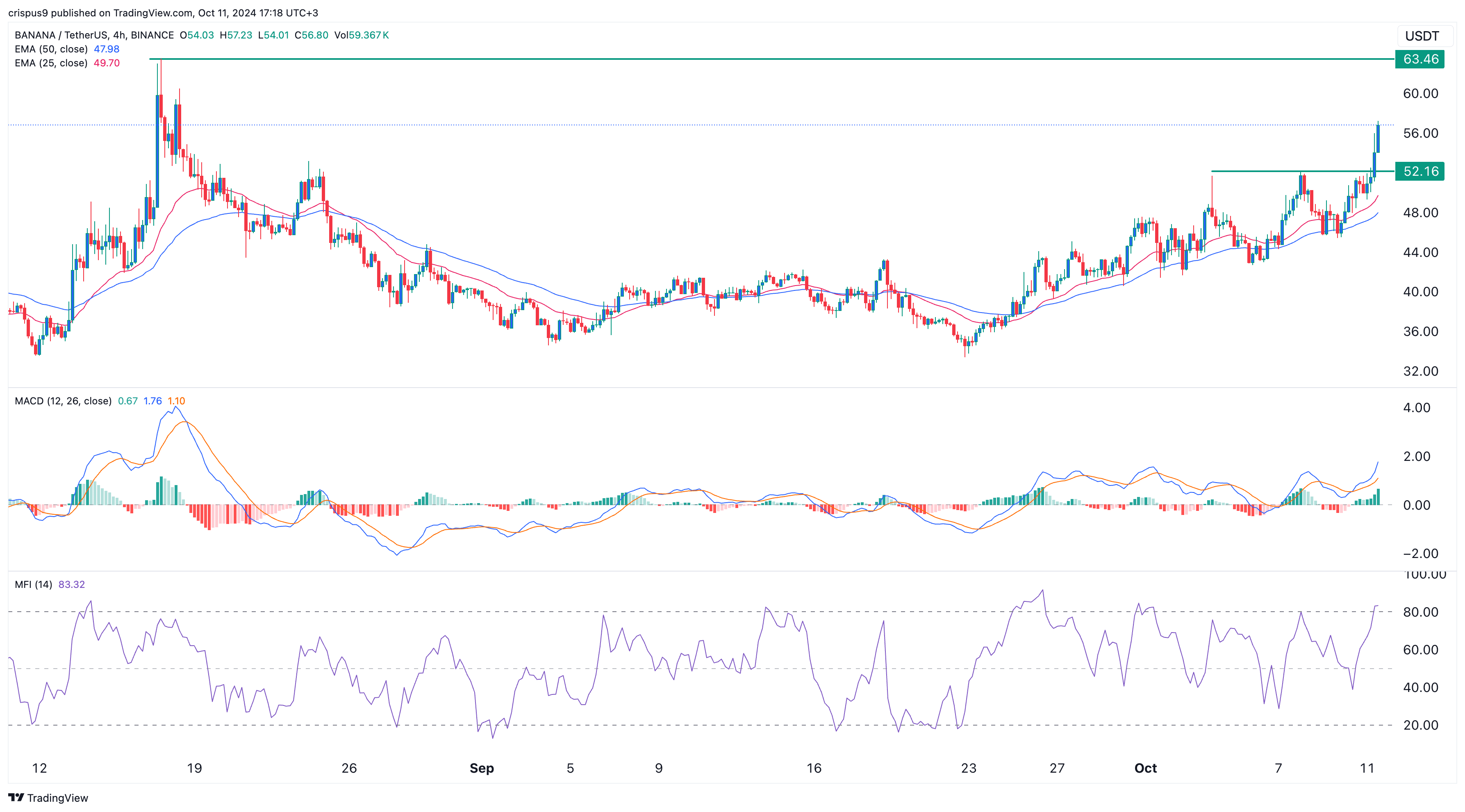

The 4-hour chart shows that the Banana Gun token has been in a strong bull run over the past few days. It flipped the important resistance point at $52.15 on Friday, marking its highest point on Oct. 8.

The token has also remained above the 50-period and 25-period moving averages. Additionally, oscillators like the Money Flow Index and the MACD have pointed upwards.

Therefore, the token will likely continue rising as bulls target the all-time high of $63.45, which is about 12% above the current level.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more