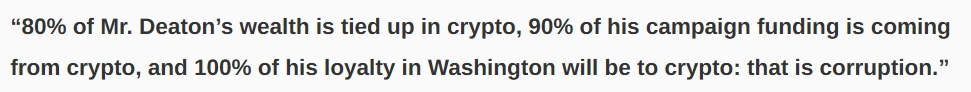

In a heated exchange between Senator Elizabeth Warren and Attorney John Deaton, a debate arose over the percentage of Deaton’s campaign funding sourced from the crypto industry. Warren’s statement that “90%” of Deaton’s support is from crypto sources raised questions. This claim prompted Eleanor Terret, a FOX journalist, to dig deeper along with James Delmore, a blockchain analyst of Breadcrumbs. Their investigation sheds light on the actual numbers behind Deaton’s campaign funding.

????NEW: In both debates between @SenWarren and @JohnEDeaton1, Warren kept repeating that Deaton’s campaign is “90% funded by the crypto industry.”

That seemed like a high number so I did some digging with the help of blockchain analyst @JamesDelmore1 of @AppBreadcrumbs.… https://t.co/PUfbFXowwd

— Eleanor Terrett (@EleanorTerrett) October 24, 2024

Examining Warren’s Campaign Funding Claims

According to the data uncovered by Terret and Delmore, Deaton’s campaign financial totals approximately $2 million, of which he personally loaned $1 million. Thus, the remaining $1 million in donations came from the outside supporters. So only $100,000 of these donations, or about 10%, came from individual in the crypto sector.

Deaton’s Commonwealth Unity Fund and its Impact

The Commonwealth Unity Fund, a super PAC supporting Deaton’s candidacy, has raised $2.5 million, but these funds are legally separate from Deaton’s direct campaign finances. If included, the proportion of crypto-related contributions would rise to 60%, but still short of Warren’s 90% claim.

Deaton has received significant support from prominent crypto figures, including Ripple executives Brad Garlinghouse and Chris Larsen, and Gemini co-founders Cameron and Tyler Winklevoss. However, crypto donors represent a small fraction of his total individual donations.

Terrett’s investigation reveals a nuanced picture of Deaton’s campaign financing, indicating that while crypto donors are a part of his base, they are far from the what Warren suggests. This discrepancy brings attention to the need for clear distinctions between direct campaign funds and Super PAC contributions when discussing financial support for political figures. Transparency and precise reporting on funding sources remain critical as campaigns become more scrutinized.

Also Read: Binance Launches $MOODENG Perpertual Contract; Price Surges 150%