3 Reasons Why AAVE Price May Surge 200% This Year

AAVE declined for the second consecutive week, mirroring the performance of most altcoins as tariff risks remained a concern.

AAVE (AAVE) token fell to a low of $196.4, its lowest level since November 25, and is currently 50% below its highest level this year.

The token has a few catalysts that may push it to its all-time high of $666, up by 170% from the current level.

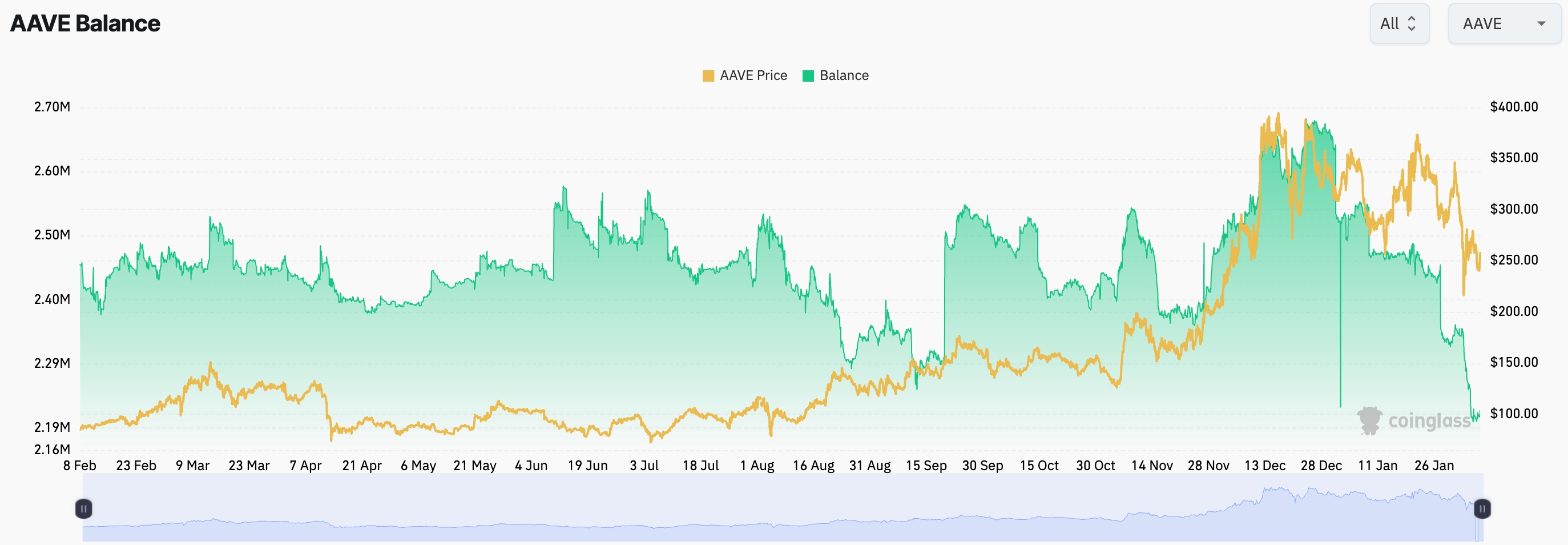

First, there are signs of increased accumulation by investors. Coinglass data shows that AAVE’s balances on exchanges have crashed to the lowest level in years. These balances moved to 2.2 million on Friday, down from 2.67 million in December.

A significant drop in exchange balances suggests that investors are holding their tokens rather than selling, which is a positive indicator. In contrast, rising balances often indicate selling pressure, as investors move their holdings from self-custody to exchanges to sell.

Second, AAVE is still the biggest lending and borrowing protocol in the crypto industry, with about $20 billion in assets. It is also one of the most profitable as the annualized fees has jumped to over $721 million. TokenTerminal data shows that it has made over $103 million in fees this year.

Notably, AAVE successfully handled over $201 million in liquidations on Monday as cryptocurrency prices dropped. Despite the substantial liquidations, no bad debt was accrued to AAVE, and total bad debt fell by 2.7%.

https://twitter.com/chaos_labs/status/1886399314462683277

AAVE’s network is also expanding. More than 440 million USDS stablecoins have been deposited into the network. Additionally, AAVE has moved to Base, the blockchain network owned by Coinbase, and a vote is underway to activate it on Linea.

AAVE’s price has strong technical indicators that suggest a potential rally in the coming months. It has formed a cup and handle chart pattern, with the upper boundary at $400. The recent pullback is part of the handle formation, which is typically followed by a strong rebound.

AAVE has also formed a small hammer candlestick pattern, signaling that the handle phase may be ending, which could lead to further gains. The depth of the cup is about 90%, and measuring the same distance from the upper boundary suggests that the coin could surge to $765 in the long term, a 200% increase from its current level.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more