YEN, US DOLLAR, CHINA, PBOC, STIMULUS, COVID-19 – TALKING POINTS:

- Yen, US Dollar down as financial markets cheer Chinese stimulus increase

- Australian Dollar in the lead as PBOC pledges “more powerful” measures

- European, US stock index futures hint risk-on follow-through likely ahead

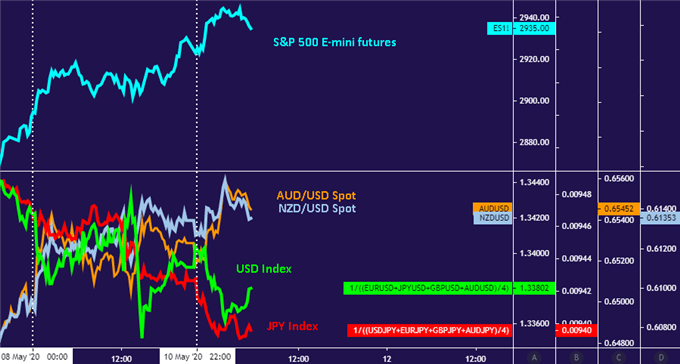

The Japanese Yen traded broadly lower as an upbeat mood prevailed across financial markets at the start of the trading week, punishing the perennially anti-risk currency. The US Dollar also faced selling pressure as the rosy backdrop sapped haven demand. The cyclical Australian Dollar registered outsized gains, tracking higher alongside Asia Pacific stocks.

A positive lead from Friday’s Wall Street session looks to have been compounded by hopes for more monetary stimulus from China. Writing in its quarterly policy implementation report, the People’s Bank of China (PBOC) said the country faces unprecedented economic challenges in the wake of the Covid-19 outbreak. It promised to deploy “more powerful” measures to help reboot growth.

The PBOC demonstratively excluding a previous commitment to “avoid excess liquidity flooding the economy” in its guidance and scrapped verbiage pointedly flagging reserve requirement ratios (RRR) as the vehicle for easing. That bolsters the sense that a new toolkit is on verge of being unveiled. Still, the central bank said it will stock to “normal” policy, implying an aversion to QE or a negative rate regime.’’

Chart created with TradingView

Looking ahead, a relatively limited offering of scheduled event risk suggests broad-based sentiment trends will continue to drive price action. Futures tracking European and US equity benchmarks are pointing higher in late APAC trade, suggesting the risk-on tilt has scope to extend as bourses in London, Frankfurt and New York come online. Headline sensitivity remains high however, warning of elevated reversal risk.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter