Japanese Yen, USD/JPY, Moderna, Coronavirus, Dow Jones, Crude Oil – Asia Pacific Market Open

- Japanese Yen depreciated as Dow Jones and S&P 500 surged

- All eyes turned to Moderna coronavirus vaccine trial outcome

- USD/JPY may rise, AUD/USD and NZD/USD could also gain

The anti-risk Japanese Yen and similarly-behaving US Dollar were some of the worst-performing major currencies on Monday. On the flip side of the risk spectrum, the sentiment-oriented Australian Dollar and New Zealand Dollar appreciated. As one might anticipate, there was a broad aggressive upbeat tone in sentiment over the past 24 hours. The Dow Jones and S&P 500 closed +3.85% and +3.15% respectively.

While market mood was generally upbeat throughout the session, the pace aggressively picked up tempo in late European and early North American trade. Reports crossed the wires from Moderna – a US biotechnology company – that a vaccine had ‘promising results’ in an early interim clinical trial. The doses triggered an immune response in eight healthy volunteers. The CEO of Moderna said the data ‘couldn’t have been better’.

The results likely brought forward expectations of a sooner-than-anticipated recovery in global growth. WTI crude oil closed at its highest in over 2 months. This is as China reported that oil demand at pre-covid 19 levels. Energy shares were the outperformers on Wall Street followed by industrial stocks. The Euro appreciated as Germany and France proposed a €500 billion coronavirus recovery fund.

Discover your trading personality to help find forms of analyzing financial markets

Tuesday’s Asia Pacific Trading Session

With that in mind, Asia Pacific equities may follow Wall Street higher. That could open the door for the Australian and New Zealand Dollars to expand upon gains over the past 24 hours. The AUD/USD may also look past incoming RBA meeting minutes after a rather tepid response to the rate announcement earlier this month. It may focus on broader sentiment instead. An upbeat tone may also bode ill for the Yen.

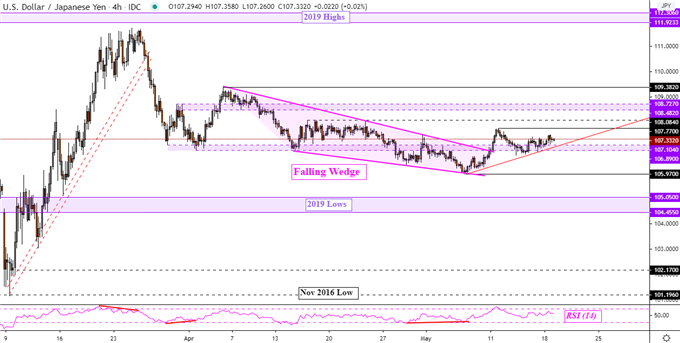

Japanese Yen Technical Analysis

USD/JPY may still be in a position to see gains pickup from a technical standpoint. Last week, prices pushed above a bullish Falling Wedge chart pattern. Follow-through has been somewhat lackluster, but prices seem to be pointing upward after testing near-term rising support from May 6 – red line below. That places the focus on immediate resistance at 107.77. Clearing the latter may pave the way for further gains.

USD/JPY Technical Analysis – Daily Chart

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter