US Dollar Outlook, US Q1 GDP Data, Jobless Claims Report – Talking Points

- US Dollar may rise if Q1 GDP data reinforces fear of prolonged recession

- Initial jobless claims report could amplify demand for haven-linked assets

- EUR/USD has broken above a key inflection range – what happens now?

Asia-Pacific Recap

Early into Asia’s Thursday trading session, foreign exchange markets traded mixed though the anti-risk Japanese Yen was in the red versus its G10 counterparts. Meanwhile, US equity futures pointed higher despite the number of Covid-19 cases topping 5 million. The Bank of Korea projected 2020’s GDP growth rate for the country at -0.2 percent vs the 2.1 percent forecast in February.

The spread on credit default swaps (CDS) for insuring South Korean sovereign debt subsequently widened in conjunction with a strengthened USD/KRW exchange rate. To learn more about credit derivatives and their impact on FX markets, be sure to follow me on Twitter @ZabelinDimitri.

US Q1 GDP Data: What to Expect

The US Dollar may rise if the secondary reading for Q1 GDP data out of the world’s largest economy prints a worse-than-expected figure. Covid-19 and the subsequent shelter-in-place orders implemented to contain it has caused the global economy to come to a grinding halt. Consumption and job creation has been crushed as businesses scramble to stay afloat amid the worst economic crisis since the Great Depression.

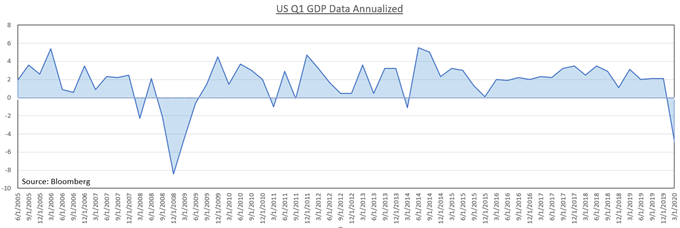

Q1 US GDP Data is Anticipated to Show an Unchanged Figure at -4.8 Percent

Demand for liquidity may spike if the statistics reinforce worries about the outlook for growth amid the so-called “Great Lockdown”. Fed Chairman Jerome Powell has said that the most important metrics to monitor are medical. For the time being, fiscal and monetary policies are in large part crafted and implemented in accordance to the prevailing trend in coronavirus-related statistics.

A higher number of infected and fatal reports will likely then be reflected in prolonged and/or stricter lockdown measures which would almost certainly exacerbate the economic contraction. As a result, lawmakers and monetary authorities will likely then implement more growth-stimulating policies.

Employment Data May Amplify Risk-Off Tilt

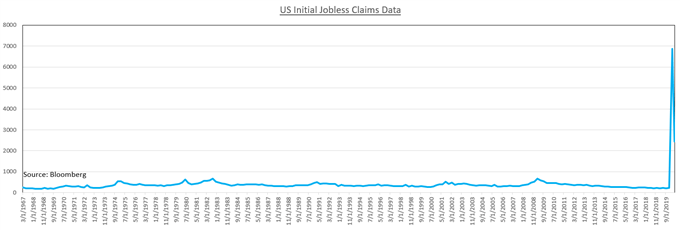

Initial jobless claims data is anticipated to print a 2100k figure as unemployment continues to skyrocket to unprecedented levels amid the coronavirus pandemic. While the estimate is lower than the prior 2438k print, the prospect of softer consumption from fewer people spending money has wide-ranging implications for economic activity.

Consequently, if the figures are worse-than-expected, it could spark a risk-off tilt in market mood and cause capital to flow into the haven-linked US Dollar. In this scenario, growth-oriented assets like equities, emerging market FX, AUD, NZD, NOK and other cycle-sensitive assets could be at risk of facing heightened liquidation pressure.

EUR/USD Outlook

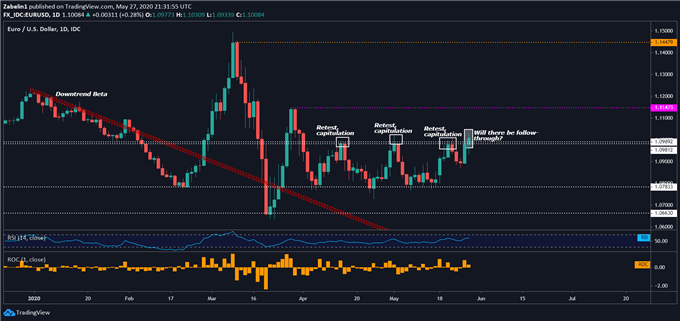

EUR/USD has broken above the upper layer of the 1.0981-1.0989 inflection range – but will there be follow-though? The pair has traded sideways since early April, but a break above resistance could open the door to retesting the swing-high at 1.1142 (purple-dotted line). Surmounting that ceiling could inspire additional buyers to enter the market if it signals that a bullish short-term run is in the cards.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter