Japanese Yen, USD/JPY, CSI 300, BoJ Governor Kuroda - Talking Points

- Wall Street sees optimistic trading session, with Dow, S&P 500 hitting fresh record highs

- Chinese equities under pressure as traders weigh tightening liquidity markets in China

- USD/JPY in focus after a Golden Cross formed with BoJ Governor Speech on tap for today

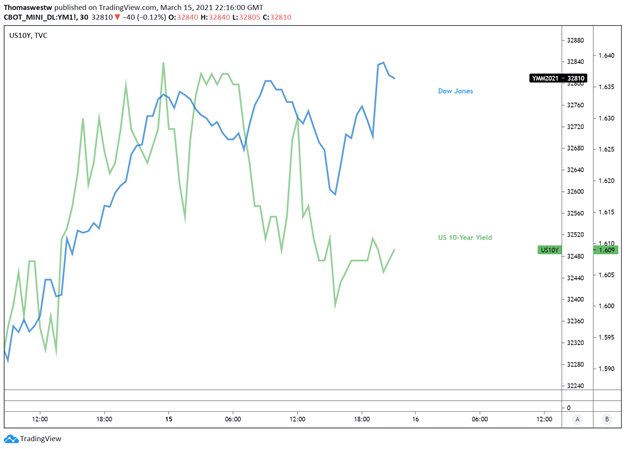

US equity markets saw an influx of strength today as investors continue to grow more optimistic about the global economic recovery. The Dow Jones Industrial Average (DJIA), S&P 500, and small-cap Russell 2000 index all closed at record highs. Technology stocks also gained, pushing the Nasdaq 100 Index 1.12% higher. The 10-year Treasury yield pulled back slightly along with other longer-dated government bond yields.

Wall Street will turn an eye to US retail sales for February, slated to cross the wires Wednesday, with analysts expecting a 0.5% drop versus the prior month, according to the DailyFX Economic Calendar. A better-than-expected figure will likely add to the economic rebound story as vaccine progress in the United States continues to progress.

The vaccine rollout in the United States has seen better progress than initially expected. More than 109 million doses have been administered so far in the US, according to Bloomberg. Markets will also be watching the Federal Reserve as the central bank begins a two-day meeting when it will announce a decision on interest rates later this week.

Dow Jones vs US 10-Year Treasury Yield - 30-Minute Chart

Chart created with TradingView

Tuesday’s Asia-Pacific Outlook

Asia-Pacific equity markets may move higher at the open after a mixed performance on Monday. Hong Kong’s Hang Seng Index (HSI) closed 0.33% higher. However, liquidity concerns pushed mainland China’s CSI 300 deep into the red, closing 2.15% lower. Elsewhere, Australia’s ASX 200 managed to gain 0.09%, while South Korea’s KOSPI lost near’ a quarter of a percentage point.

The liquidity concerns in China drove sentiment to help push equities in the country lower despite better-than-expected data prints on Monday showing the world’s second-largest economy’s recovery remains strong. Concern over the Chinese government tightening conditions stemmed from the People’s Bank of China (PBOC) injecting 100 billion Yuan – nearly matching the amount due in markets.

Tuesday’s economic calendar shows minutes from the most recent RBA meeting and industrial production data out of Japan. Hong Kong and South Korea will release unemployment data. Bank of Japan (BoJ) Governor Haruhiko Kuroda is set to give a speech at the FIN/SUM conference. Later this week, the BoJ will announce its interest rate decision when some suspect that the central bank will announce a phasing out of its target on asset buying.

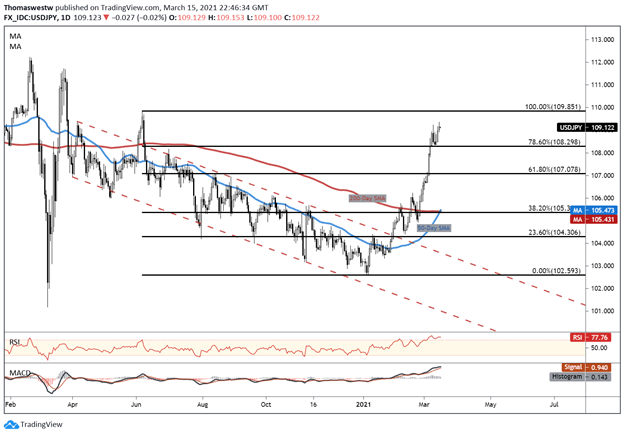

USD/JPY Technical Outlook

The US Dollar has seen a significant strengthening versus the Japanese Yen as the global reflation trade heats up, driving investors out of the safe-haven Yen. USD/JPY is up nearly 2.5% since the start of March, and upside momentum may drive prices higher. A Golden Cross formed this week, with the 50-day Simple Moving Average (SMA) crossing above the longer-term 200-day SMA.

The bullish signal may help propel prices higher after the bullish signal’s completion despite an already overbought reading on the Relative Strength Index (RSI). A pullback, however, could see prices drop to the 78.6% Fibonacci retracement level. To the upside, the June multi-month high is now in focus at 109.851

USD/JPY Daily Chart

Chart created with TradingView

USD/JPY TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinarand have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwateron Twitter