Europe Open, USD/JPY, FOMC, Nasdaq Talking Points:

- Risk appetite was plentiful in Asia trade as Australian consumer confidence rebounded

- The Nasdaq 100 has breached 10,000 despite US entering first recession since 2009

- USD/JPY slicing through three-month trend support. Where to next?

Asia-Pacific Recap:

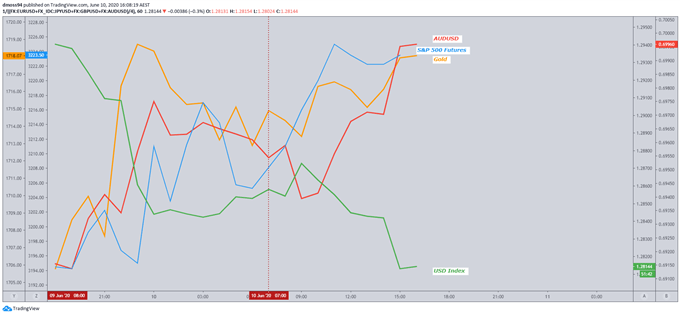

‘Risk-on’ was the motto for investors during Asia trade as the ASX 200 pushed back above 6,100 after Westpac Consumer Confidence bounced to pre-crisis levels, rising 6.3% in June.

The risk-sensitive Australian and New Zealand Dollars followed equity markets higher as the haven-linked US Dollar continued its fall to 12-week lows.

US Treasury yields declined alongside crude oil and gold continued its climb back above 1,700 as investors eye the upcoming FOMC meeting.

Source – Trading View

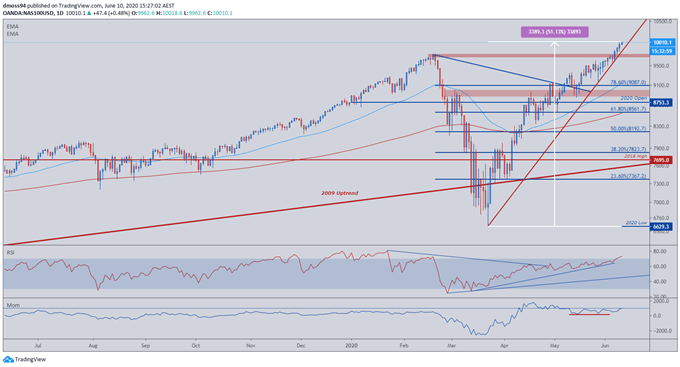

Nasdaq Hits 10,000 as US Enters Recession

Economists from the National Bureau of Economic Research declared Monday that the US has formally fallen into recession due to the “unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy”.

This news failed to dull tech investors, as the Nasdaq 100 surged above the historic 10,000-handle confirming a new ‘bull market’.

Currently up 14% on the year and more than 50% from the yearly low set in March (6,629), the Nasdaq has erased any fallout from the coronavirus outbreak as it pushes into overbought territory for the first-time post-crisis.

Although price continues to climb, the momentum indicator fails to confirm the move, with bearish divergence signalling a degree of weakness in the recent rally.

RSI diving back below 70 may trigger a correction back to immediate support found at the steep uptrend extending from the yearly low, with a zone of support at the February highs (9,675 – 9,750) the next key region of interest.

Nasdaq Daily Price Chart

Source – Trading View

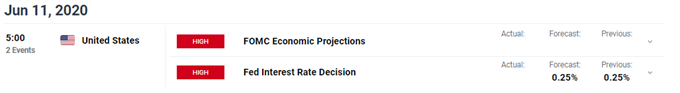

With the old adage ‘don’t fight the Fed’ ringing in many seller’s ears, attention will be intently focused on Wednesday’s FOMC meeting to determine if the central bank and Chair Jerome Powell will continue to ‘do as much as we can, for as long as we can’.

USD/JPY Daily Rate Chart

Source – Trading View

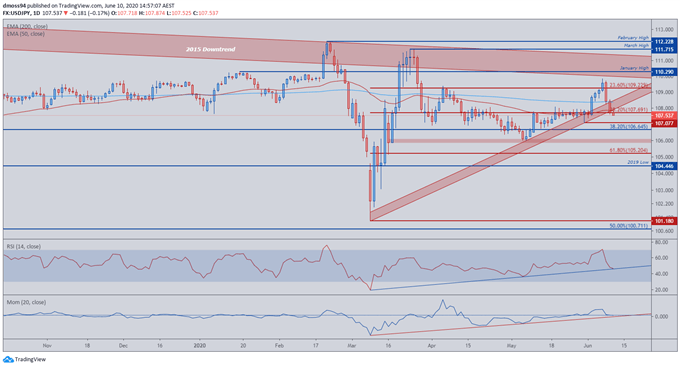

This week of price action has seen the US Dollar lose all ground gained against the Japanese Yen, failing to close above the psychologically imposing 110-handle as RSI was unable to sustain overbought readings.

Breaching the supportive uptrend from the March low and the 38.2% Fibonacci (107.69) may invigorate sellers as they push USD/JPY back towards the monthly low (107.07).

However, with RSI and momentum yet to break their respective three-month uptrends USD/JPY could find support at the psychologically pivotal 107-handle, although price action suggests that this may be unlikely.

A daily close below the June low (107.07) could carve a path back to a key region of interest at the May lows (105.85 – 106.05) with the 61.8% Fibonacci (105.204) acting as the last line of defence for the risk-associated exchange.

-- Written by Daniel Moss

Follow me on Twitter @DanielGMoss