US Dollar, EUR/USD, USD/CAD Talking Points:

- The US Dollar continues to show strength, setting a fresh four-month-high earlier today.

- EUR/USD appears to be the big loser as the pair is setting a fresh four-month-low while other major pairs such as AUD/USD or GBP/USD appear more subdued, finding support around 1-2 month lows.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

There’s been a chorus of Fed speakers commenting on markets this week and the net result so far has been a bullish push in the US Dollar, with the currency pushing up to fresh four-month-highs.

To be sure, the Fed continues to say that they’re going to be as accommodative as needed in the near-term, and that there’s no plans to remove the massive support that’s been in-place now for a year. Powell has also went as far as saying that he feels inflationary pressure is transitory, and even if it’s not, Powell has said that the Fed has tools at their disposal to address the issue.

We have seen some softening in Treasury rates over the past week but the US Dollar has continued to trade-higher. There could be some additional push to the USD on the back of Euro and even GBP weakness, as Covid has created even more near-term uncertainty on the European continent and many countries are going back into lockdown. This, of course, could prolong the recovery theme in Europe and may lead to a bit of continued re-pricing as the US and Europe see different paths forward in regards to the pandemic.

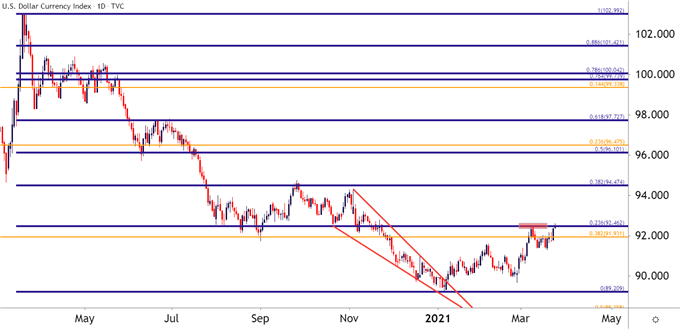

In the US Dollar – prices are testing a critical area of resistance at the moment, taken from around the 92.50 psychological level in DXY. This psych level is confluent with the 23.6% Fibonacci retracement of the 2020 sell-off and this is the same resistance zone that caught the advance earlier this month. From the Daily chart below it’s evident that we’ve begun to test above but, as of yet, bulls haven’t been able to leave this confluent spot on the chart behind.

To learn more about Fibonacci, check out the Fibonacci sub-module inside of DailyFX Education

US Dollar Daily Price Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

EUR/USD Pushes to Fresh Low

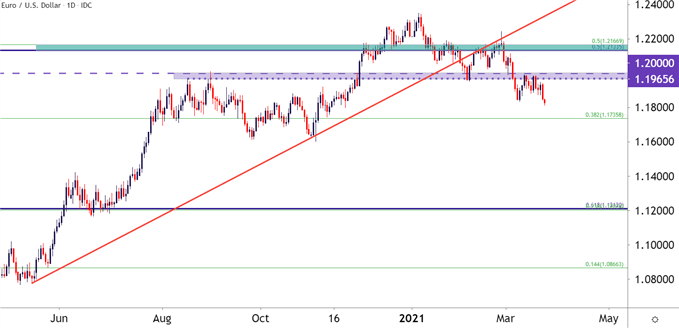

For those looking at USD-strength strategies, amongst major pairs, EUR/USD may be one of the more attractive candidates. Case in point – as the US Dollar is working on a fresh four-month-high, both AUD/USD and GBP/USD are working on monthly lows, and catching some support. EUR/USD, on the other hand, is working on its own four-month-lows. And given the recent news around Covid rearing its ugly head in some of the largest economic centers in Europe, there’s reason to imagine that the recovery road ahead may be a bit bumpier than what many were expecting.

Given the context, this can keep the focus on the bearish drive behind EUR/USD, particularly for those looking for a continuation of USD-strength.

EUR/USD Daily Price Chart: Fresh Four-Month Lows

Chart prepared by James Stanley; EURUSD on Tradingview

USD/CAD Re-Load

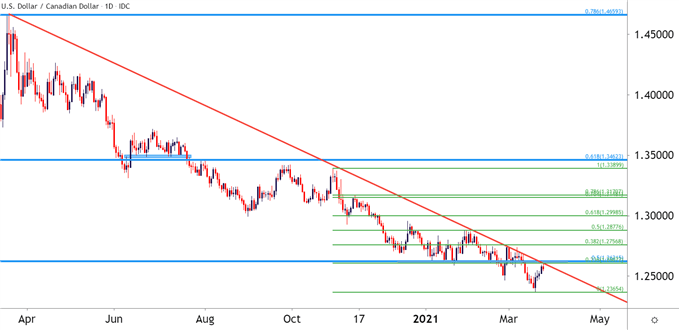

On the short side of the US Dollar, USD/CAD has been a pretty compelling option so far in 2021. As in, the US Dollar has been moving up but USD/CAD still lower, owed in no small part to the Canadian Dollar strength that’s shown up. For those that are looking to fade this recent run of USD-strength, USD/CAD may be a compelling option.

As for chart reference – there’s a zone of prior support just a little above today’s high. Much of that built due to some confluence amongst Fibonacci levels spanning from 1.2607-1.2622. A hold of resistance below this zone keeps the door open for bearish continuation scenarios in the pair.

USD/CAD Daily Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX