US Dollar, DXY, Fiscal Stimulus, Coronavirus Vaccinations, Jobless Claims – Talking Points:

- Risk appetite notably faded during APAC trade as tightening coronavirus restrictions in Hong Kong weighed on market sentiment.

- Loose monetary policy conditions and the prospect of additional deficit spending may cap the US Dollar’s potential upside.

- The US Dollar Index (DXY) looks set to revisit the yearly lows as price continues to track within a Descending Channel.

Asia-Pacific Recap

Risk appetite appeared to fade during Asia-Pacific trade as tightening coronavirus restrictions outweighed fiscal stimulus optimism. Hong Kong’s Hang Seng index tumbled 1.32% after the government announced it will lockdown the core urban district of Kowloon. Australia’s ASX 200 slipped 0.34% while Japan’s Nikkei 225 fell 0.44%.

In FX markets, the risk-sensitive AUD, NZD and CAD lost ground against their major counterparts, while the haven-associated USD and CHF largely outperformed. Gold and silver slid lower as a resurgent Greenback weighed on precious metal prices.

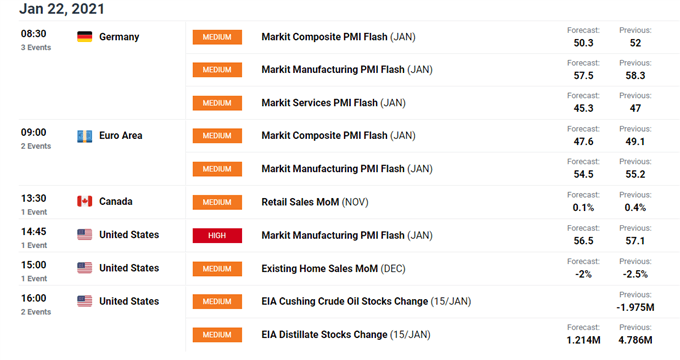

Looking ahead, a flurry of PMI figures out of Germany, the US and the Euro-zone headline the economic docket alongside Canadian retail sales figures.

Stimulus Hopes to Weigh on the US Dollar

The US Dollar looks set to continue losing ground against its major counterparts, as loose monetary policy conditions and the prospect of additional fiscal support notably weigh on the haven-associated Greenback.

President Joe Biden is determined to deliver an addition $1.9 trillion in fiscal aid to support the nation’s nascent economic recovery, with his proposal calling for an additional $1400 per-person in direct stimulus payments, enhanced unemployment benefits, funding for state and local governments, and increased spending to assist coronavirus vaccine distribution.

However, it seems relatively unlikely that the bill will be passed in its entirety, given the recent comments from several Republican members of the bipartisan group that helped pass the $900 billion aid package at the end of 2020.

Senator Susan Collins stated that “it’s hard for me to see when we just passed $900 billion of assistance why we would have a package that big now”, while Mitt Romney – the spearhead of the bipartisan group – and Lisa Murkowski also stated that it was too soon to provide additional aid.

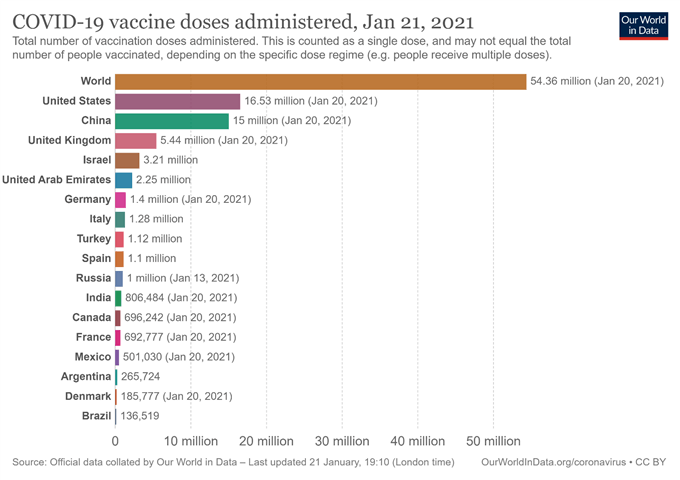

That being said, with only 16.5 million Americans receiving at least one dose of the coronavirus vaccine and weekly continuing jobless claims hovering above 5 million, the provision of further support seems almost a necessity.

Moreover, Treasury Secretary nominee Janet Yellen’s warning that avoiding “doing what we need to do now to address the pandemic and the economic damage that its causing, would likely leave us in a worse place fiscally”, may encourage both sides of the aisle to see eye-to-eye.

Therefore, the intensifying push for supplemental deficit spending may undermine the Greenback against its major counterparts and ultimately drive the US Dollar Index (DXY) lower in the coming weeks.

US Continuing Jobless Claims (2020 – Present)

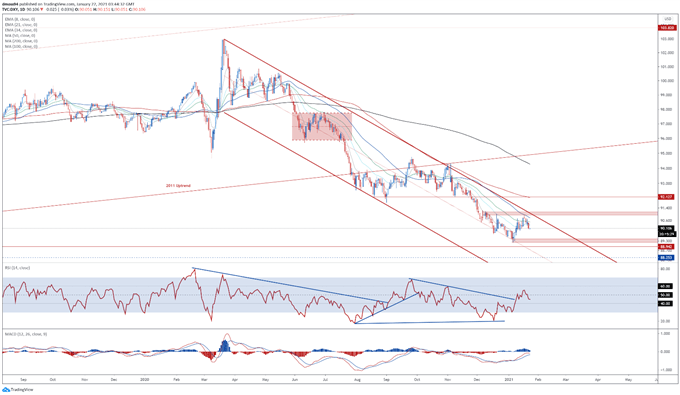

US Dollar Index (DXY) Daily Chart – Descending Channel Guiding Price Lower

From a technical perspective, the US Dollar Index’s (DXY) outlook remains skewed to the downside, as prices continue to track within the confines of a Descending Channel.

With the RSI diving back below its neutral midpoint, and the MACD gearing up to cross below its ‘slower’ signal line counterpart, the path of least resistance seems lower.

A daily close below psychological support at 90.00 would probably ignite a retest of range support at 89.20 – 89.40. Clearing that likely signals the resumption of the primary uptrend and brings the 2018 low (88.25) into the crosshairs.

Alternatively, staying constructively perched above 90.00 could allow buyers to drive the index towards the monthly high (90.95) and channel resistance.

DXY daily chart created using Tradingview

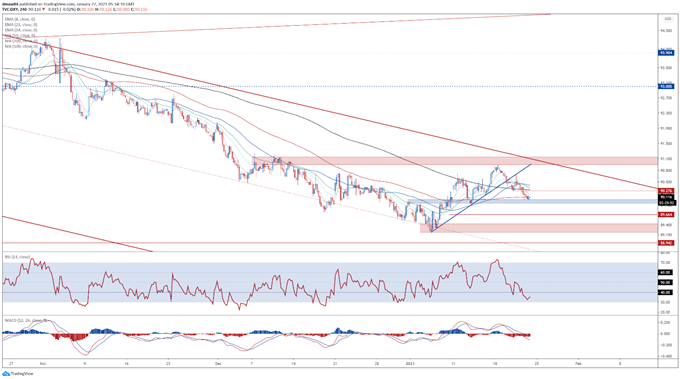

US Dollar Index (DXY) 4-Hour Chart – Uptrend Break Hints at Further Losses

Zooming into the 4-hour chart reinforces the bearish outlook depicted and the daily timeframe, as price snaps the uptrend extending from the monthly low and collapses through the sentiment-defining 200-MA (90.30).

A convincing breach of range support at 89.95 – 90.05 would likely intensify selling pressure in the near term and carve a path for price to challenge the January 8 low (89.66). Hurdling that probably brings the monthly low into focus.

On the contrary, climbing back above the 8-EMA (90.19) may neutralize near-term selling pressure and open the door for the index to retest psychological resistance at 90.50.

DXY 4-hour chart created using Tradingview

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss