US DOLLAR, FED, YELLEN, AUD, NZD, SNB, EUR/USD – TALKING POINTS:

- US Dollar aims to continue higher after Fed-inspired surge

- Treasury Secretary Yellen to testify on 2022 federal budget

- EUR/USD trying to unlock the way below the 1.19 figure

Financial markets continued to digest the implications of a momentous Fed monetary policy announcement, where the central bank seemed to signal a relatively hawkish pivot in its posture. Officials now expect to raise interest rates twice in 2023, marking an upshift in the timeline. This may imply that the tapering of QE asset purchases begins sooner than previously anticipated.

Asia-Pacific equity benchmarks shed close to 1.2 percent on average, echoing a downbeat close on Wall Street in the wake of the Fed’s inching toward weaning markets off record-setting stimulus. Chinese stocks managed to buck the trend and clawed higher, but this may have been little more than a correction after two days of heavy-handed selling.

Price action was relatively staid in the G10 FX space following the Fed-inspired fireworks. The Australian and New Zealand Dollars found some modest support following better than expected economic data. Australia added nearly four times more jobs than expected in May while New Zealand GDP growth surged. Output grew 1.6 percent in the first quarter, sailing past forecasts calling for a rise of 0.5 percent.

From here, a muted economic calendar seems unlikely to distract in a lasting way from the post-FOMC narrative. A revised set of May Eurozone CPI data probably won’t move the needle on ECB policy while the SNB policy announcement is unlikely to deviate much from the ultra-dovish script. The Swiss Franc already faces selling pressure in anticipation, putting into question further follow-through potential.

With that in mind, the Greenback might have scope for follow-through. This could be helped along if Treasury Secretary Janet Yellen reiterates her sanguine stance on scaling back monetary stimulus if that enables pursuing the Biden administration’s fiscally expansive agenda. She is due in the House of Representatives to testify about the 2022 federal budget.

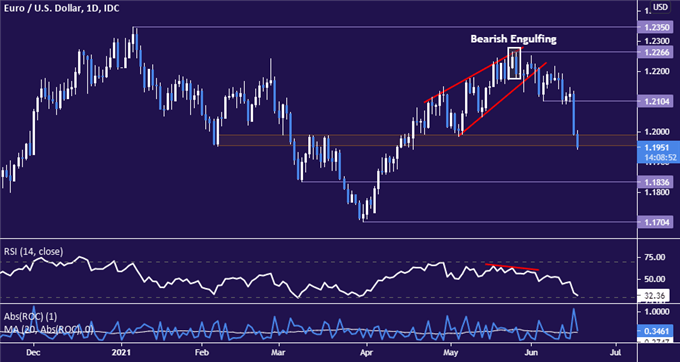

EUR/USD TECHNICAL ANALYSIS – EURO MAY OPEN THE WAY BELOW 1.19

EUR/USD accelerated lower having marked a top below the 1.23 figure as expected. Prices are now threatening a breach below the 1.1950-90 inflection zone, with confirmation on a daily closing basis perhaps opening the door for a slide to test the next layer of support at 1.1836. The first layer of meaningful resistance seems to line up at the 1.21 mark, where prices were idling pre-FOMC news.

EUR/USD daily chart created withTradingView

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Head Strategist, APAC at DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter