S&P 500 Index, Congressional Stimulus Negotiations, President Donald Trump – Talking Points:

- Equity markets moved higher during the Asian trading session as fiscal stimulus hopes firmed market sentiment.

- Congressional stimulus negotiations may continue to dictate the near-term outlook for US benchmark stock indices.

- S&P 500 index futures at risk of further losses as price struggles to breach key resistance.

Asia-Pacific Recap

Equity markets climbed higher during Asia-Pacific trade on the back of President Donald Trump’s discharge from the Walter Reed Army Medical Centre and renewed fiscal stimulus hopes.

Japan’s Nikkei 225 index rose 0.48% while Australia’s benchmark ASX 200 index nudged marginally higher despite the Reserve Bank of Australia’s decision to keep its monetary policy levers steady.

The risk-sensitive Australian Dollar spiked temporarily above the 0.72 mark immediately after the announcement but finished the session almost 0.2% lower.

The haven-associated US Dollar and Japanese Yen held steady against their major counterparts and gold drifted lower.

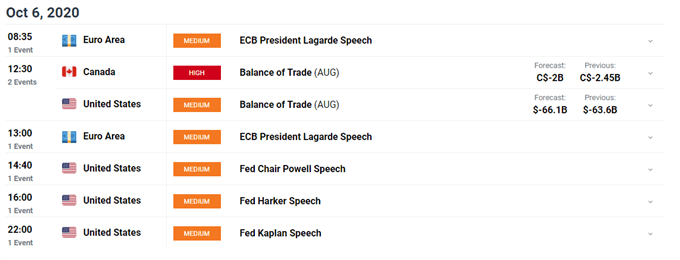

Looking ahead, speeches from European Central Bank President Christine Lagarde and Federal Reserve Chairman Jerome Powell headline the economic docket alongside the Canadian trade balance release for August.

Fiscal Stimulus Wait Limiting S&P 500 Upside

As mentioned in previous reports, Nancy Pelosi’s recent comments suggesting that a much-needed fiscal stimulus package could still be delivered before the US Presidential Election in November may buoy US equity markets, as the House Speaker and Treasury Secretary Steven Mnuchin continue to engage in pandemic relief talks.

In fact, Pelosi appears to believe that President Donald Trump’s recent coronavirus diagnosis could “change the dynamic” of negotiations as Republicans “see the reality of what we have been saying all along”.

However, with Democrats pushing for a $2.2 trillion package and Mnuchin proposing a skinnier $1.6 trillion deal, it appears relatively unlikely that US policymakers will be able to ratify a deal ahead of Election Day.

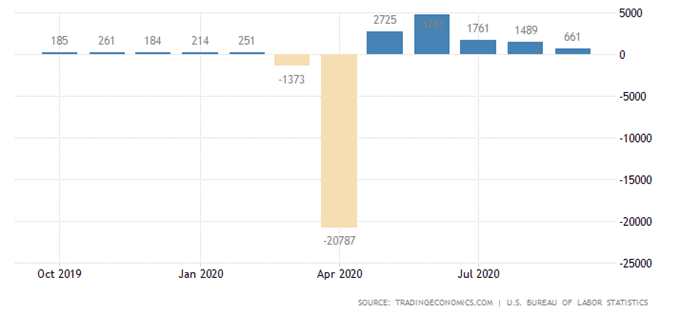

US Non-Farm Payrolls (October 2019 – Present)

Nevertheless, with the non-farm payrolls report for September drastically undershooting expectations and Federal Reserve Bank of Chicago President Charles Evans stressing that “fiscal policy support is important if we’re going to avoid widespread employment cuts beyond what we’ve already seen”, the need for fiscal stimulus is likely to intensify in the near-term.

To that end, the outlook for the US benchmark S&P 500 index may continue to be dictated by Congressional stimulus negotiations, with the absence of additional fiscal aid in the coming weeks potentially fuelling a resurgence of risk aversion and resulting in the marked discounting of risk-sensitive assets.

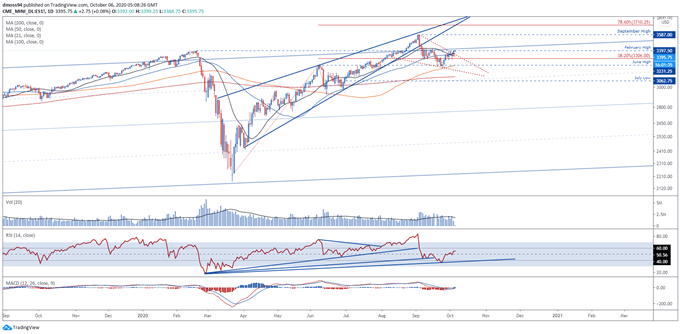

S&P 500 (e-Mini) Index Futures Daily Chart – February High Hampering Bulls

S&P 500 (e-Mini) Index futures daily chart created using TradingView

From a technical perspective, the US benchmark S&P 500 index could be gearing up to climb back towards the record high set on September 2 (3587), after price sliced through resistance at the 50-day moving average (3363.24) and broke to the topside of a bullish Falling Wedge continuation pattern.

However, below average volume and the RSI’s notable flattening out just prior to bullish territory above 60, suggests that the path of least resistance may be lower.

Therefore, a reversal lower could be on the cards if key resistance at the February high (3306) remains intact, with a daily close back below the 38.2% Fibonacci (3306) potentially igniting a more marked correction and bringing confluent support at the 100-DMA and June high (3231.25) into focus.

Conversely, a daily close above the psychologically imposing 3400 level could signal the resumption of the primary uptrend and facilitate a climb to retest the September high (3587).

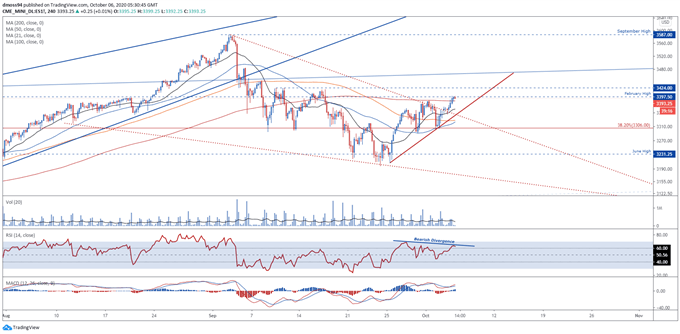

S&P 500 (e-Mini) Index Futures 4-Hour Chart – RSI Divergence Hints at Pullback

S&P 500 (e-Mini) Index futures 4-hour chart created using TradingView

Zooming into a 4-hour chart suggests a short-term pullback could be in the offing, as price struggles to break above the February high (3397.50) and the RSI fails to follow the S&P 500 index to higher highs.

That being said, with price tracking above the sentiment-defining 200-MA (3385.46) and the RSI and MACD indicators both tracking in bullish territory, a topside push is hardly out of the question.

Nevertheless, if buyers fail in their attempts to breach the 3400 level, a push back to the uptrend extending from the September 24 low (3198) looks likely in the near-term, with a break below the 21-DMA (3361.14) potentially igniting a decline to support at the 38.2% Fibonacci (3306).

On the other hand, a break and close above the September 9 high (3424) would probably validate bullish potential and could see the US benchmark index climb back towards the record high set in September (3587).

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss