NEW ZEALAND DOLLAR, NZD/USD, STOCKS, EARNINGS – TALKING POINTS:

- New Zealand Dollar accelerates lower in risk-off APAC trade

- Markets may look to the day’s earnings reports to lift sentiment

- NZD/USD flirts with key support break, may expose 0.68 mark

The New Zealand Dollar underperformed while as Asia-Pacific markets followed Wall Street lower, establishing a broadly risk-off backdrop for the G10 FX space. The currency was seemingly playing catch-up to recent weakness elsewhere in the commodity-currency bloc, having been relatively resilient thanks in part to a hawkish pivot at the RBNZ. The US Dollar found outsized support in haven demand.

A lull in top-tier scheduled event risk Monday seemed to clear the way for follow-through on the risk-off sweep triggered in the wake of Friday’s worrying US consumer confidence data. A similarly barebones offering this time may see momentum fizzle however as markets search for fresh catalysts. European bourses are tellingly chipper in early trade and futures tracking US equity benchmarks point upward.

Hopes for salvation from the earnings calendar may be helping too. A handful of heavy-weight names including Halliburton, Netflix and United Airlines are due to report second-quarter results. The global reporting season is just getting underway but early indications point to a rosy backdrop, with a plurality of companies surprising to the topside of forecasts.

A key question still needing an answer is how much of this is already priced in. It is surely no secret that economic growth rates surged in the second quarter, with the JPMorgan Global PMI index tracking broad-based economic activity flagging the fastest expansion since 2006. Meanwhile, worries about second-round effects – most notably, the rapid pace of reflation – have already emerged as market-moving.

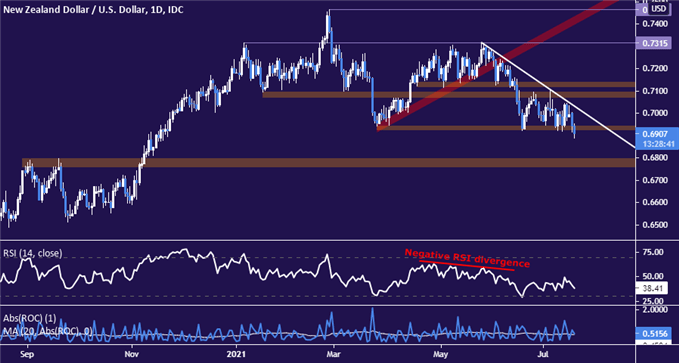

NZD/USD TECHNICAL ANALYSIS – SELLOFF LOOKS TO GATHER STEAM

The New Zealand Dollar looks to be on the cusp of breaking key support in the 0.6923-43 zone, marked by the late-March low. Confirming the breach on a daily closing basis may open the door for a push toward the 0.68 figure. A dense resistance block runs up through 0.7138. Overtaking that seems necessary to neutralize near-term selling pressure.

NZD/USD daily chart created with TradingView

FX TRADING RESOURCES

Just getting started? See our beginners’ guide for FX traders

What is your trading personality? Take our quiz to find out

Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Head Strategist, APAC at DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter