New Zealand Dollar, NZD/USD, NZ Building Permits -Talking Points

- Wall Street mixed after Fed speakers calm premature market taper expectations

- Risk-sensitive currencies move higher, with NZD/USD and AUD/USD gaining overnight

- NZD/USD tracking higher as the currency pair eyes the April high just below 0.73

Thursday’s Asia-Pacific Outlook

Asia-Pacific markets may see an upbeat trading day despite a mixed performance on Wall Street overnight when technology and small-cap stocks moved lower. The tech-heavy Nasdaq 100 index dropped 0.30% while the Dow Jones Industrial Average (DJIA) gained 0.29%, a new record high. The US Dollar was mostly unchanged, while Treasuries caught a bid across the curve from bond traders.

Speaking on a CNBC interview Wednesday, Federal Reserve Vice Chair Richard Clarida said “we’re not there yet” when asked about whether or not it’s time to start discussing tapering. However, the Vice Chair did note that he expects the economy to grow rapidly this year and will continue to evaluate economic data as it comes in.

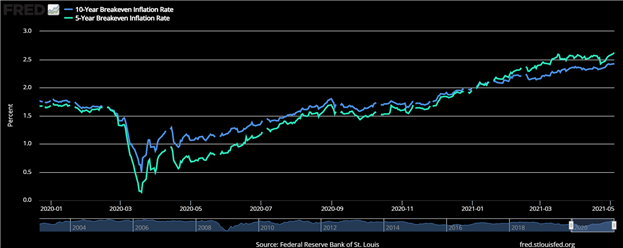

Mr. Clarida, along with other Fed speakers Wednesday, harped on the transitory outlook for inflation. However, inflation expectations rose to multi-year highs, evidenced through the 5- and 10-year breakeven inflation rate – which measures inflation expectations through the Treasury constant maturity and inflation-indexed Treasury rates.

US Breakeven Inflation Rates

Source: fred.stlouisfed.org

Speaking of economic data, New Zealand reported building permits data for March, showing a 17.9% rise for March compared to last month’s revised read of -19.3%, according to the DailyFX Economic Calendar. The New Zealand Dollar continued its move higher overnight after yesterday’s stellar jobs report – which showed the Q1 unemployment rate falling to 4.6% -- injected fresh optimism in the Kiwi Dollar. The upbeat building permits print may extend NZD’s strength in the coming days.

The risk-sensitive Australian Dollar is also aiming higher after a better-than-expected March building permits figure showing a 17.4% increase on a month-over-month basis. AUD/USD gained nearly half a percentage point overnight. The RBA statement on monetary policy will be released later this week, a potentially high-impact event that may drive direction in the Aussie Dollar.

Still, the most pertinent market event this week concerning market sentiment, and therefore to the Australian Dollar and New Zealand Dollar, will be the US non-farm payrolls report, with the DailyFX Economic Calendar showing a consensus forecast of +978k jobs for April. Elsewhere, the Bank of Japan (BoJ) will publish its monetary policy meeting minutes today.

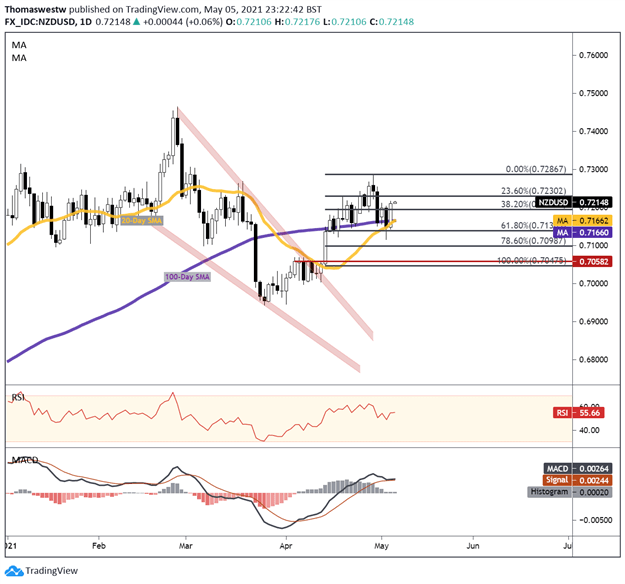

NZD/USD Technical Analysis

NZD/USD gained near a full percentage point overnight and now appears to be tracking higher/lower following today’s economic data print. The next obstacle standing ahead of the Kiwi Dollar appears to be the 23.6% Fibonacci retracement level. Alternatively, a reversal lower would see prices find possible support at the 38.2% Fib level and then the 20-day and 100-day Simple Moving Averages (SMA).

NZD/USD Daily Chart

Chart created with TradingView

NZD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinarand have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwateron Twitter