Gold Talking Points:

- Gold has been range-bound of recent, following a bounce in the first week of July.

- That early-July bounce was in response to a really aggressive sell-off in June, marking the worst month for Gold since November of 2016.

- This week brings a slew of drivers, with CPI data to be released tomorrow and Chair Powell speaking in front of Congress on Wednesday and Thursday.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

Gold prices finished June as the yellow metal’s worst month since November of 2016. Of course, that prior instance took place around the Presidential Election in 2016, as the election of Trump was thought to have brought upon the reflation trade, when the economy would remain strong and the Fed would be able to lift rates.

And lift rates, they did, in the next two years the Fed would hike rates seven times, and eight if we include the move in December of 2016. So, that prior instance of Gold underperforming in November of 2016 proved to be pretty prescient in terms of forecasting rate hikes – did the move that just completed in June of this year do the same?

The Fed is facing rising inflation and that’s shown very visibly in the data. Up to this point, the FOMC has said that this is transitory and they’re expecting inflation to recede. That has helped to keep Treasury yields extremely low with stock prices continuing to run high. But we’ll find out tomorrow how inflation data is printing as we’ll get the release of June inflation numbers. Core CPI is forecasted to have risen by 4% while headline inflation is expected to have jumped by 4.9%.

To learn more about CPI and Inflation, check out DailyFX Education

The days after that release, on Wednesday and Thursday, will see Chair Powell testifying in front of Congress, so we’ll get some definition on whatever prints tomorrow from the head of the FOMC later in the week.

In Gold – prices have recovered a bit from that June swoon, with the range looked at last week putting in multiple tests of support around the 1795-1800 area.

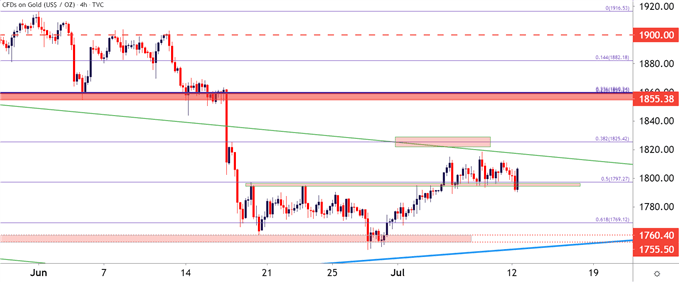

Gold Four-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

The current spot of short-term support is around the 50% marker of the recent bullish move, taken from the March low up to the June high; and resistance over the past week has plotted at the 38.2% retracement of the shorter-term sell-off that took place last month.

What does this mean? The market is currently devoid of any clear trends and, likely, the data and headline flow from this week will help to decide on that next direction.

But – this does provide some element of context while providing traders with some potentially usable levels ahead of what could be a really interesting week in markets.

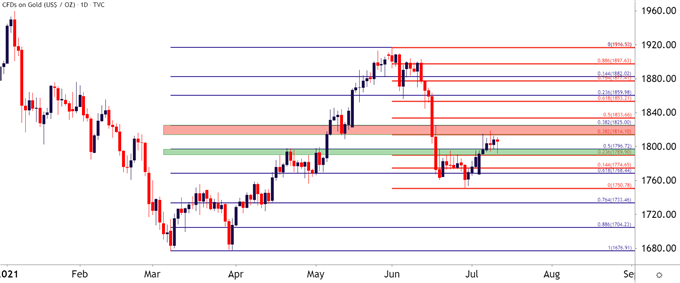

Gold Daily Price Chart

Chart prepared by James Stanley; Gold on Tradingview

Gold Strategy Moving Forward

At this point, it appears as though longer-term perspectives may focus more heavily on the potential for bearish trends in Gold, looking for continuation of the move that showed up in June; while shorter-term strategies may default towards strength on the basis of the bounce that took place in the first week of July.

For that bullish theme to hold, the current support zone is key, with both the 23.6% Fibonacci retracement of the June move and the 50% retracement of the March-June move defining this zone in green on the below chart.

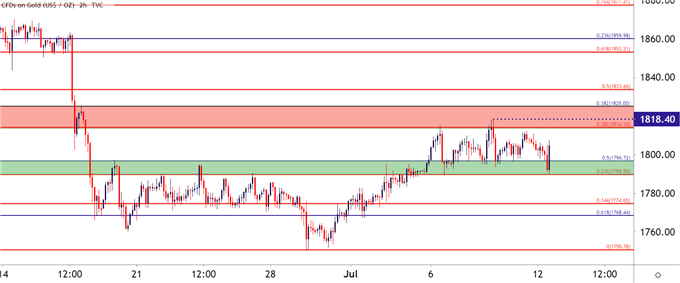

On the short side of the matter, there’s a couple of ways to move forward: For aggressive bearish trends, traders can look for a hold below last week’s swing high, plotted at 1818.40. If bulls do pose a deeper test in this zone but continue to hold below the 38.2% retracement of the March-June move, the door can remain open for bearish themes although that would set up as more of a reversal scenario given the failed probe at the highs.

Gold Two-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX