Euro, EURUSD, EUR/USD, ECB Talking Points:

- This morning’s ECB rate decision highlighted a Central Bank that doesn’t appear to concerned about strength in the Euro.

- EUR/USD started September with a reversal off of a huge level of 1.2000.

- Coming into this morning, support had cauterized around the 1.1750 figure already, with a quick pop of strength on the back of this morning’s rate decision/press conference.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

Euro Jumps on ECB

Many market participants came into this morning’s ECB rate decision expecting the bank to unveil some details about what plans they may have on the horizon. With both growth and inflation lagging, and a really strong Euro showing through most of the summer as USD-weakness took center-stage, there were a wide range of expectations for some form of stimulus announcement out of the ECB.

But that didn’t happen – and the blow was somewhat softened by the fact that ‘sources’ indicated ahead of the rate decision that the European Central Bank wasn’t overly concerned by strength in the Euro. Christine Lagarde largely echoed this tone throughout her speech, without explicitly stating as much; but this has allowed the single currency to show some fairly clear strength against a number of counterparts, the US Dollar included.

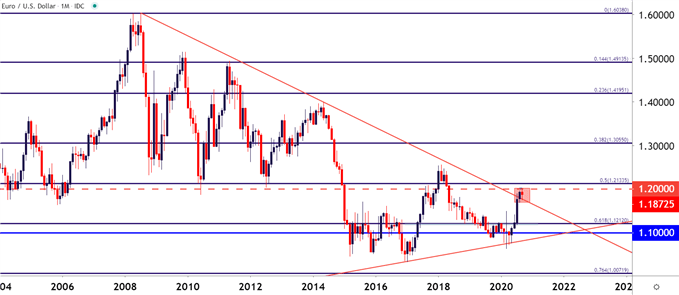

In EUR/USD, the pair put in a support test earlier this week around a long-term trendline projection. That long-term trendline is generated from spanning swing highs in 2008 and 2014 – both major inflection points in the history of the single currency.

EUR/USD Monthly Price Chart: Breakout, Check-back to Long-Term Trendline

Chart prepared by James Stanley; EUR/USD on Tradingview

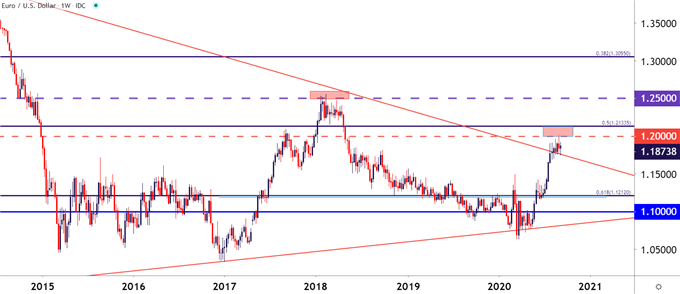

Taking a shorter-term look at the matter, and that August breakout ran into a brick wall of resistance at the 1.2000 psychological level. This is somewhat similar to what happened in the pair in 2018 – when a really strong bullish trend ran into resistance at the 1.2500 handle. After a few months of failed tests from bulls, and with a little help from political tensions between Rome and Brussels, the pair soon reversed – bears took control and drove price action for much of the next couple years. All the way into the coronavirus pandemic that started to get priced-in to Western markets in February and March of this year.

EUR/USD Weekly Price Chart: Full Stop at Big Fig 1.2500 – Will a Repeat Show at 1.2000?

Chart prepared by James Stanley; EUR/USD on Tradingview

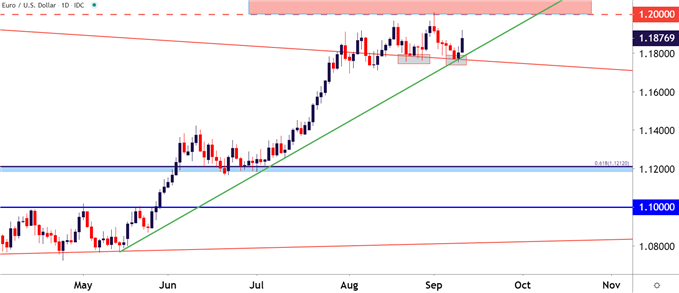

Going down to a Daily chart and recent tension becomes a bit more clear. EUR/USD bulls initially began to slow the approach when the 1.1900 figure came into play in late-July. Persistent albeit slowing strength lasted through August and on September first, the pair re-engaged with the 1.2000 handle.

That didn’t work out well for EUR/USD bulls as the pair promptly reversed by about 250 pips, finally cauterizing a bit of support on that trendline projection ahead of this morning’s ECB rate decision. There’s also been the entrance of another trendline into the equation, which can be found by plotting the May 14th and July 10th lows, the projection of which falls into that same recent zone of support.

EUR/USD Daily Price Chart

Chart prepared by James Stanley; EUR/USD on Tradingview

EUR/USD Strategy Moving Forward

At this point, the big question is whether EUR/USD may see another trip back up to the 1.2000 handle and, beyond that, whether buyers can actually support the move this time. Playing into that scenario is tomorrow’s inflation print out of the US, which will likely prod some element of USD volatility and the US Dollar is yet another factor of contention to be considered when analyzing EUR/USD.

As looked at over the past few weeks, the US Dollar has run into a big area of long-term chart support. So far through early-September trade, that support has helped to hold the lows, opening the door to the potential for USD-reversals. This morning’s moves hit that theme to a degree as USD has dropped to go along with this EUR/USD strength: But is that a theme that can remain?

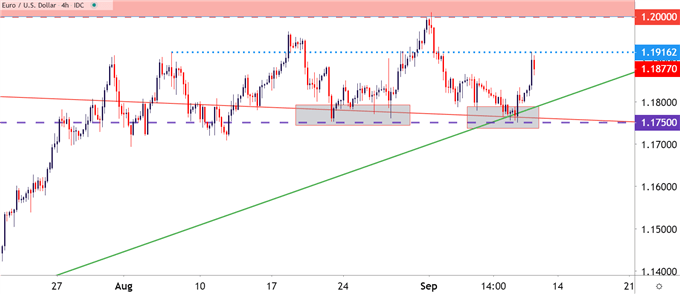

Taking a shorter-term look at the four-hour chart, and today’s high comes in at a familiar area of 1.1916, which similarly helped to set a high in early-August. If sellers are able to hold resistance below the 1.2000 spot and, perhaps more proactively, below the 1.1916 spot, the door for reversal themes can remain as open, with focus on that confluent zone of support around 1.1750.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley; EUR/USD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX