Euro, EUR/USD, Covid-19 Third Wave, ECB, German Easter Lockdown – Talking Points:

- Risk appetite notably faded during APAC trade as investors weighed the impact of renewed lockdowns on the global economic recovery.

- The Euro may come under pressure in the near term on the back of coronavirus third wave fears.

- EUR/USD rates remain constructively perched above the 200-MA

The Quiz

Discover what kind of forex trader you are

Asia-Pacific Recap

Risk appetite notably faded during Asia-Pacific trade, as lockdown fears dampened recovery hopes and traders eyed a slew of upcoming Treasury auctions. China’s CSI 300 slumped 1.32% as several Western nations imposed sanctions on the world’s second largest economy, in response to alleged human rights abuses in Xinjiang. Hong Kong’s Hang Seng Index toppled 1.5%, Japan’s Nikkei 225 slipped 0.61% and Australia’s ASX 200 nudged 0.1% lower.

In FX markets, the New Zealand Dollar plummeted against its major counterparts after the local government announced measures to cool the local housing market, while the haven-associated Swiss Franc, Japanese Yen and US Dollar largely outperformed. Gold prices held relatively steady as yields on the benchmark 10-year US Treasury note dipped just under 3 basis points lower.

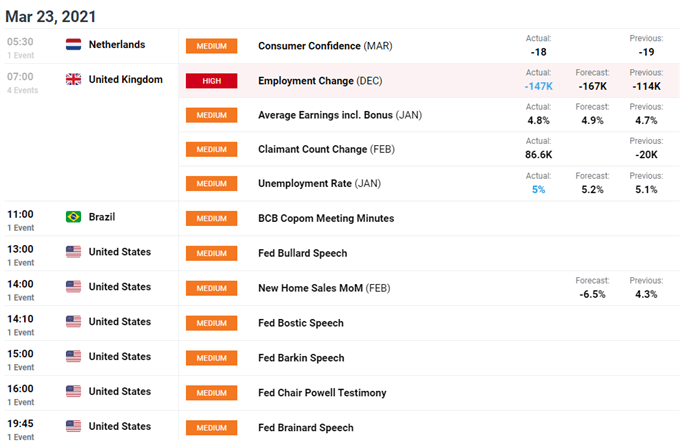

Looking ahead, a flurry of speeches from members of the Federal Reserve headline the economic docket, alongside US new home sales for February.

DailyFX Economic Calendar

Third Wave Fears May Begin to Weigh on EUR

As mentioned in previous reports, the Euro has remained resiliently positioned against its US Dollar counterpart in recent days despite the European Central Bank’s pledge to up its purchases of bonds to counter rising bond yields, and the suspended use of AstraZeneca’s vaccine in several European nations.

The ECB bought 21.1 billion euros of bonds through its Pandemic Emergency Purchase Programme (PEPP) in the week to March 17 – the highest amount in over three months – following through on its promise to purchases at a “significantly higher pace” in the coming months.

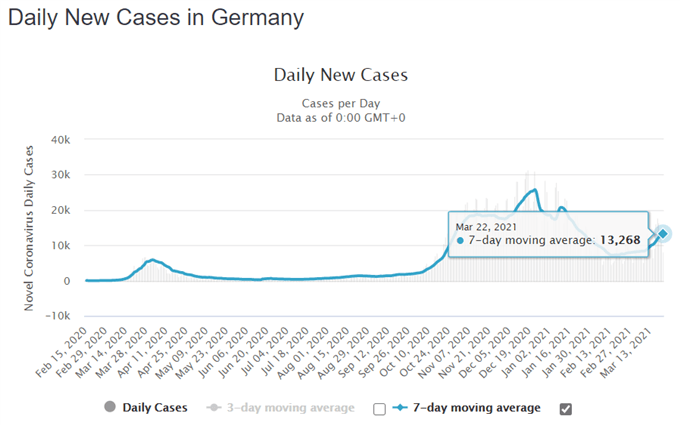

This has to yet have a meaningful impact on the currency, with the EUR/USD exchange rate climbing 0.26% during yesterday’s session. However, the Euro may come under pressure in the near term as Covid-19 infections rise across the trading bloc, and look set to continue trending higher given only 9.1% of the population have received at least one dose of a coronavirus vaccine.

Source – Worldometer

Indeed, German Chancellor Angela Merkel has announced a five-day snap lockdown starting on April 1 to combat the recent rise in case numbers. The measures will see all stores closed, private gatherings limited to one other household, and public meetings banned for five days.

Merkel stated that “we are now in a very, very serious situation”, adding that “the case numbers are rising exponentially and intensive-care bed are filling up again”. This dire assessment could flow through into regional risk-sentiment, putting a premium on the haven-associated US Dollar and ultimately hampering the Euro in the process.

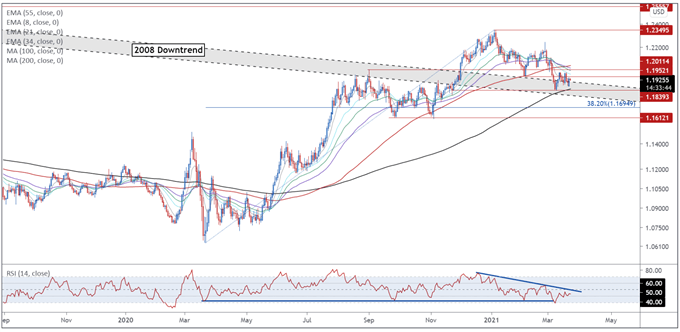

EUR/USD Daily Chart – Perched Precariously Above 200-MA

EUR/USD daily chart created using Tradingview

From a technical perspective, the outlook for EUR/USD rates remains skewed to the upside, as prices consolidate above the sentiment-defining 200-MA (1.1850) and former trend resistance-turned-support extending from the 2008 highs.

However, with price tracking below all three short-term moving averages – 8-, 21-, and 34-day – and the RSI hovering below its neutral midpoint, a more extended push lower is hardly out of the question.

Nevertheless, if the exchange rate can gain a firm foothold above the 21-EMA (1.1973) on a daily close basis, an impulsive surge to challenge the February high (1.2243) could be on the cards.

On the other hand, sliding back below 1.1900 could intensify short-term selling pressure and generate a retest of the monthly low (1.1835).

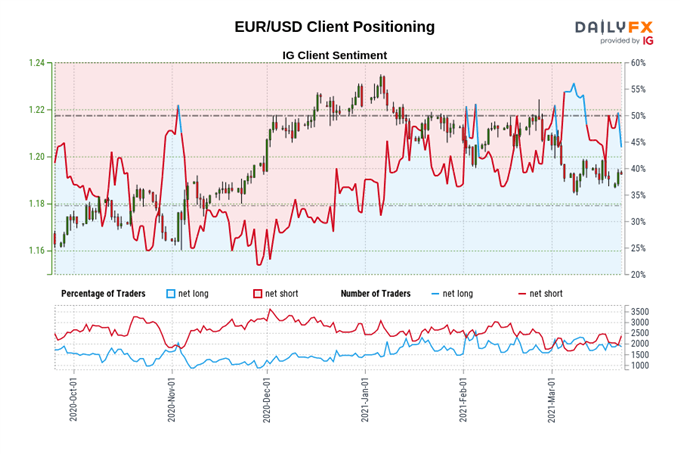

The IG Client Sentiment Report shows 44.09% of traders are net-long with the ratio of traders short to long at 1.27 to 1. The number of traders net-long is 6.66% lower than yesterday and 4.20% lower from last week, while the number of traders net-short is 20.67% higher than yesterday and 1.52% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss