Euro, EUR/USD, Fiscal Stimulus, Inflation, Federal Reserve, European Central Bank – Talking Points:

- Equity markets slipped lower during APAC trade as climbing bond yields weighed on sentiment.

- US fiscal stimulus progress and Fed Chair Powell’s congressional testimony will likely cap the Greenback’s potential upside.

- EUR/USD looking to extend recent gains as price consolidates below key resistance.

Asia-Pacific Recap

Equity markets slipped lower during Asia-Pacific trade as the relentless climb in Treasury yields began to gnaw at market sentiment. Australia’s ASX 200 slid 0.19%, while Hong Kong’s Hang Seng Index dropped 0.48%. China’s CSI 300 plunged 2.57% after the local banking regulator tightened restrictions on fintech companies co-lending with commercial banks.

In FX markets, the cyclically-sensitive AUD, NZD, CAD and NOK largely outperformed while the haven-associated USD, JPY and CHF lost ground against their major counterparts. Copper surged to its highest levels in more than nine years on global growth optimism, and yields on US 10-year Treasuries surged to the highest levels since February of 2020.

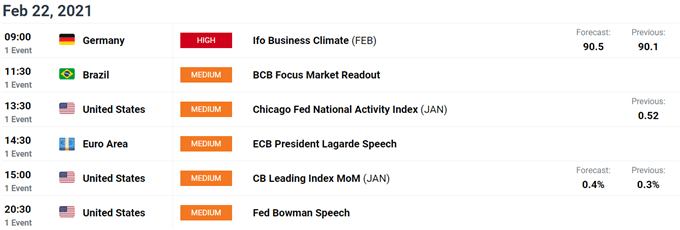

Looking ahead, German business climate figures for February headline the economic docket alongside a speech from European Central Bank President Christine Lagarde.

Powell’s Congressional Testimony to Cap USD Upside

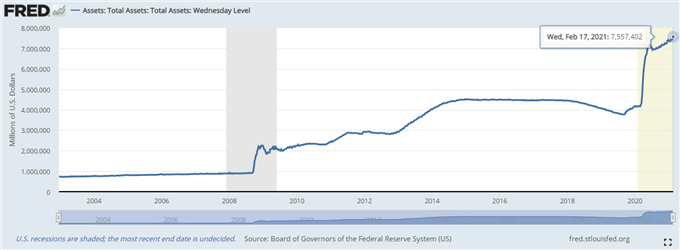

Federal Reserve Chair Jerome Powell’s semi-annual monetary policy testimony before Congress may ultimately cap the Greenback’s potential upside, and open the door for the Euro to extend its recent 1.5% rebound higher.

Powell is expected to reiterate the central bank’s commitment to supporting the economy by keeping interest rates at record lows and continuing to purchase at least $80 billion of Treasury securities and $40 billion of agency-mortgage-backed securities a month “until substantial progress has been made towards the Committee’s maximum employment and price stability goals”.

The chairman may also repeat his calls for more fiscal support to bolster the nation’s nascent recovery, given his previous statement that “it will require a society-wide commitment, with contribution from across government and the private sector” to restore the labour market to pre-pandemic levels.

Further dovish rhetoric from the central bank head, combined with the impending deliver of a substantial fiscal support package, will likely keep the haven-associated US Dollar on the back foot. The House of Representatives is expected to put President Joe Biden’s proposed $1.9 trillion coronavirus-relief package to a vote on Friday.

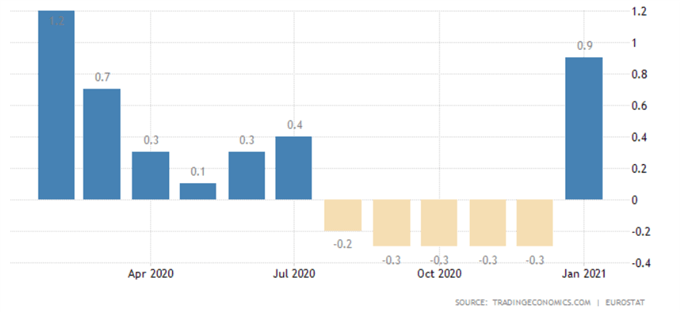

On the European front, better-than-expected PMI figures out of Germany, and a marked rise in Euro-area inflation in January, may buoy the Euro against its lower-beta counterparts in the near-term. The Euro-area core inflation rate jumped to 1.4% in January, while headline inflation climbed to 0.9%.

This could convince the European Central Bank to hold fire on loosening its monetary policy settings further, despite several Governing Council members flagging the possibility of cutting interest rates further into negative territory.

Positive lfo survey figures out of Germany may also put a premium on the trading bloc’s currency, by suggesting that the region’s largest economy is weathering its recent lockdown better than originally expected.

Euro-Area Inflation Rate

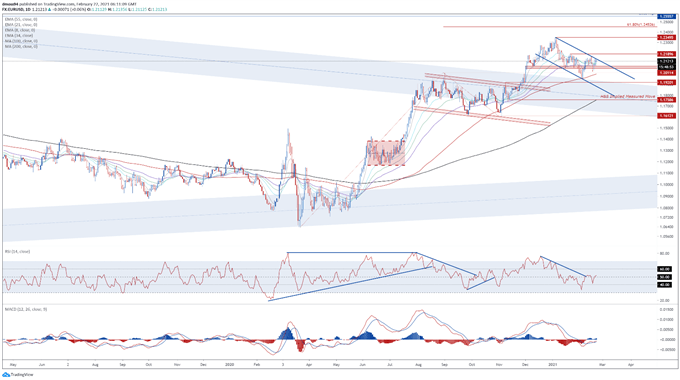

EUR/USD Daily Chart – Consolidating Above Key Range Support

From a technical perspective, the Euro looks set to extend its rebound higher against the US Dollar as price consolidates below Descending Channel resistance.

With the exchange rate tracking above all six moving averages, and the RSI nudging back above its neutral midpoint, the path of least resistance seems higher.

A daily close above the February high (1.2169) would likely neutralize near-term selling pressure and open the door for buyers to probe psychological resistance at 1.2200. Clearing that brings the yearly high set on January 6 (1.2349) into focus.

However, failing to breach Descending Channel resistance may allow sellers to drive the exchange rate back towards range support at 1.2055 – 1.2075.

EUR/USD daily chart created using Tradingview

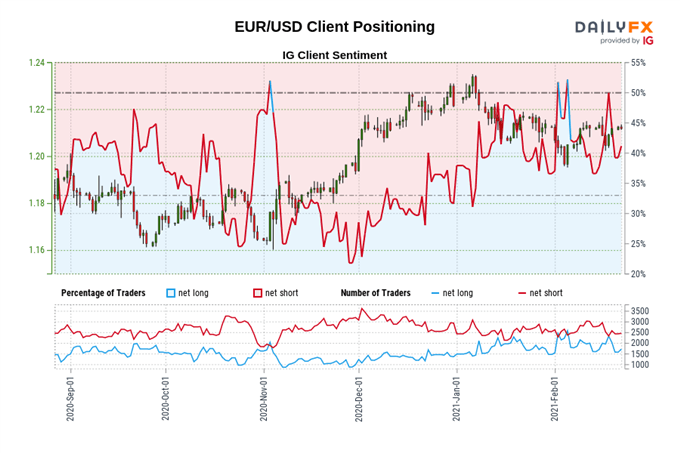

IG Client Sentiment Report

The IG Client Sentiment Report shows 42.31% of traders are net-long with the ratio of traders short to long at 1.36 to 1. The number of traders net-long is 14.71% higher than yesterday and 0.67% higher from last week, while the number of traders net-short is 0.82% higher than yesterday and 12.01% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss