Euro, EUR/USD, Fiscal Stimulus, Coronavirus Vaccinations, Q4 GDP – Talking Points:

- Equity markets continued to climb during APAC trade on the back of falling Covid-19 cases.

- The impending provision of additional fiscal stimulus may limit the US Dollar’s upside.

- EUR/USD rates poised to extend recovery after breaching key resistance.

Asia-Pacific Recap

Equity markets continued pushing higher during Asia-Pacific trade, buoyed by progress in the global vaccine rollout and declining coronavirus cases. Australia’s ASX 200 climbed 0.91% and Japan’s Nikkei 225 surged above 30,000 for the first time since 1990, on better-than-expected GDP figures for the fourth quarter of 2020.

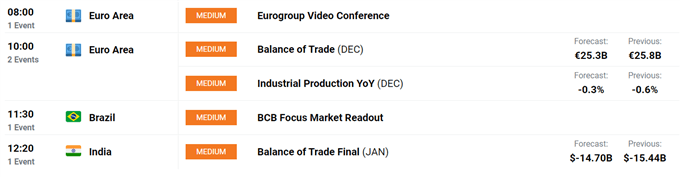

In FX markets, the cyclically-sensitive NOK, AUD, NZD and CAD largely outperformed, while the haven-associated USD, JPY and CHF slipped lower against their major counterparts. Gold price dipped marginally lower as yields on US 10-year Treasuries stormed 5-basis points higher. Looking ahead, trade balance and industrial production figures out of the Euro-area headline a rather light economic docket, with US markets shut for Presidents’ Day.

DailyFX Economic Calendar

US Fiscal Stimulus Underpinning EUR/USD

As mentioned in previous reports, growing hopes that a substantial fiscal support package will be delivered by US lawmakers in the coming weeks has fuelled the Euro’s recovery against the US Dollar. The House Budget Committee is expected assemble the various pieces of President Joe Biden’s $1.9 trillion stimulus package this week, with the bill expected to go to the floor of the chamber on February 22.

A swift approval seems relatively likely given House and Senate Democrats have paved the way to pass the majority of the coronavirus-relief package with a simple majority – in a process called reconciliation. This will likely put further downward pressure on the Greenback in the near term.

Moreover, the Federal Reserve’s commitment to continue purchasing at least $80 billion of Treasury securities and $40 billion of agency mortgage-backed securities a month “until substantial progress has been made toward the Committee’s maximum employment and price stability goals” will probably cap USD’s potential upside.

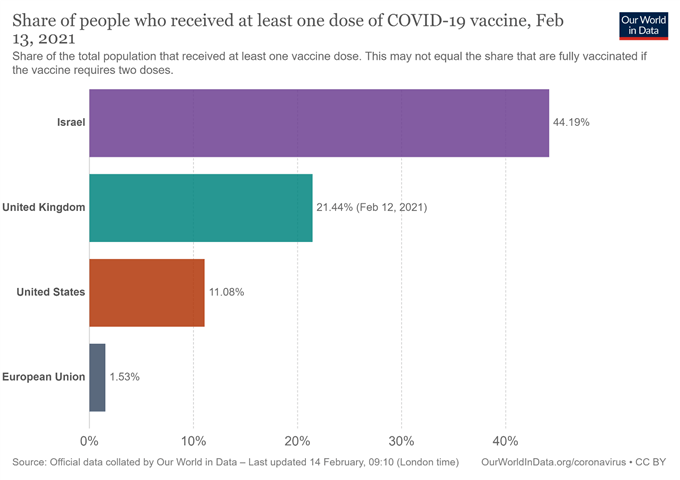

However, the European Union’s cumbersome vaccine rollout could hamper the EUR/USD exchange rate’s upside, considering a meagre 2.65% of the population has received at least one dose of a coronavirus vaccine. To contrast, 17.7% of the UK population and 9.44% of Americans have been inoculated with at least one dose.

Upcoming fourth quarter GDP and employment figures could also take some wind out of the Euro’s sail, if data shows a worse than expected slowdown in the final three months of 2020. Nevertheless, the impending delivery of a substantial aid package out of the US looks set to steer EUR/USD higher in the coming weeks.

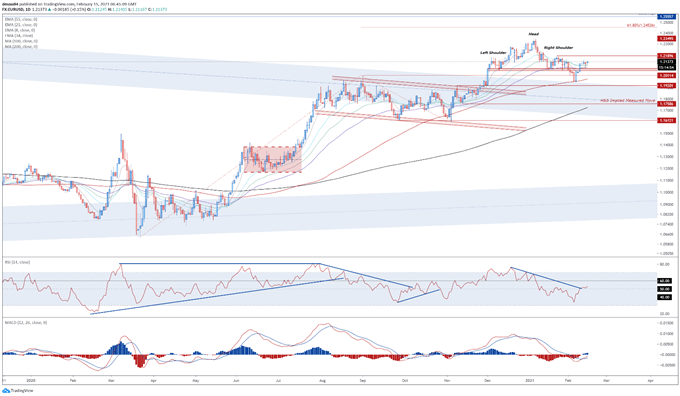

EUR/USD Daily Chart – Keying in on 1.2200 Mark

EUR/USD daily chart created using Tradingview

From a technical perspective, EUR/USD looks poised to extend its recovery from its lowest levels in three months, as price burst back above psychological resistance at 1.2100.

A bullish MACD crossover, in tandem with the RSI snapping its downtrend extending from the December 2020 extremes, suggests the path of least resistance is higher.

A daily close above the February 11 high (1.2149) is required to open the door for prices to challenge psychological resistance at 1.2200. Clearing that likely paves the way for buyers to drive the exchange rate towards the yearly high (1.2349).

Alternatively, slipping back below range support at 1.2055 – 1.2075 could neutralize buying pressure and trigger a downside push back towards the monthly low (1.1952).

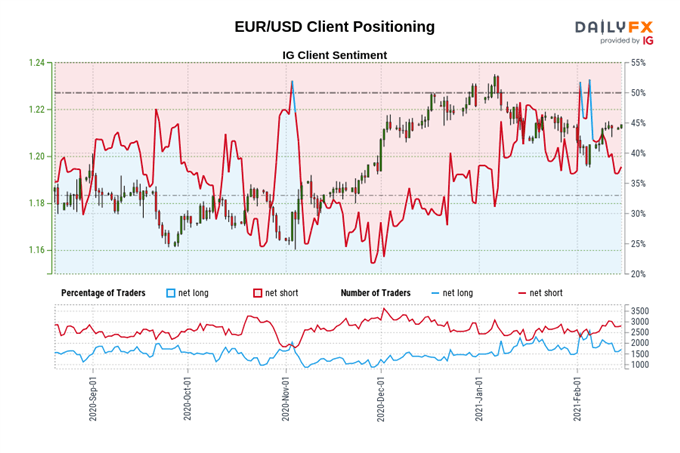

The IG Client Sentiment Report shows 39.06% of traders are net-long with the ratio of traders short to long at 1.56 to 1. The number of traders net-long is 11.86% higher than yesterday and 4.81% lower from last week, while the number of traders net-short is 0.62% higher than yesterday and 3.62% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss