Euro, EUR/USD, US Dollar, Inflation, Treasury Yields – Talking Points:

- An aggressive sell-off in global bond markets notably weighed on risk assets during APAC trade.

- Surging real yields may buoy the US Dollar against the Euro in the short term.

- EUR/USD at risk of reversal after the formation of a bearish Shooting Star candle.

Asia-Pacific Recap

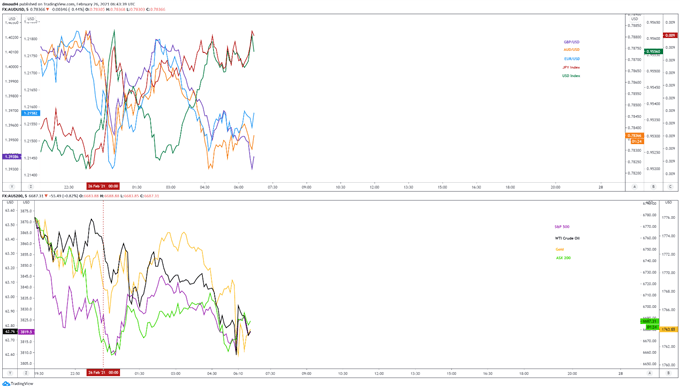

Risk assets continued to slide lower during Asia-Pacific trade as an aggressive rise in global bond yields notably weighed on market sentiment. Australia’s ASX 200 plunged 2.35% as yields on local 10-year government bonds surged to the highest levels since April 2019, while Japan’s Nikkei 225 plummeted 3.6%. Hong Kong’s Hang Seng Index dropped over 3% and China’s CSI 300 fell 1.87%.

In FX markets, the haven-associated USD, JPY and CHF largely outperformed, while the cyclically-sensitive AUD, NZD and NOK slid lower. Gold and silver prices lost ground as yields on US 10-year Treasuries held above 1.47%. Looking ahead, US PCE figures for January and consumer sentiment for February headline the economic docket alongside trade balance data out of Mexico.

Market reaction chart created using Tradingview

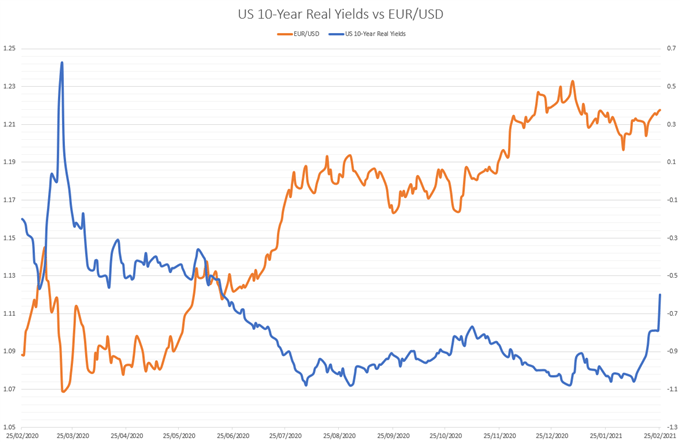

Surging Real Yields Buoying US Dollar

Surging bond yields have buoyed the heavily under-fire US Dollar in recent days, and may open the door for the Greenback to claw back lost ground against the Euro in the near term. Yields on benchmark 10-year Treasuries surged to the highest level since early February of 2020, climbing over 14 basis points in 24 hours as investors continue to bet on the Federal Reserve adjusting its policy levers sooner-than-expected.

However, this seems relatively unlikely given the dovish rhetoric of several members of the Federal Reserve over the last few weeks. Atlanta Fed President Raphael Bostic – one of the first to suggest tapering measures at the end of 2021 – is not expecting to Federal Reserve to react prematurely to climbing yields, stating that they “have definitely moved at the longer end, but right now I am not worried about that”.

This reinforces the comments from Jerome Powell at the Fed’s semi-annual monetary policy testimony before Congress, with Powell reiterating that “the economy is a long way from our employment and inflation goals, and therefore the central bank will maintain its loose approach to monetary policy until “substantial further progress has been made” towards achieving its two mandated goals.

Data Source – Bloomberg

Nevertheless, breakeven inflation rates have stormed to multiyear highs, with the 10-year currently sitting at 2.1% and the 5-year at 2.35%. Real yields have also soared to 9-month highs, while expectations of the Federal Reserve’s first rate hike have been pulled forward from early-2024 to early-2023.

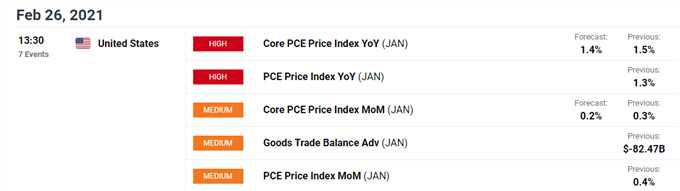

These dynamics could open the door for a short-term US Dollar recovery, with attention now intently focused on upcoming PCE figures for the month of January. A larger-than-expected increase in core PCE prices probably intensifying tapering bets and pushing the Greenback higher against its major counterparts.

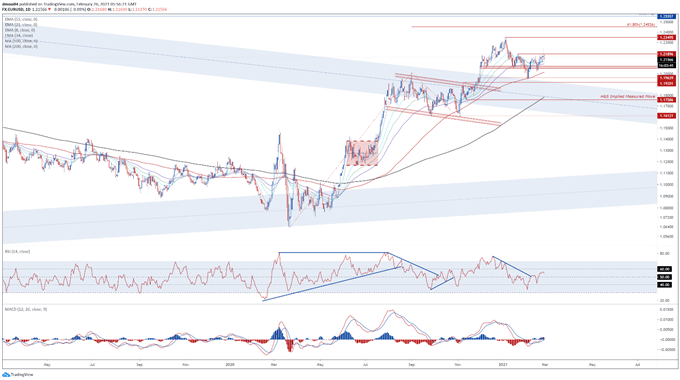

EUR/USD Daily Chart – Shooting Star Candle Hints at Bearish Reversal

From a technical perspective, the formation of a Shooting Star candle just shy of key psychological resistance at 1.2200 suggests that EUR/USD could be at risk of a reversal back towards range support at 1.2055 – 1.2075.

The notable U-turn of the RSI prior to 60, and the flattening slope of the 55-EMA (1.2095), is indicative of fading bullish momentum.

Dipping back below the 8-EMA (1.2140) would probably neutralize near-term buying pressure and open the door for sellers to drive the exchange rate back towards psychological support at 1.2100. Clearing that brings range support at 1.2055 – 1.2075 into the crosshairs.

Alternatively, a daily close above the January 22 high (1.2190) would probably signal the resumption of the primary uptrend and carve a path to challenge the yearly high (1.2349).

EUR/USD daily chart created using Tradingview

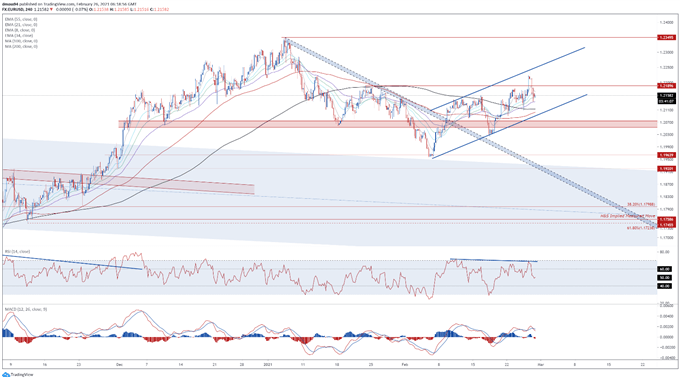

EUR/USD 4-Hour Chart – Ascending Channel May Guide Price Higher

However, zooming into the 4-hour chart contradicts the bearish outlook depicted on the daily timeframe, as EUR/USD tracks within the confines of an Ascending Channel and remains constructively positioned above the trend-defining 55-EMA (1.2138).

Pushing convincingly back above the 8-EMA (1.2170) could generate a retest of the monthly high (1.2243). Clearing that opens the door for buyers to probe the 1.2300 mark.

Alternatively sliding below 1.2130 could intensify selling pressure and bring the channel support and the February 22 low (1.2091) into play.

EUR/USD 4-hour chart created using Tradingview

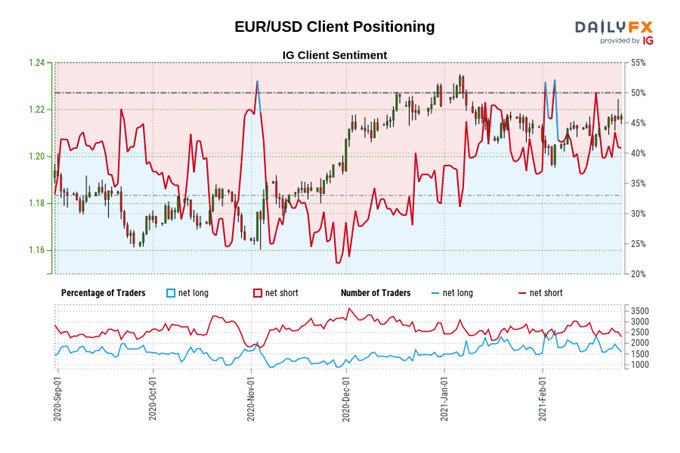

IG Client Sentiment Report

The IG Client Sentiment Reportshows 39.22% of traders are net-long with the ratio of traders short to long at 1.55 to 1. The number of traders net-long is 15.20% lower than yesterday and 25.51% lower from last week, while the number of traders net-short is 8.93% lower than yesterday and 10.50% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss