Euro Price Outlook, EUR/USD, Easing Restrictions, Coronavirus Vaccinations, IGCS – Talking Points:

- Easing coronavirus restrictions in several European nations may underpin the Euro in the near term.

- EUR/USD rates eyeing an extended push higher after clearing key resistance.

The Quiz

Discover what kind of forex trader you are

Asia-Pacific Recap

Equity markets traded mixed during Asia-Pacific trade, as market participants digested the impact of President Joe Biden’s proposal for a significant increase to capital gains taxes. Australia’s ASX 200 slipped lower alongside Japan’s Nikkei 225, while China’s CSI 300 and Hong Kong’s Hang Seng Index climbed higher.

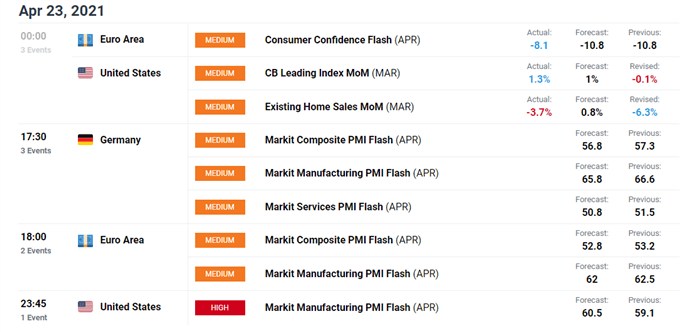

In FX markets, the cyclically-sensitive AUD and NOK largely outperformed, while the haven-associated USD and JPY lost ground. Gold and silver prices traded relatively steady, despite yields on US 10-year Treasuries rising just under 2 basis points higher. Looking ahead, US manufacturing PMI figures for April headline a rather light economic docket.

Easing Coronavirus Restrictions to Underpin Euro

A rather uneventful European Central Bank meeting, in combination with the easing of restrictions in several European nations, may pave the way for the Euro to gain ground against the Greenback in the near term.

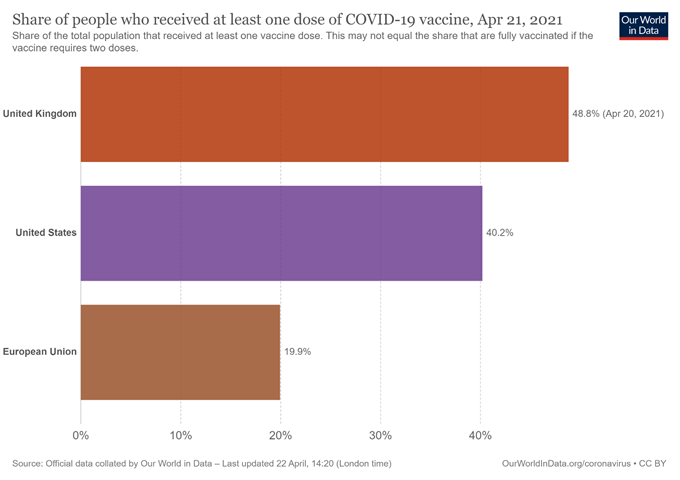

With just under 20% of the region’s population having received at least one dose of a coronavirus vaccine, optimism is growing that the EU’s recovery could be back on track. Italy is scheduled to ease restrictions at the start of next week, with Greece looking to do the same in May.

Germany is also contemplating introducing privileges for vaccinated individuals, while France is planning to lift the ban on domestic travel on May 3. These promising developments, alongside the ECB keeping its monetary policy settings steady for the time being, could ultimately result in the EUR/USD exchange rate extending its recent push higher.

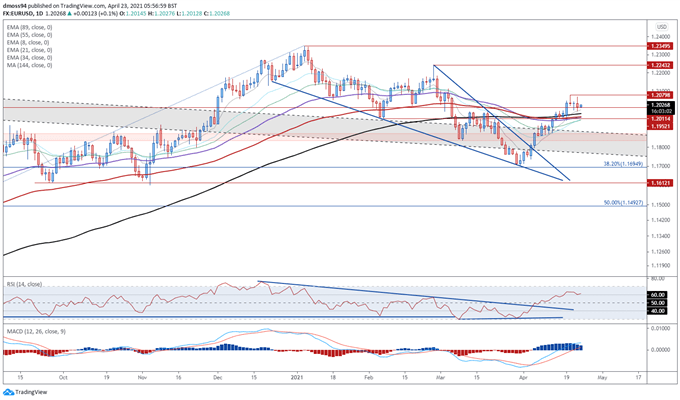

EUR/USD Daily Chart – Break Above 1.2000 to Foster Further Gains

From a technical perspective, the EUR/USD exchange rate’s outlook appears relatively bullish, as prices consolidate above all six moving averages and psychological support at 1.2000.

With the RSI climbing above 60 into bullish territory, and the MACD tracking firmly above its neutral midpoint, the path of least resistance seems higher.

A daily close above the monthly high (1.2080) probably intensifies buying pressure and brings the February high (1.2243) into focus.

However, if 1.2000 gives way, a pullback to the trend-defining 55-EMA (1.1959) may ensue.

Chart prepared by Daniel Moss, created with Tradingview

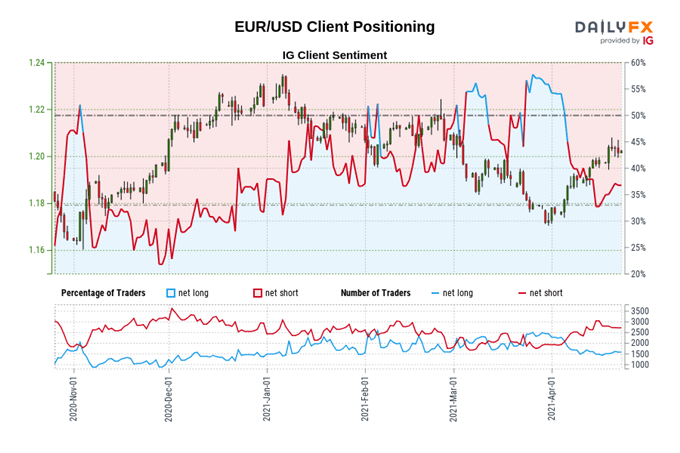

IG Client Sentiment Report

The IG Client Sentiment Report shows 36.78% of traders are net-long with the ratio of traders short to long at 1.72 to 1. The number of traders net-long is 4.98% lower than yesterday and 3.46% higher from last week, while the number of traders net-short is 2.48% higher than yesterday and 8.81% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss