Euro, Eurozone Economy, Recession, Coronavirus – Talking Points

- Euro is being hammered by recession risks, political tension

- Coronavirus widening familiar, unwelcome North-South rift

- EUR/USD prior steep downtrend appears to be back in play

Asia-Pacific Recap

US equity futures pointed higher along with the cycle-sensitive Australian and New Zealand Dollars, reflecting what appeared to be a “risk-on” tilt in market mood. The anti-risk Japanese Yen and US Dollar also suffered while Asia-Pacific stock markets were in the green. This jubilant dynamic continued even after Chinese GDP printed its first contraction in 28 years.

Euro at Risk as Coronavirus Amplifies Regional Political Strains

The Euro may be at risk of aggressive liquidation pressure as the politically-sensitive currency is tormented by familiar internal geopolitical rifts between the North and South. While inter-regional tensions are nothing new, the circumstances in which they are resurfacing could have more of an impact on the Euro now than before. The Eurozone now stands on the edge of a recession far worse than what it had endured over a decade ago.

After debating for over 16 hours, Eurozone finance ministers were able to reach a shallow agreement. Some of the provisions agreed upon included borrowing with almost no strings attached from the bailout fund known as the Emergency Stability Mechanism. Italian officials rejected the offer after recalling what had happened to their Mediterranean neighbors during the Eurozone debt crisis.

The fear of losing domestic sovereignty to external institutions is a bitter fruit for Mediterranean states to swallow, and constitutes a part of the wedge driven between Northern and Southern eurozone members. This sentiment is particularly acute in Italy where the right-wing leader Matteo Salvini of Lega Nord has decried the proposal. Here is an segment of his comments on radio talk show La7:

“I don’t believe in measures like the European Stability Mechanism (ESM), which is still talked about in Berlin, Amsterdam and Brussels because it would be a debt imposed on our children. I don’t trust loans coming from Europe, which will then mean - as we have seen in Greece for example -that airports, rails and even monuments will be sold to the highest bidder.” – La7.

Southern member states are instead more fond of issuing joint debt in the form of so-called “coronabonds”, though their fiscally-conservative Northern neighbors have strongly rejected the idea – a rift as old as time. This issue will likely continue to be a major sticking point. In the meantime, this will likely cause borrowing costs in economically-distressed countries like Italy to continue to rise – and the Euro may suffer for it.

Euro Outlook

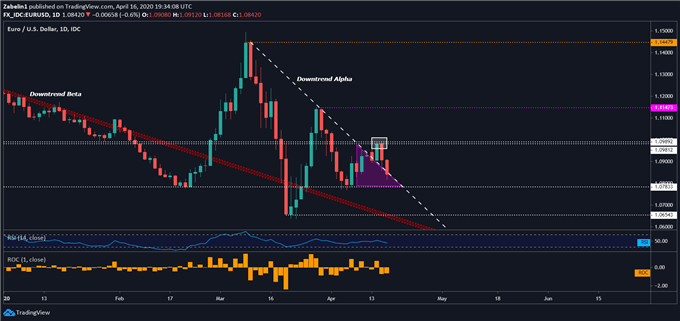

EUR/USD may once again start trading under the steep guidance of descending resistance (labelled as “Downtrend Alpha”. This came after the pair failed to clear the lower tier of an inflection range between 1.0981 and 1.0989 that subsequently led to a 1.30 percent decline. The next level to monitor will be support at 1.0783. If it breaks below it with follow-through, EUR/USD may face severe liquidation pressure.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead!

- New to trading? See our free trading guides here!

- Get more trading resources by DailyFX!

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter