EUR/USD Analysis, Coronavirus, How German IFO Data May Pressure the Euro, US Dollar Preview – Talking Points

- US Dollar could rise if durable goods orders data underwhelms

- Euro may fall if final German IFO data reinforces gloomy outlook

- EUR/USD is trading at a key cross section: where will it go next?

Asia-Pacific Recap

US equity futures pointed higher with APAC stocks after optimism from a rosy Wall Street session spilled over into Asia and pressure the haven-linked US Dollar. The risk-on tilt in market mood came from what appeared to be hope about a bipartisan virus-relief bill out of the world’s largest economy. Speaker of the House Nancy Pelosi said she is optimistic a deal could be ratified soon.

German IFO Data: What to Expect

The final readings for German IFO business climate, expectations and current assessment data will be published at 09:00 and may elicit some volatility in the Euro. As the largest economy in the Eurozone, data out of Germany carries significantly more weight relative to France and Italy, the second and third-largest regional economies, respectively.

Having said that, since they are final readings, volatility may be more subdued than when the preliminary readings were published. Consequently, markets may focus on broader risk trends and updates pertaining to the coronavirus and its impact on Europe. Credit markets appear to be feeling less stressed with spreads on credit default swaps for insuring sub-investment grade corporate debt having narrowed by a whopping 96 basis points.. by a whopping 96 basis points. Having said that, they are still at Eurozone debt crisis levels.

US Dollar Preview Ahead of US Durable Goods Orders

Preliminary durable goods order for February are anticipated to show a -1.0 percent reading, though it is possible that given the spread of the coronavirus, this report will fall short of its forecast. Depending on the severity, an underwhelming figure of notable magnitude could sour what appeared to be a flicker of resurrected risk appetite after Tuesday’s rosy session on Wall Street.

In this scenario, the US Dollar may nurse some of its recent losses as its appeal as a haven-linked asset briefly receded in an environment where investors were prioritizing returns over liquidity. However, if the data outperforms, it is unlikely to have a long-lasting effect given that the total impact of the coronavirus outbreak has not yet been fully revealed in the economic statistics.

US Dollar Preview Ahead of US Durable Goods Orders

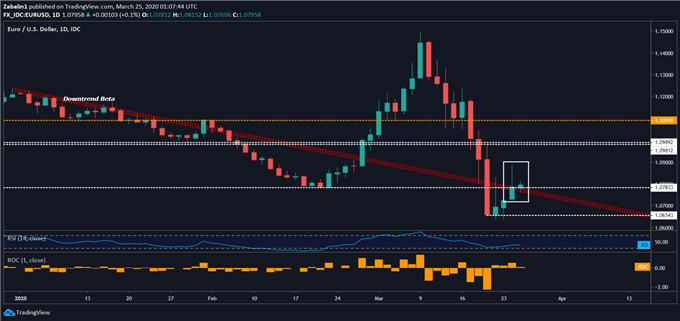

EUR/USD is trading a critical cross-section between the descending resistance (labelled as “Downtrend Beta”) and an inflection point at 1.0781. The pair may attempt to climb higher with an eye at the lower tier of the former-support-turned resistance 1.0981-1.0989 range. However, looking at the wick on Tuesday indicates that traders had a desire to climb higher but ultimately lacked confidence. This may speak to a wider bearish overhang haunting EUR/USD.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EUR/USD TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead!

- New to trading? See our free trading guides here!

- Get more trading resources by DailyFX!

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter