EURO, EUR/USD Price Chart, ECB, Coronavirus – Talking Points

- Euro at risk of selloff contagion as regional growth outlook darkens

- Wuhan reports no new infections as Italy death rate passes China

- EUR/USD trading below January descending resistance. What now?

ASIA-PACIFIC RECAP

The Australian and New Zealand Dollars rose with the British Pound midway in Asia’s Thursday trading session. This came as APAC equities were trading in the green as what appeared to be a broader “risk on” tilt in market mood. The People’s Bank of China (PBoC) unexpectedly. held interest rates unchanged. This may have supported the buoyant outlook if it signaled that officials are expecting conditions to stabilize enough that it may not require additional stimulus.

EURO AT RISK OF SELLING CONTAGION AS EUROPEAN CORONAVIRUS DEATHS SURGE

As outlined in my prior report, Europe has now become the new epicenter of the coronavirus pandemic according to World Health Organization Officials. Italy, the third largest Eurozone economy, reported 3,405 deaths from the Covid-19, surpassing China’s mortality rate. As of January 19, Wuhan reported no new additional cases of the virus after authorities initiated a two-month lockdown.

The measures governments have taken to contain the virus gives a lot of insight as to how potentially powerful the economic impact of covid-19 could be. Here is an excerpt from Yale Professor of Sociology Nicholas Christakis thoughts on the coronavirus:

“We can get a sense of how strong something is by getting a sense of what sort of force is required to stop it, to borrow a Newtonian physics metaphor. COVID-19 requires a powerful force to stop. This is clear from the Chinese response”

The response by central banks like the ECB’s 750 billion Euro aid package known as the Pandemic Emergency Purchase Programme (PEPP) shows the threat officials believe the coronavirus poses to the global economy. ECB President Christina Lagarde said: “Extraordinary times require extraordinary action. There are no limits to our commitment to the euro. We are determined to use the full potential of our tools, within our mandate”.

The similarity between her comments and Mario Draghi’s “whatever it takes” speech in 2012 amid the Eurozone debt crisis was not lost, and again reiterates the severity of the situation. Germany – the largest economy in the currency bloc – is looking to sign a measure that would allow the government unlimited spending power to counter the blow of the virus.

This also demonstrates the severity of the situation since Berlin has always advocated for maintaining a balanced budget and avoiding deficits. This came as Italian Prime Minister Guiseppe Conte urged Brussels to allow for the use of the EU’s 500 billion Euro emergency fund and to “open ESM (European Stability Mechanism) credit lines to all member states to help them fight the consequences of the COVID-19 epidemic”.

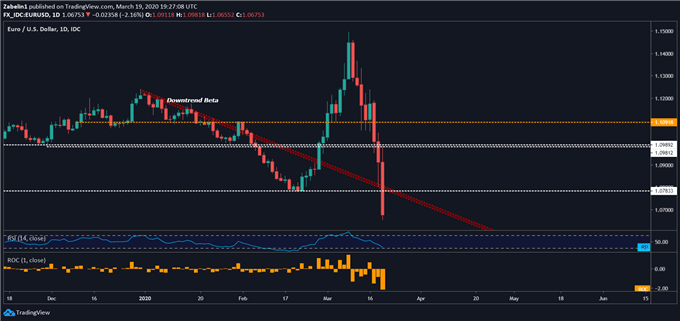

EUR/USD OUTLOOK BEARISH

EUR/USD suffered its largest one-day loss since June 2016, broke below the three-year swing-low at 1.0783 and is now trading below the descending resistance channel (labelled as “Downtrend Beta”). A move of this magnitude combined with its positioning below a steep slope of appreciation may amplify bearish sentiment and pressure the pair to testing four-year lows.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead!

- New to trading? See our free trading guides here!

- Get more trading resources by DailyFX!

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter