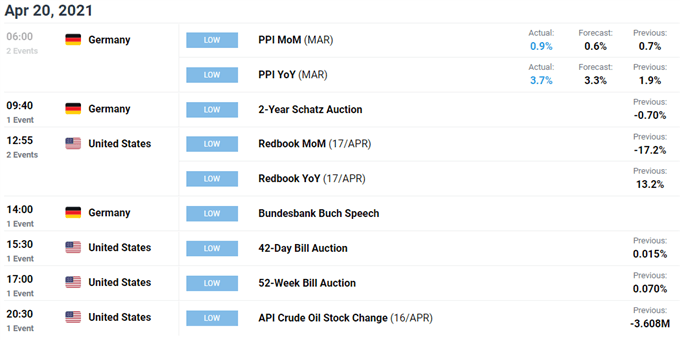

Dow Jones, S&P 500, Nasdaq 100, Corporate Earnings, Treasury Yields – Talking Points:

- Robust Q1 earnings figures may drive US benchmark equity indices higher in the coming days

- However, a pickup in longer-term Treasury yields may limit overall gains.

The Quiz

Discover what kind of forex trader you are

Asia-Pacific Recap

Equity markets registered broad declines during Asia-Pacific trade, as a spike in coronavirus cases weighed on market sentiment. Australia’s ASX 200 fell 0.67%, while Japan’s Nikkei 225 plunged 1.97%. Hong Kong’s Hang Seng Index and China’s CSI 300 on the other hand held relatively steady as the PBoC left benchmark interest rates at the current level for the twelfth consecutive month.

In FX markets, the cyclically-sensitive AUD, NZD and NOK outperformed their major counterparts, while the haven-associated JPY, CHF and USD lost ground. Gold prices gave up early gains as yields on US 10-year Treasuries climbed for the third consecutive day. Looking ahead, API crude oil inventory data highlights a rather light economic docket.

Robust Earnings Season, Falling Treasury Yields to Underpin Equities

US benchmark equity indices could be poised to continue pressing to fresh record highs in the near term, on the back of robust corporate earnings and a notable decline in long-term Treasury yields.

Reported earnings for the first quarter of 2021 have been impressive, with 81% of S&P 500 companies that have reported exceeding earnings expectations, while 84% beat expectations for sales. Moreover, on aggregate companies are reporting earnings that are 30% above estimates, which is significantly above the 5-year average of 7% – according to data from FactSet.

Treasury yields have also dipped lower as of late, as market participants price in a smaller-than-expected fiscal stimulus package. President Joe Biden recently hinted that he could favour a smaller package in a recent sit-down with a bipartisan group of policymakers.

These dynamics may buoy market sentiment and ultimately drive equity prices even higher in the coming weeks.

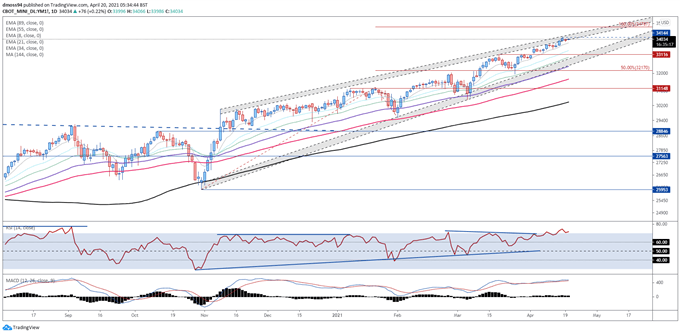

Dow Jones Futures Daily Chart – Rising Wedge Remains in Play

Chart prepared by Daniel Moss, created with Tradingview

From a technical perspective, the outlook for the Dow Jones appears overtly bullish, as the index tracks firmly above all six moving averages and continues to break to fresh all-time highs.

Indeed with the RSI holding in overbought territory, and the MACD hovering at its highest levels in four weeks, the path of least resistance seems higher.

However, a short-term pullback is hardly out of the question, given price is running into Rising Wedge resistance and is struggling to breach the psychologically imposing 34,200 mark.

Failing to gain a firm foothold above the April 16 high (34144) on a daily close basis could encourage would-be sellers and open the door for the index to retrace back towards former resistance-turned-support at 33700. Hurdling that could result in a more extended decline to challenge support at the March 30 high (33129).

Ultimately, a close above 34,150 is needed to validate bullish potential and carve a path to probe the 100% Fibonacci (34,787).

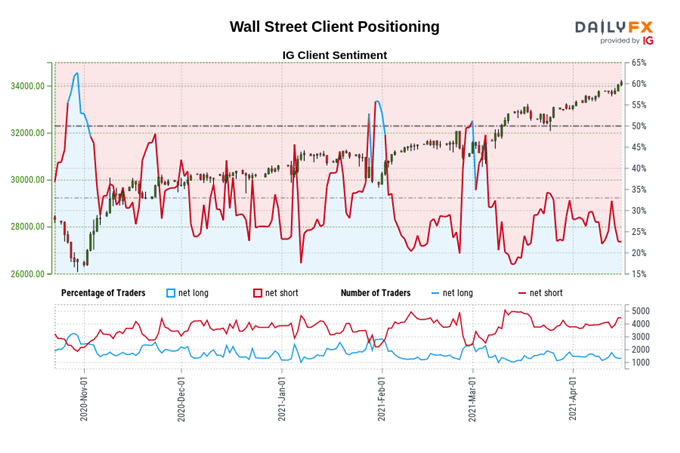

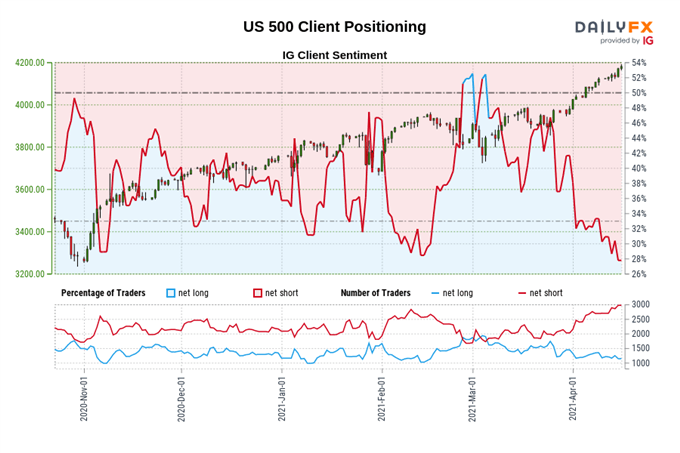

The IG Client Sentiment Report shows 28.85% of traders are net-long with the ratio of traders short to long at 2.47 to 1. The number of traders net-long is unchanged than yesterday and 21.57% higher from last week, while the number of traders net-short is unchanged than yesterday and 0.15% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Wall Street prices may continue to rise.

The combination of current sentiment and recent changes gives us a further mixed Wall Street trading bias.

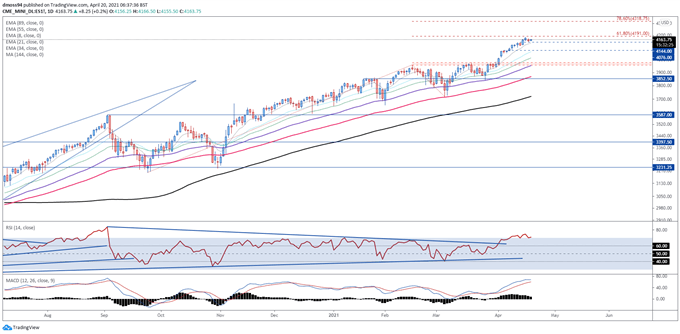

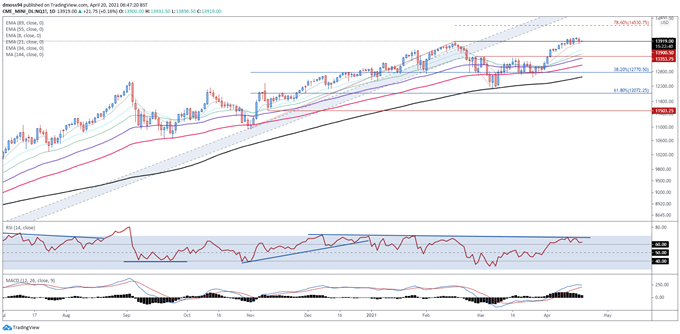

S&P 500 Futures Daily Chart – 61.8% Fibonacci Capping Upside Potential

Chart prepared by Daniel Moss, created with Tradingview

The benchmark S&P 500 index also seems poised to continue moving higher in the coming days, as prices remain constructively perched above all six moving averages and the RSI hovers in overbought territory.

However, with a bearish MACD crossover taking shape, and price struggling to clear the 61.8% Fibonacci (4191), a counter-trend downside move may take place in the coming days.

Breaching confluent support at the 8-EMA and 4,150 handle probably neutralizes buying pressure and clears a path for the index to slide back towards the April 6 high (4076).

Alternatively, a convincing push above 4,200 likely generates an impulsive surge to challenge the 78.6% Fibonacci (4319).

The IG Client Sentiment Report shows 30.80% of traders are net-long with the ratio of traders short to long at 2.25 to 1. The number of traders net-long is unchanged than yesterday and 0.86% higher from last week, while the number of traders net-short is unchanged than yesterday and 2.37% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests US 500 prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed US 500 trading bias.

Nasdaq 100 Futures Daily Chart – 8-EMA Guiding Price Higher

Chart prepared by Daniel Moss, created with Tradingview

The tech-heavy Nasdaq 100 index, like its other US counterparts, may be due a pullback, as bearish RSI divergence hints at uptrend exhaustion.

Indeed, with the slope of the 8-EMA notably plateauing, and the MACD retracing from its highest levels since February, the path of least resistance seems lower.

A daily close below the 8-EMA (13859) is required to validate bearish potential and prompt liquidation back towards the 21-EMA (13582). Slicing through that would put former resistance-turned-support at the February 25 high (13354) under pressure.

Alternatively, a retest of the yearly high (14060) probably eventuates if the 13,900 mark remains intact, with a break above needed to signal the resumption of the primary uptrend.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss