Canadian Dollar, CAD, USD/CAD Price Analysis:

- USD/CAD fell from Fibonacci resistance last week, reverting back to the 1.3900 handle before bouncing up to 1.4000.

- After the fireworks in March, USD/CAD has now spent more than a month digesting prior gains.

- Will USD/CAD bulls re-enter the equation to continue that March major move? Or is more mean reversion or possibly even a deeper pullback on the cards as a shorter-term bearish formation may be building.

USD/CAD Mean Reversion After March Mayhem

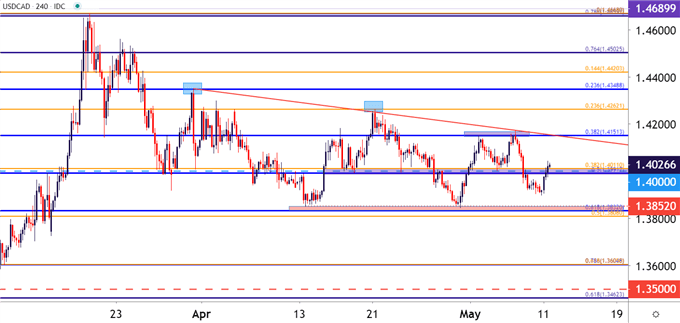

Last week saw USD/CAD push up to a fresh multi-week high, just after catching a support inflection off of a big zone around the psychological level of 1.4000. Within a 20 pip range around that price are a couple of different Fibonacci levels that, collectively, had helped to previously elicit a resistance inflection.

At this point, that area on the chart appears to be towards the middle of the recent range in the pair, and that mean reversion has been going on for more than a month now following a burst of activity in March. Support has held a couple of different inflections already and that resides around the 1.3850 area; while resistance has been coming in at progressively lower-highs: Around 1.4349 in late-March, at 1.4262 in mid-April and, most recently, around 1.4150 last week.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

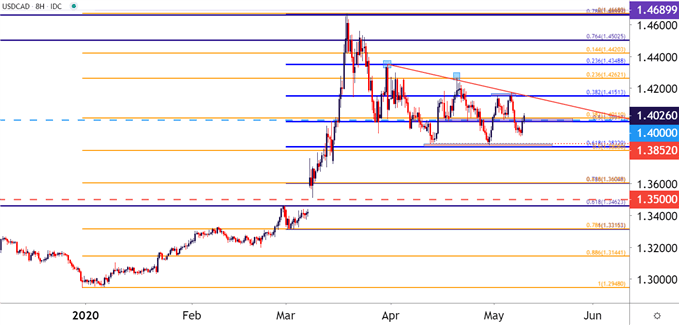

Each of the recent swing-highs listed above show around Fibonacci levels derived from a couple of different moves that have already shown in 2020. The first, in gold below, is the 2020 major move, taking the December 31st swing low up to the March high. The second is from the March major move, taking the lows that held through the monthly open up to the fresh four-year-high that was set on March 18th.

The levels from these Fibonacci studies may allow for strategy arrangement in the days and weeks ahead as digestion has continued in USD/CAD following that significant breakout from a couple of months ago.

USD/CAD Eight-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

USD/CAD Digestion, Near-Term Strategy Parameters

On a near-term basis, given the past month of mean reversion traders would rightfully be cautious of assigning directional biases to the pair. And additionally, there could be a case of conflicting signals given the build of what could be considered a descending triangle given the pace of lower-highs combined with that horizontal support around 1.3850. This would be counter to the massive bullish trend that triggered in March, at which point buyers shied away from a re-test of the 17-year-high. Also of note from that bullish run a couple of months ago, a portion of unfilled gap remains around another major psychological level of 1.3500.

From a longer-term perspective, that unfilled gap may function as some semblance of projected support, particularly should the shorter-term observation of potentially bearish behavior show given the build of the descending triangle looked at above.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX