Canadian Dollar, CAD, USD/CAD Talking Points:

- USD/CAD has been in a clean sell-off for over a year now, but has recently encountered a major psychological level that’s proving difficult to break.

- I had looked into this theme early last week but dynamics have begun to shift, with Oil prices breaking out to help keep CAD relatively strong. This can once again make USD/CAD as an attractive candidate for bearish-USD themes.

- Tomorrow brings headline risk for both USD and CAD on the economic calendar, with jobs reports out of both economies due at 8:30 AM ET.

Sellers have dominated in USD/CAD now for more than a year. And more pertinent to the present tense, that bearish sell-off was very pronounced from late-April and through the first couple weeks of May.

At the core of the move was a fundamental driver, with the Bank of Canada starting to talk about post-pandemic policy while the Fed seemingly shied away from even acknowledging the topic. That doesn’t mean that market participants have rested on their laurels, however, and this topic will again be center stage tomorrow morning when jobs numbers are released from both the US and Canada at 8:30 AM ET.

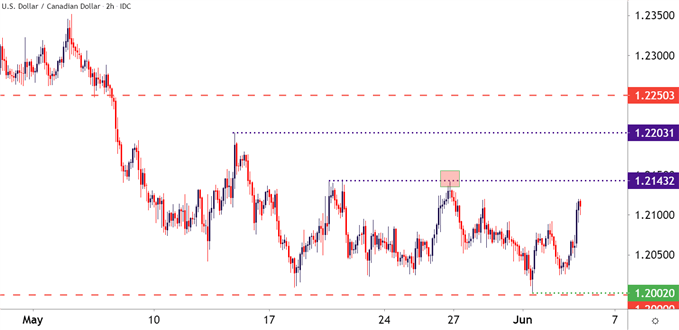

I had looked into the bearish trend in USD/CAD last week, remarking that the pair was oversold and facing a big spot of support, and environment that could be conducive for pullback scenarios. And while that’s been playing out quite visibly in the US Dollar, USD/CAD has been a bit more subdued.

The first resistance level pointed out in that article did come into play; after which sellers took another swing at support. But, the 1.2000 level remained unfettered, with sellers coming a mere 2 pips away from testing the psychological level. But, when a psychological level like 1.2000 makes an impact without even coming into play, there may be a deductive message that can be gleaned from that, and in the days since that failed test sellers have continued to pull back on the throttle.

To learn more about psychological levels, check out DailyFX Education

USD/CAD Two-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

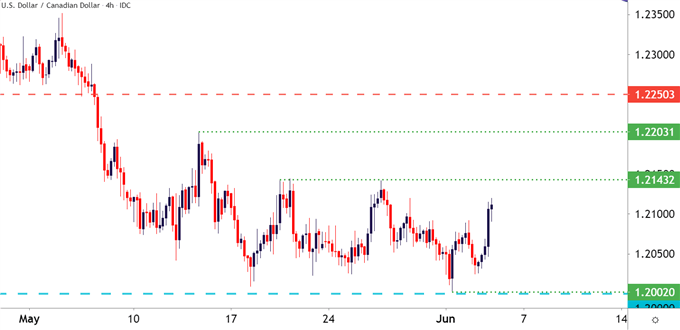

USD/CAD Not Tracking USD – Attractive for Bearish USD Themes

One important note – while sellers have backed off of USD/CAD, at least for now, it’s not near to the same degree as what’s showing in the US Dollar. This highlights the continued play of CAD-strength, with at least some help from the Bank of Canada. But, also a factor more recently has been the bullish breakout in Oil, with WTI crude oil moving up to fresh two-year-highs, as I’d looked at in the analyst pick last week ahead of the break.

This can keep USD/CAD as an attractive vehicle for strategies behind USD-weakness. And with NFP on the cards for tomorrow, there’s ample opportunity for sellers to go back on the prowl.

For resistance levels in USD/CAD, the same structure as last week applies. The 1.2143 level is very nearby and has already supplied at least one resistance reaction. But, above that, another level of note sits at 1.2203 and a bit-higher, the psychological level at 1.2250 is confluent with a prior swing that keeps this level active as a potential ‘r3’ area of resistance.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX