Canadian Dollar, USD/CAD, CAD/JPY, EUR/CAD Talking Points:

- The Canadian Dollar has remained very strong against many major currencies, with the CAD driving to a fresh three-year-high against the US Dollar to start this week.

- While the trend in USD/CAD has been clear, CAD-strength has also been on full display against the Euro and Japanese Yen, similar to what was looked at in early-February just ahead of the CAD-breakout move.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

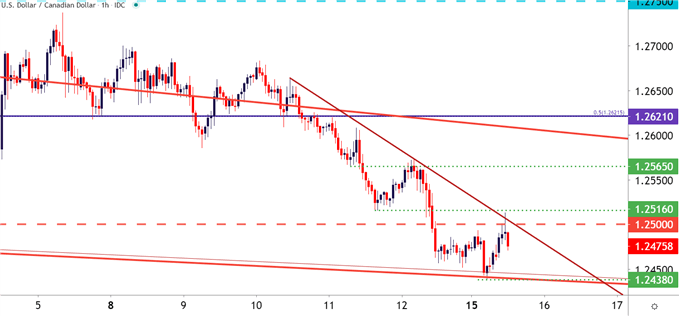

The Canadian Dollar continues to show signs of strength, helped along by the topside drive in Oil prices that’s helped to bring buyers back to the bid behind the commodity currency. On Thursday of last week, I looked at the potential for breakdown in USD/CAD as the pair was closing in on a re-test of the vaulted psychological level at 1.2500. That breakout has since clear as the USD/CAD pair pushed down to a fresh three-year-low to start this week.

Buyers have since shown up around a trendline projection that I’ll talk about a little lower in this article; but the big question to start this week is whether sellers can hold resistance at that same 1.2500 big figure that had previously helped to set support.

To learn more about psychological levels and how they might impact support or resistance in a market, check out DailyFX Education

USD/CAD Hourly Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

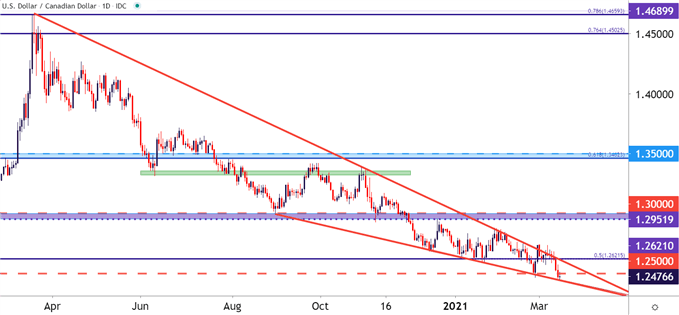

Taking a step back on the chart to look at the longer-term setup in USD/CAD, and there could be continued scope for reversal potential. The longer-term falling wedge remains in-play, with the support side of that formation coming in to help set this morning’s low.

While calling for reversals in both the US and Canadian Dollars can be dauting, the fact that there’s an FOMC rate decision during this week could keep the door open for some fast change across markets. But, perhaps more operative – for those that are looking for Canadian Dollar strength, similar to what was looked at in early-February, there may simply be more amenable pastures elsewhere, such as EUR/CAD or CAD/JPY. In USD/CAD, the longer-term falling wedge looms large given the fact that it’s been building for a year now. Such patterns are often approached with the aim of bullish reversals, begging the question: Will the Fed elicit a larger push of USD-strength at this week’s rate decision?

To learn more about falling wedge formations, check out DailyFX Education

USD/CAD Daily Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

CAD/JPY Explodes Higher

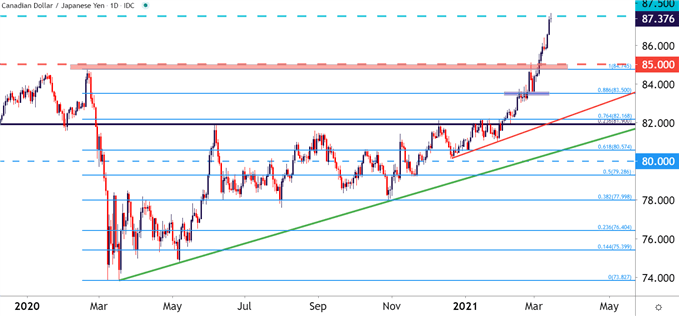

When I looked into the Canadian Dollar back in early-February, CAD/JPY was a focus chart as there were a couple of different bullish items brewing. Price action at the time had built into an ascending triangle formation – often approached with the aim of bullish breakouts. Higher-low support going along with horizontal resistance opens the door for that bullish enthusiasm to eventually play-through for a topside break, and that’s what happened in February as the pair exploded up to a fresh two-year-high, continuing to run so far through March trade.

As of this morning, CAD/JPY has tagged another fresh high watermark, testing the 87.50 psychological level. This could be a daunting area to chase topside given how overbought the pair has become. But – given prior resistance at the 85.00 psychological level combined with the fact that there hasn’t been much for support showing there since the breakout – there’s an ideal place to look for prices to pullback towards.

CAD/JPY Daily Price Chart

Chart prepared by James Stanley; CADJPY on Tradingview

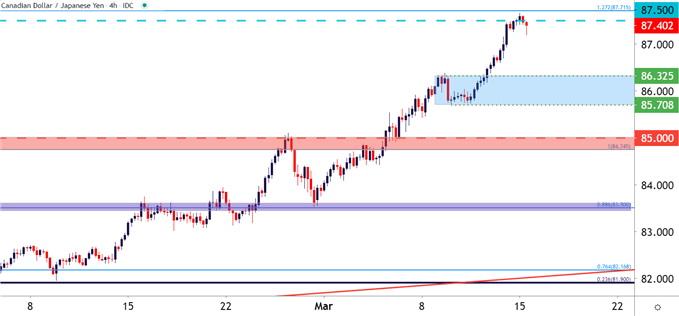

The only complication there is that an approximate 250 pip pullback would be sizable – suggesting that perhaps something had shifted in the backdrop. This is something that could possibly play-through around the FOMC rate decision, but this would seem an exceptional case that may or may not happen. So, instead, a shorter-term level around 86.25 could be looked to for higher-low support potential, and from shorter-term charts, we can see where there was a bit of gyration around 85.70-86.30 which can present an area of potential higher-low support for bullish continuation scenarios.

CAD/JPY Four-Hour Price Chart

Chart prepared by James Stanley; CADJPY on Tradingview

EUR/CAD Drives to Fresh Yearly Low

The past couple of weeks have been especially sharp in EUR/CAD, where the typically sleepy pair has put in a robust breakdown through March trade.

I had also looked at EUR/CAD for CAD-strength scenarios in early-February. This setup was a little different, however, as there was a resistance inflection on the underside of a previously bullish trendline, and there was little inclination that the pair was about to become as volatile as it did in the six weeks since. The pair fell down to a fresh yearly low earlier this morning, and RSI has now moved into oversold territory on the Daily chart.

To learn more about drawing and using trendlines on charts, join us in DailyFX Education

EUR/CAD Daily Price Chart

Chart prepared by James Stanley; EURCAD on Tradingview

EUR/CAD is currently oversold while trading near newly-established yearly lows. This could be a difficult backdrop to justify chasing, but for those that are looking at bearish continuation scenarios, a pullback to find resistance around the 1.5000 psychological level may re-open the door for such. This price offered some support when prices were on the way down last week; but since breaking below, there hasn’t yet been much for resistance.

EUR/CAD Four-Hour Price Chart

Chart prepared by James Stanley; EURCAD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX