Canadian Dollar, Loonie, USD/CAD Talking Points:

- This is an update to an article published on February 1, looking at CAD potential against the US Dollar (USD/CAD), the Euro (EUR/CAD) and the Japanese Yen (JPY).

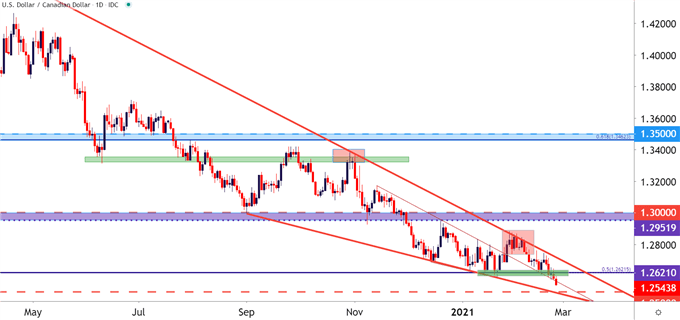

- USD/CAD has pushed down to fresh two-year-lows.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

Commodity currencies continue to rally and in USD/CAD, this theme has already made a mark as USD/CAD has pushed down to fresh two-year-lows, even as the US Dollar holds support around the 90-handle.

This can make for an especially exciting backdrop in commodity currency pairs should the head and shoulders pattern currently showing in the USD give way; which opens the door for a potent combination of continued strength in commodity currencies to go along with bearish breakout potential in the US Dollar.

In USD/CAD, bears didn’t want to wait around for the USD to take-out its own support. Sellers are currently driving the pair to fresh two-year-lows, getting very close to the 1.2500 psychological level on the chart.

USD/CAD Daily Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

CAD/JPY Breaks Out in a Big Way

As looked at earlier this month, CAD/JPY carried breakout potential as prices had built into an ascending triangle pattern around a big level of resistance, just inside of the 82.00 handle. Ascending triangles can lead into bullish breakouts, driven by the assumption that the same bullish behavior that’s brought bulls in at higher-lows will, eventually, allow for a break through horizontal resistance.

To learn more about the ascending triangle pattern, check out DailyFX Education

The pair has since broken out in a big way and prices are fast approaching the two-year-high, right around 84.75. This, combined with the 85 psychological level, makes for an imposing area of resistance that this breakout appears to be stretching towards. This can make continuation prospects a bit more daunting at current – but it does open the door for pullback potential to a prior area of resistance, around the 83.50 level on the chart.

CAD/JPY Daily Price Chart

Chart prepared by James Stanley; CADJPY on Tradingview

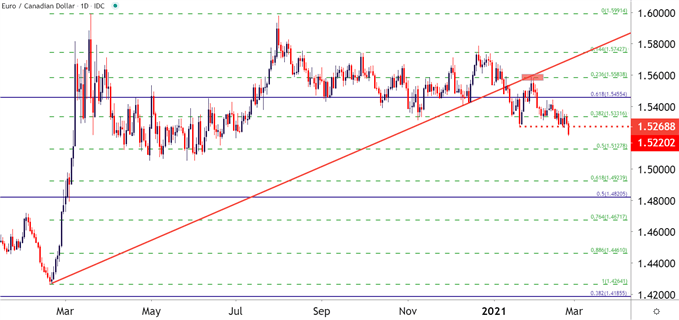

EUR/CAD Breakdown Through Big Support

EUR/CAD was another pair looked at earlier this month as an alternative area to look for CAD-strength. At the time, EUR/CAD had found resistance on the underside of a previously bullish trendline. Such trendline inflections can often signal a change of trend, and that’s continued to show over the past few weeks.

To learn more about trendlines, join us in DailyFX Education

The pair has now broken down to fresh seven-month-lows, and given the fresh breakout in the Canadian Dollar, this may be a difficult theme to chase. However – a recent area of prior support, around the 1.5269 area on the chart, can be re-purposed for resistance.

EUR/CAD Daily Price Chart

Chart prepared by James Stanley; EURCAD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX