Canadian Dollar, USD/CAD, AUD/CAD, GBP/CAD Talking Points:

- The Canadian Dollar has shown a general tendency towards strength over the past week.

- USD/CAD may be problematic for CAD-bulls given proximity to the 1.3000 psychological level.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

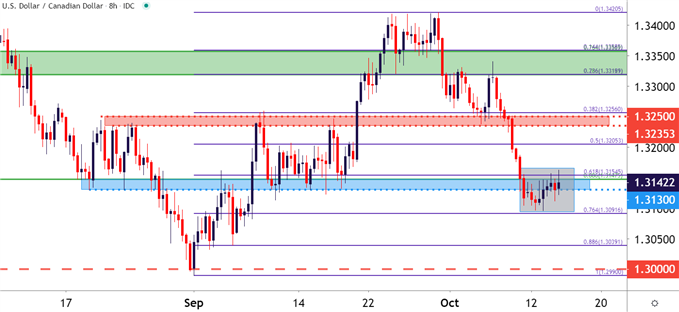

The Canadian Dollar continues to show signs of strength, and in the major USD/CAD pair, prices have pushed down to a fresh monthly low, finding a bit of support above the 1.3100 figure. When I had looked into USD/CAD last week, prices had just started to re-engage with the key zone running from 1.3130-1.3150. And while that support was unable to hold the lows, sellers weren’t able to stray very far and, at this point, that zone is currently showing tendencies of acting as short-term resistance.

USD/CAD Eight-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

In a normal backdrop, a recent fresh lower-low combined with potential resistance taken from an area of prior support would normally be construed as bearish. The caveat here, however, is the 1.3000 psychological level, which so far in 2020 has proven to be a tough price to take-out.

This was also the case for much of last year. Sellers continually teased a 1.3000 break but that didn’t actually happen until the last day of 2019. And after coming into the year holding just inside of 1.3000, prices broke-out in early January. There was a re-test in early-September but that test failed and sellers quickly relinquished control: Prices rallied by more than 400 pips over the remainder of the month, and now that we’re almost half-way through October, sellers have taken out approximately 61.8% of that prior bullish move.

So the quandary here on the short side may be one of potential as that psychological level is relatively near-by. For those that want to look for themes of CAD-strength, there may simply be more attractive venues elsewhere. And likewise on the side of CAD-weakness, there may simply be more attractive venues away from the US Dollar as the US currency goes through its own themes and drives as we’re now three weeks away from the US Presidential Election.

USD/CAD Weekly Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

AUD/CAD Interesting for Cases of CAD Strength

For those that do want to investigate long-CAD strategies, AUD/CAD may hold some interest. AUD/CAD is currently sitting on a big support level around the .9400 handle, as this is the 38.2% retracement of the 2008-2012 major move. This same price had held as resistance throughout the month of June, eventually giving way to a bullish advance. But, prices came right back in late-September and after a bounce up to a lower-high, again in mid-October.

At this point, that series of lower-highs can be incorporated with this horizontal support to produce a descending triangle formation. Such a formation will often be approached with the aim of bearish breakouts, and given the secondary support level around .9313, there could be an area to look for prices to breakdown to.

To learn more about descending triangles, check out our DailyFX Education section.

AUD/CAD Daily Price Chart

Chart prepared by James Stanley; AUDCAD on Tradingview

GBP/CAD Possibly of Interest for CAD-Weakness Scenarios

For those on the other side of the Canadian Dollar, looking for CAD-weakness scenarios, GBP/CAD may hold some interest. Despite the craziness of 2020 the pair has, by and large, stuck into a range. It hasn’t been a smooth range but there’s little doubt that mean reversion has so far been the name of the game for GBP/CAD in the year of 2020.

What makes this area compelling for CAD-bears is the fact that prices have appeared to give a recent push off of support, making a move towards the resistance side of the range that’s already seen multiple inflections so far this year.

On the resistance side, there’s potential around 1.7221, 1.7350, 1.7431 and then at 1.7539. If those can get taken-out, the next obvious level is around the 1.7675 area on the chart. For support – there’s a confluent zone from around 1.6965 up to the 1.7000 psychological level, followed by 1.6823.

To learn more about psychological levels, check out our DailyFX Education section.

GBP/CAD Daily Price Chart

Chart prepared by James Stanley; GBPCAD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX