Canadian Dollar, USD/CAD, CAD/JPY, Bank of Canada, Inflation – Talking Points:

- Progress in US fiscal aid talks appeared to firm market sentiment during APAC trade.

- Retail sales and inflation data may dictate the outlook for the Canadian Dollar.

- USD/CAD poised to extend declines as price tracks within price channel.

- CAD/JPY eyeing a push to fresh monthly highs.

Asia-Pacific Recap

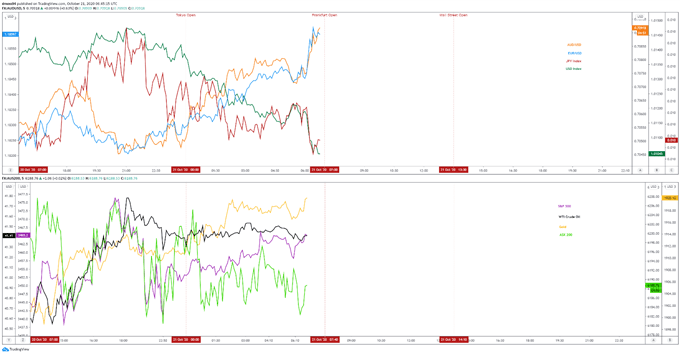

The haven-associated US Dollar and Japanese Yen continued to lose ground against their major counterparts during the Asian trading session, as progress in US fiscal stimulus negotiations appeared to firm market sentiment.

Gold and silver prices edged higher despite US 10-year Treasuries yields soaring above 80 basis points for the first time since June.

Australia’s ASX 200 index rose 0.12% and Japan’s Nikkei 225 index pushed back above the 23600 mark, as S&P 500 futures continued to trek higher.

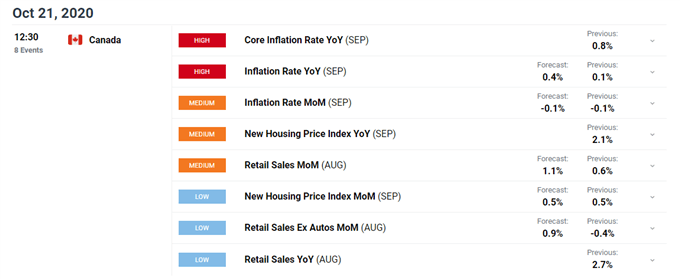

Looking ahead, Canadian inflation data for September headlines the economic docket alongside speeches from European Central Bank President Christine Lagarde and Federal Reserve Governor Lael Brainard.

Market reaction chart created using TradingView

Retail Sales Data to Dictate CAD

Upcoming retail sales and inflation data may dictate the near-term outlook for the Canadian Dollar, after the Bank of Canada’s Business Outlook Survey showed that “business sentiment has improved but remains weak across all regions [and] businesses expect the pace of the recovery in their sales to slow”.

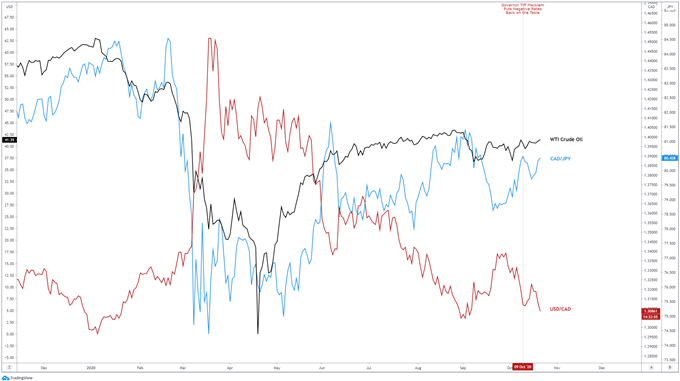

Surprisingly, despite business sentiment remaining “well below its historical average” and manufacturing sales for the month of August falling 0.6% more than the expected 1.4% decline, the Canadian Dollar has continued to outperform the haven-associated Japanese Yen and US Dollar in recent days.

Of course, this could be down to the recent resiliency seen in oil prices this month, in tandem with the renewed hopes of a pre-election fiscal stimulus package out of the US.

Nonetheless, the cyclically-sensitive currency has erased the losses it took after Tiff Macklem suggested that taking interest rates into negative territory is still a possibility, with the Bank of Canada Governor stating that although the central bank is “not actively discussing negative interest rates at this point”, it is still in “our toolkit and never say never”.

Canadian Dollar comparison chart created using TradingView

However, Macklem also voiced that “as much as a bold policy response was needed, it will inevitably make the economy and financial system more vulnerable to economic shocks down the road”, adding that “the bottom line is that the private and public sectors together need to be acutely aware of financial system risks and vulnerabilities as the economy recovers”.

This could indicate that Canadian policymakers are becoming more sensitive to the potential impact of alternative monetary policy measures and may hesitate to ease further in the absence of a notable deterioration in economic data.

With that in mind, the Canadian Dollar may continue to outperform the haven-associated Japanese Yen and US Dollar, if upcoming economic data encourages the Bank of Canada to retains it wait-and-see approach to monetary policy.

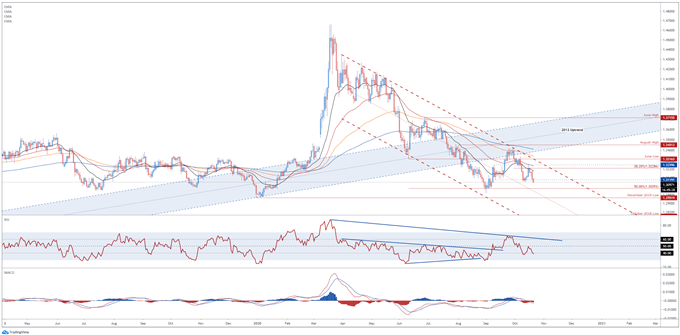

USD/CAD Daily Chart – Descending Channel Guiding Price Lower

From a technical perspective, the USD/CAD exchange rate’s outlook remains skewed to the downside, as price continues to track within the confines of a Descending Channel after failing to break back above confluent resistance at the 21-day moving average (1.3200) and 38.2% Fibonacci (1.3228).

The development of the RSI and MACD indicator hints at swelling bearish momentum, as both oscillators continue to track firmly below their respective midpoints.

With that in mind, a daily close below the October 13 swing-low (1.3099) would probably signal the resumption of the primary uptrend and carve a path for price to test key support at the 50% Fibonacci (1.3039).

Conversely, a reversal higher could be in the offing if the psychologically imposing 1.3100 mark successfully stifles buying pressure, with a break back above the 21-DMA (1.3200) potentially generating a test of Descending Channel resistance and the October 15 swing-high (1.3259).

USD/CAD daily chart created using TradingView

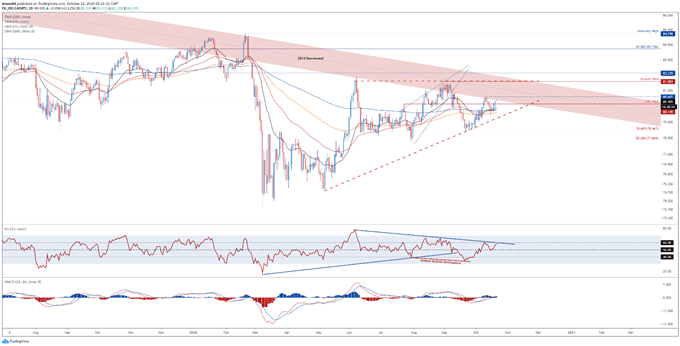

CAD/JPY Daily Chart – Eyeing a Push to Fresh Monthly Highs

CAD/JPY rates appear to be gearing up for a push to fresh monthly highs, as price bounces away from the sentiment-defining 200-MA (79.75) and breaks back above resistance at the July high (80.14).

With the RSI strengthening above its neutral midpoint and the MACD indicator travelling comfortably in positive territory, the path of least resistance seems higher.

That being said, given the RSI has yet to snap its downtrend extending from the June extremes and price hasn’t breached the October high (80.60), a near-term pullback is certainly not out of the question.

Nevertheless, a daily close above the monthly high (80.60) would probably generate a more impulsive topside push and potentially bring key resistance at the August high (81.58) into focus.

On the other hand, failure to break to fresh monthly highs may inspire would-be sellers and ignite a short-term pullback towards the Ascending Triangle uptrend, if support at the July high (80.14) gives way.

CAD/JPY daily chart created using TradingView

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss