British Pound, GBP/USD, Dow Jones, Japanese Yen – Asia Pacific Market Open

- British Pound fell as Brexit talks fell short of expectations

- GBP/USD broke under support, opening door to reversal

- Yen may gain if Japanese 1Q GDP data spooks investors

The British Pound declined on Friday as Brexit talks fell short of making meaningful progress. Michel Barnier – EU’s Chief Brexit negotiator – mentioned that he is ‘not optimistic’ about talks. Across the English Channel, UK Chief Negotiator David Frost said that ‘very little progress’ was made toward the EU pact. With both sides appearing to head for a stalemate, further uncertainty took to its toll on Sterling amid Covid-19.

The S&P 500 and Dow Jones rose 0.25% and 0.39% respectively in a rather quiet session. Risk aversion sank in on a couple of developments. Fears of US-China trade tensions escalated as the White House moved to cut Huawei off from global chip suppliers. According to a person close to the Chinese government, the nation is ready to take countermeasures. This may include suspending Boeing airplane purchases.

Retail sales in the world’s largest economy contracted -16.4% m/m in April which both missed expectations and was the sharpest drop on record. A final push from equities into Wall Street close trimmed earlier losses. Still, the haven-linked US Dollar outperformed as well as the similarly-behaving Japanese Yen. The growth-linked Australian Dollar depreciated.

Discover your trading personality to help find forms of analyzing financial markets

Monday’s Asia Pacific Trading Session

Top-tier event risk during Monday’s Asia Pacific trading session include first-quarter Japanese GDP data. If it sours sentiment by further revealing the severity global growth is facing amid the coronavirus, the Japanese Yen could appreciate. This is as the Federal Reserve warned on Friday that there could be a ‘major decline in asset prices’ if the pandemic worsens.

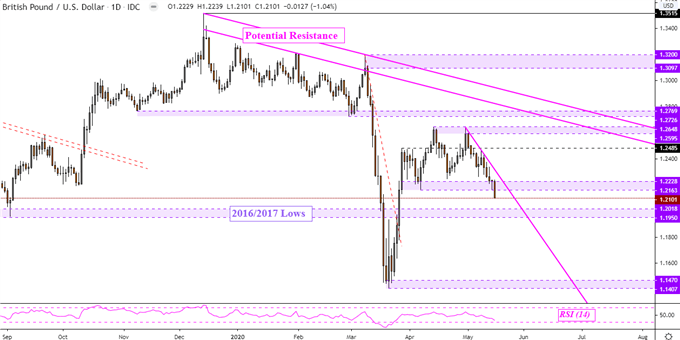

British Pound Technical Analysis

The drop in GBP/USD Friday meant that Sterling broke under key support which is a range between 1.2163 – 1.2228. Thus the pair has exited its persistent consolidative mode since late March. Yet technical confirmation is lacking at this point, a confirmatory downside close could set the stage for deeper losses. This is as prices could face former lows from 2017 and 2016 between 1.1950 – 1.2018.

GBP/USD Technical Analysis – Daily Chart

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter