British Pound, GBP/USD, UK Reopening, Coronavirus Infections, Vaccination Rates – Talking Points:

- Climbing coronavirus case numbers in several Asian nations weighed on risk appetite during APAC trade.

- Reopening optimism may drive the British Pound higher against its major counterparts in the near term.

- GBP/USD poised to extend gains as price remains constructively positioned above key support.

The Quiz

Discover what kind of forex trader you are

Asia-Pacific Recap

Equity markets lost ground during Asia-Pacific trade as climbing coronavirus infections in several Asian nations weighed on risk appetite. Australia’s ASX 200 (-0.22%), Japan’s Nikkei 225 (-0.31%), and China’s CSI 300 (-0.18%) all slid lower, while Hong Kong’s Hang Seng Index (0.12%) traded marginally higher.

In FX markets, the Japanese Yen fell against its major counterparts as the BoJ retained its dovish monetary policy stance, while the risk-sensitive Australian and Canadian Dollars climbed marginally higher. Gold prices held relatively steady alongside US 10-year Treasury yields, and crude oil rose just under 1%.

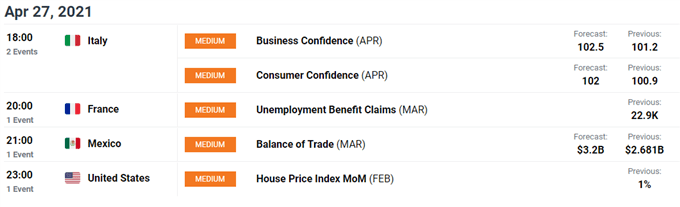

Looking ahead, US housing price index release for February headlines a rather light economic docket, with Mexico’s March trade balance figures also on the schedule.

Progressive Reopening to Underpin GBP

The British Pound may continue to climb higher in the near term, on the back of the nation’s rapid rollout of coronavirus vaccines, falling infection numbers, and progressive return to economic normality.

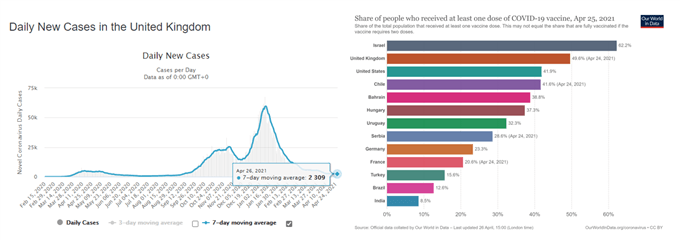

Covid-19 case numbers have slid to the lowest levels since September last year, placing the UK on a course to move successfully to the third stage of Prime Minister Boris Johnson’s four-stage reopening plan on May 17. This next phase will see indoor hospitality and professional sporting venues reopen to the public.

Source – Worldometer

A string of better-than-expected economic data releases highlight Britain’s robust recovery and will likely buoy the currency against its major counterparts. Retail sales figures for March substantially exceeded consensus estimates, coming in at 7.2% (estimated 3.5%), alongside strong expansionary preliminary estimates for both manufacturing and services PMI.

With that in mind, a fairly light data calendar in the week ahead may open the door for the local currency to continue riding these positive tailwinds higher.

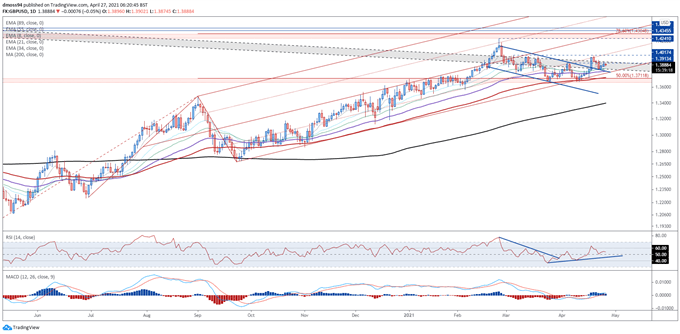

GBP/USD Daily Chart – 8-EMA Guiding Price Higher

Chart prepared by Daniel Moss, created with Tradingview

From a technical perspective, the GBP/USD exchange rate’s outlook remains bullish, as prices track above all six moving averages and remain constructively positioned above key psychological support at 1.3800.

With the RSI and MACD both travelling above their respective neutral midpoints, and an ascending Schiff Pitchfork guiding price higher, the path of least resistance seems skewed to the upside.

A retest of the monthly high (1.4009) looks likely in the near term if the 8-EMA (1.3875) holds firm, with a daily close above needed to bring the yearly high (1.4241) back into the crosshairs.

However, if 1.3800 gives way, a pullback to the 50% Fibonacci (1.3712) could be on the cards.

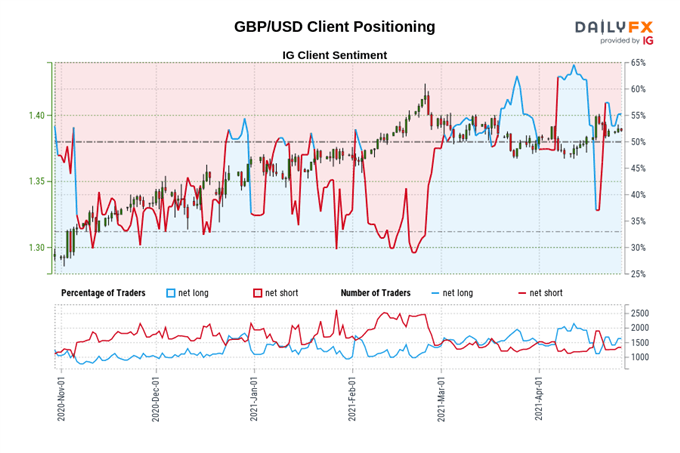

The IG Client Sentiment Reportshows 55.19% of traders are net-long with the ratio of traders long to short at 1.23 to 1. The number of traders net-long is 8.27% higher than yesterday and 44.87% higher from last week, while the number of traders net-short is 4.98% higher than yesterday and 29.57% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss