British Pound, Coronavirus Infections, Vaccination Rates, GPB/USD, GBP/JPY – Talking Points:

- Equity markets broadly gained during APAC trade as risk appetite notably firmed.

- The marked drop in coronavirus infections in the UK may underpin the British Pound in the near term.

- GBP/USD and GBP/JPY rates eyeing a push to retest their respective January highs.

Asia-Pacific Recap

Risk appetite markedly firmed during Asia-Pacific trade as investors key in on President-elect Joe Biden’s inauguration and the Senate hearing for Treasury Secretary nominee Janet Yellen. Australia’s ASX 200 soared 1.19% alongside Japan’s Nikkei 225 and Hong Kong’s Hang Seng index, climbing 1.39% and 1.75% respectively.

In FX markets, the risk-sensitive AUD, NZD and NOK largely outperformed while the haven-associated USD, CHF and USD lost ground against their higher beta counterparts. Gold and silver prices moved marginally higher as yields on US 10-year Treasuries held relatively steady at 1.1%.

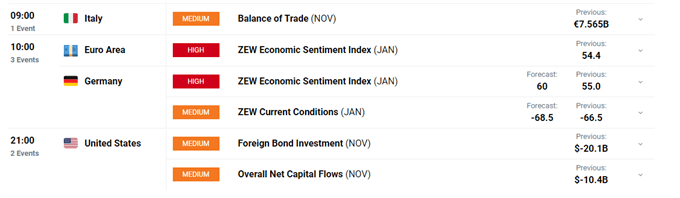

Looking ahead, the ZEW Economic Sentiment Index release for January out of Germany and the Euro-area headlines the economic docket alongside a speech from Bank of England Chief Economist Andy Haldane.

Falling Cases Numbers to Underpin GBP

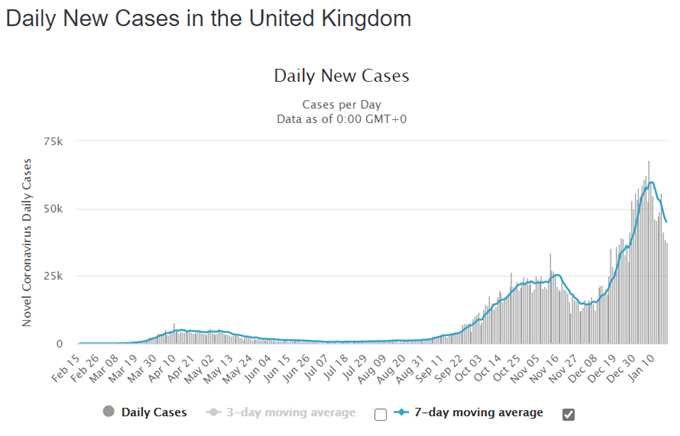

The notable decline in daily coronavirus cases in the United Kingdom could buoy the British Pound in the near term, as the imposition of the strictest lockdown measures since March begins to have a meaningful impact on the local infection rate. The 7-day moving average tracking Covid-19 cases has dropped by 15,000 in the last ten days, while the viral R rate has decreased from 1.4 to 1.2.

Moreover, with one person in 20 now vaccinated, there appears to be a sliver of light at the end of the tunnel. That being said, local health authorities have stressed that a return to normality may not occur this side of spring.

Source – Worldometer

The Scientific Advisory Group for Emergencies (SAGE) warned that “the latest figures show that we need to remain vigilant to keep this virus under control, while Prime Minister Boris Johnson stated that “this is not the time for the slightest relaxation of our national resolve and our individual efforts”.

Indeed, with the viral daily growth rate still hovering above 2%, there is a distinct possibility that case numbers could continue to climb. Nevertheless, the promising drop in infections may buoy regional risk sentiment in the coming days and in turn buoy the British Pound against its haven-associated counterparts.

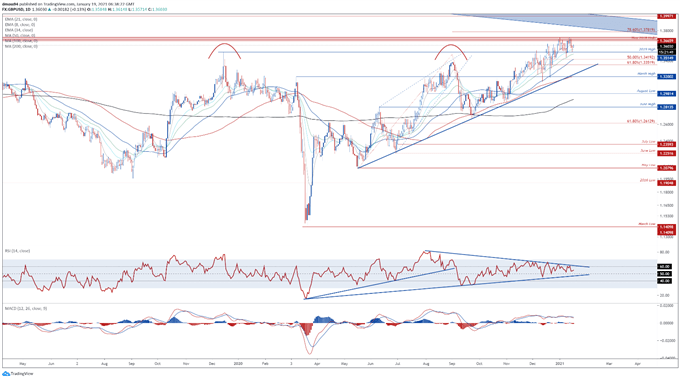

GBP/USD Daily Chart – Bullish MA Stacking Hints at Further Upside

GBP/USD daily chart created using Tradingview

From a technical perspective, GBP/USD rates look set to retest the yearly high set on January 14 (1.3711) as price remains constructively perched above the 2019 high (1.3515) and the 34-day exponential moving average.

With the RSI and MACD indicator both traveling firmly above their respective neutral midpoints, the path of least resistance looks skewed to the topside.

A daily close back above the 8-EMA (1.3600) would probably generate an impulsive push to challenge range resistance at 1.3680 – 1.3710. Clearing that likely opening the door for buyers to challenge the psychologically imposing 1.3800 mark.

Alternatively, collapsing back below the 34-EMA (1.3493) could ignite a pullback towards the monthly low (1.3451).

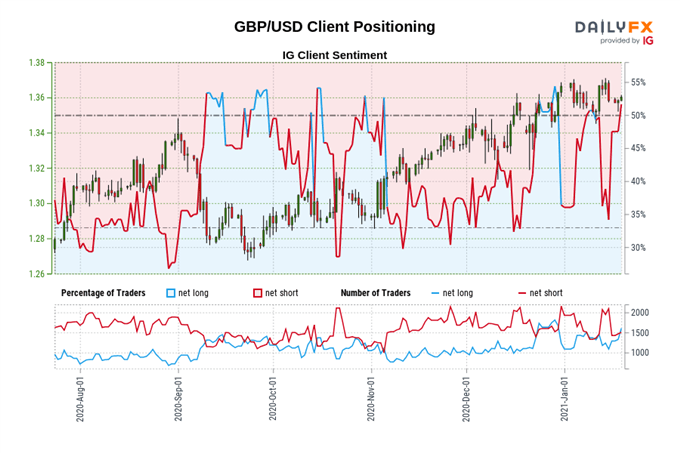

The IG Client Sentiment Report shows 52.52% of traders are net-long with the ratio of traders long to short at 1.11 to 1. The number of traders net-long is 17.39% higher than yesterday and 11.24% higher from last week, while the number of traders net-short is 2.34% lower than yesterday and 3.19% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

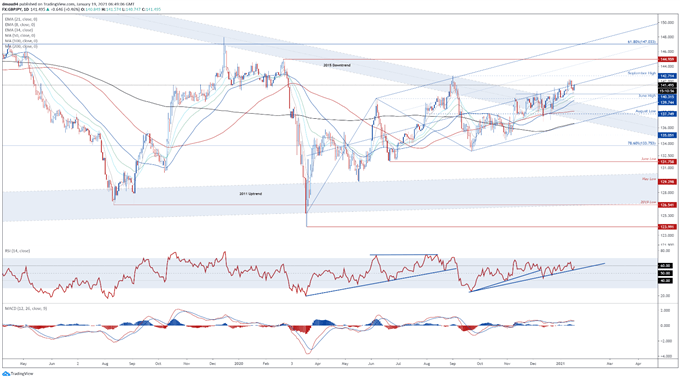

GBP/JPY Daily Chart – Schiff Pitchfork Guiding Price Higher

GBP/JPY daily chart created using Tradingview

The GBP/JPY exchange rate also looks poised to continue pushing higher as price surges away from former resistance-turned-support at the November high (140.31).

Bullish moving average stacking, in combination with the RSI eyeing a push back above 60, suggests further gains are likely in the near term.

Clambering back above the Schiff Pitchfork median line and the January 13 close (141.61) would probably carve a path for price to challenge the monthly high (124.26). A daily close above likely signalling the resumption of the primary uptrend and bringing the September 2020 high (142.71) into the crosshairs.

On the other hand, failing to overcome the pitchfork median could allow sellers to regain control of the exchange rate and drive price back towards the 34-EMA (140.07).

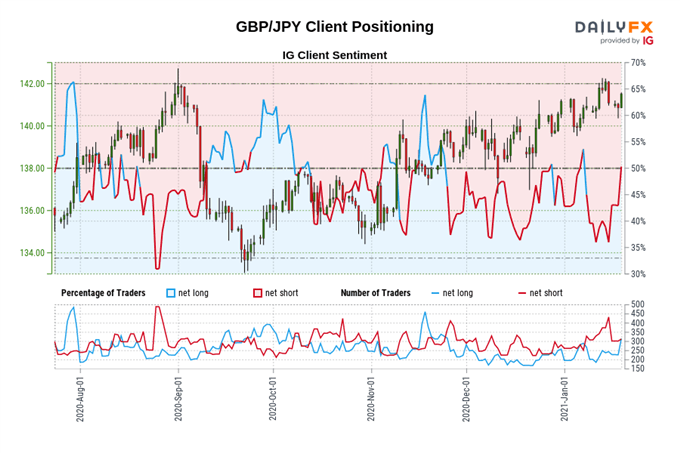

The IG Client Sentiment Report shows 48.60% of traders are net-long with the ratio of traders short to long at 1.06 to 1. The number of traders net-long is 25.79% higher than yesterday and 19.83% higher from last week, while the number of traders net-short is 6.37% lower than yesterday and 6.96% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/JPY prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/JPY price trend may soon reverse lower despite the fact traders remain net-short.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss