BRITISH POUND, GBP/USD OUTLOOK, UK GOVERNMENT BUDGET 2020 – Talking Points

- British Pound could rise on the UK 2020 government budget

- GBP closely watching Chancellor of Exchequer Rishi Sunak

- GBP/USD enters compression zone: where will it break out?

ASIA-PACIFIC RECAP

Early into Asia’s Wednesday trading session, the Japanese Yen surged against its G10 counterparts, particularly vs the growth-sensitive Australian and New Zealand Dollars. JPY’s ascent came as various equity index futures pointed lower amid region-wide risk aversion after US fiscal stimulus prospects failed to resuscitate risk appetite.

BRITISH POUND MAY GAIN ON UK GOVERNMENT 2020 BUDGET

Chancellor of the Exchequer Rishi Sunak will be announcing a multi-billion Pound initiative with “historic” investment in railways, road and scientific research as part of the UK government’s 2020 budget. Mr. Sunak’s speech will include provisions on emergency measures from the Treasury that are intended to alleviate the economic shock from the coronavirus.

The Chancellor said: “By investing historic amounts in British innovation and world-class infrastructure, we will rebalance opportunities and lay the foundations for a decade of growth for everybody”. The UK Debt Management Office anticipates gilt – UK government bond – issuance for 2020-2021 to be approximately 166.6 billion pounds. This is significantly higher than the 2019-2020 remit of £136.8 billion.

However, the official, detailed outline of the government’s infrastructure strategy will not be released publicly for a few more weeks. The magnitude of this initiative will likely gain more traction since it will constitute the highest level of public investment since 1955 over a period of five years. This may boost the British Pound and alleviate some of the downward pressure of growing easing expectations from the Bank of England.

INDUSTRIAL DATA, BOE EASING BETS, CORONAVIRUS MAY TRIM STERLING GAINS

However, the British Pound may retrace its gains if industrial data for January paints a gloomy picture and further strengthens the case for BoE rate cuts. This may be amplified by fear about the coronavirus spreading throughout the UK and impacting economic activity. UK Health Minister Nadine Dorries has reportedly been diagnosed with the virus.

GBP/USD PRICE CHART

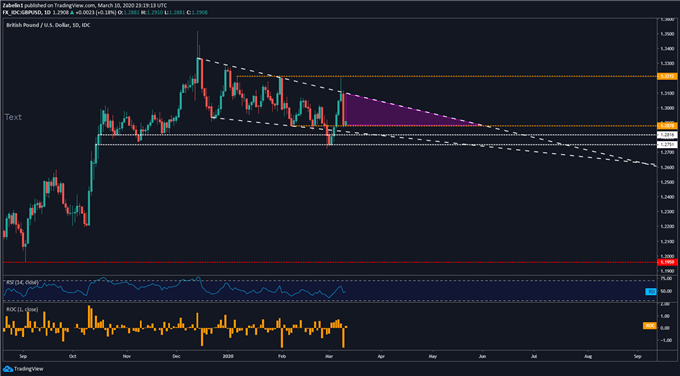

GBP/USD is currently trading in a compression zone encapsulated by the upper layer of the downward-facing channel and support at 1.2878. Despite the brief downside breakout, selling pressure quickly abated and GBP/USD re-entered its prior range. Looking ahead, as the purple-shaded area narrows amid convergence from support and descending resistance, the compression area may catalyze an upside breakout.

GBP/USD – Daily Chart

GBP/USD chart created using TradingView

BRITISH POUND TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead!

- New to trading? See our free trading guides here!

- Get more trading resources by DailyFX!

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter