AUD/USD, Fed Chair Powell, Covid, RBA -Talking Points

- Wall Street climbed as volatility sinks alongside trading volume

- RBA’s Financial Stability Review and Australia Housing data in focus

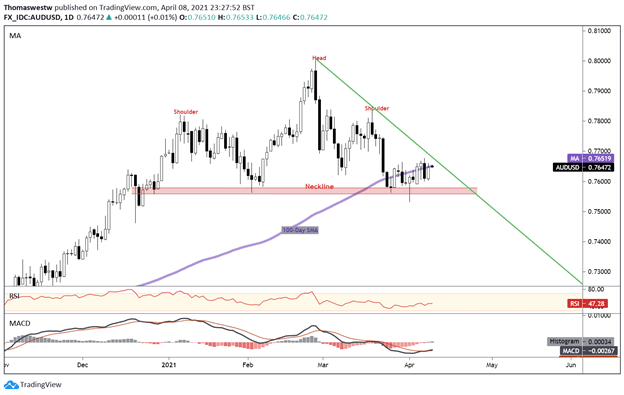

- AUD/USD takes aim at trendline resistance after H&S neckline bounce

The Quiz

Discover what kind of forex trader you are

The Nasdaq 100 index climbed 1.04% on Thursday, bringing the technology-heavy index within 1% of its all-time high set back in February. Market-based volatility dropped to its lowest point since February of last year, with the VIX index dropping to 17.0 amid low trading volume. Elsewhere, the safe-haven US Dollar weakened against most major peer currencies.

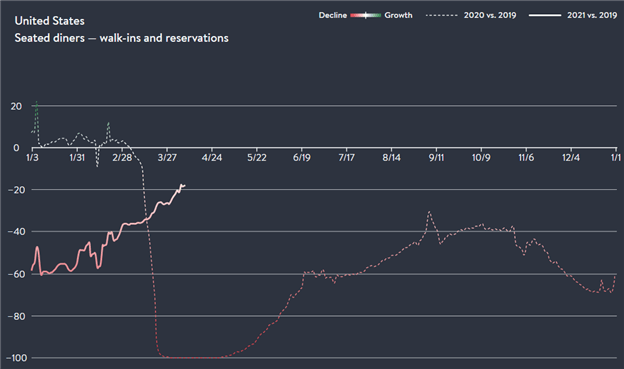

As vaccinations continue at breakneck speeds in the United States, state and local authorities are rolling back social-distancing restrictions. This, combined with the warmer spring weather in the US, is seeing more people leave their houses to enjoy eating out and other leisure-based activities. OpenTable’s State of the Industry site shows seated diners for walk-ins and reservations has increased significantly in recent weeks.

Federal Reserve Chair Jerome Powell stated, “It’s important to remember we are not going back to the same economy, this will be a different economy” during a virtual debate on Thursday. The central banker went on to suggest that not pre-pandemic job will still exist, with technology permanently replacing some of those jobs. The US labor market saw initial jobless claims for the week ending March 27 cross the wires at 3734k, slightly above the median forecast of 3650k.

Source: opentable.com/state-of-industry

Friday’s Asia-Pacific Outlook

Asia-Pacific markets will have a spotlight on the Reserve Bank of Australia’s bi-annual Financial Stability Review (FSR). Earlier this week, the RBA released its April interest rate decision when the central bank kept its benchmark cash rate unchanged at 0.1%. The country’s skyrocketing home prices will be in focus as policy makers grow increasingly cautious over them.

Speaking of Australia’s housing market, the final figure for February’s building permits will cross the wires today, with analysts forecasting a 21.6% rise on a monthly basis, according to the DailyFX Economic Calendar. Markets may see event-driven risk from China, where inflation data will drop. Chinese markets moved higher on Thursday, with the CSI 300 and Hang Seng Index (HSI) gaining 0.17% and 1.16%, respectively.

Meanwhile, government bond markets across the Asia-Pacific region are seeing buyers step back into the fold as traders roll back rate cut bets. The move, prompted by the Treasury market after the US Federal Reserve tempered market expectations over the Fed hiking sooner than expected. Australia’s 10-year yield is down over 5.5% on the week. The move lower in yields is a tailwind for equities, as the yield spread grows in favor of stocks.

AUD/USD Technical Outlook

The Australian Dollar versus the US Dollar appears to be gearing up to test a descending trendline following a bullish MACD cross above the signal line. First, AUD/USD will have to overtake the 100-day Simple Moving Average (SMA), with resistance shortly thereafter. Prices have bounced higher from the neckline of a Head and Shoulders pattern earlier this week.

AUD/USD Daily Chart

Chart created with TradingView

AUSTRALIAN DOLLAR TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinarand have your trading questions answered

- Subscribe to the DailyFX Newsletter for weekly market updates

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter