2020 Election, AUD/USD, US Fiscal Stimulus, Coronavirus, Biden-Trump Spread - Talking Points

- AUD/USD plunged as traders recalibrated US fiscal stimulus risks amid partisan stalemate

- Polls continue to show Mr. Biden in the lead in both the general election, key swing states

- AUD/USD compression zone forming between descending resistance and support at 0.7018

19 DAYS UNTIL THE US PRESIDENTIAL ELECTION

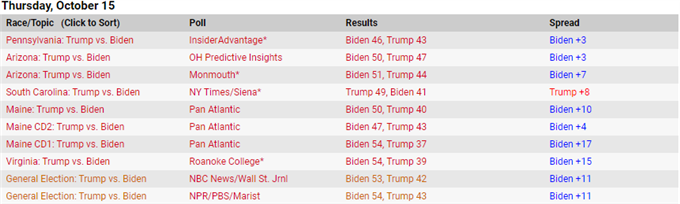

It is almost two weeks until voting day on November 3, and recent polling data from RealClearPolitics continues to reinforce the narrative that Democratic nominee Joe Biden will take the White House. While betting averages between him and the incumbent President Donald Trump have narrowed, polling data for the general election and key swing states continue to support Mr. Biden.

2020 US Election Polls

Covid-19 Spike Amplifying Fiscal Stimulus Concerns

Spiking Covid-19 cases not only in France and the UK – where governments have imposed severe lockdown measures – but in the US as well have added to the sense of urgency for passing another stimulus package. Trump has edged the stimulus package threshold slightly higher from $1.7b to $1.8b, though Secretary of State Steven Mnuchin warned that it “would be difficult” to pass a stimulus bill before the election.

Ongoing deliberations could put additional pressure on growth-anchored assets like the Australian and New Zealand Dollars along with equities while pushing have-linked currencies like the US Dollar higher. The political pressure cooker is amplified by ongoing Brexit negotiations that may be contributing to the Greenback’s rise.

AUD/USD Analysis

AUD/USD continues to trade below descending resistance that formed at the December 2018 swing-high at 0.7393. As the vacuum between it and support at 0.7018 narrows, it may reveal a directional bias depending on where it breaks out. Invalidating the steep descending resistance zone could signal the start of a positive reversal which may be amplified by virtue of its upward outbreak.

AUD/USD - Daily Chart

AUD/USD chart created using TradingView

On the other hand, if resistance holds and support cracks under pressure, the decline may accelerate if it broadcasts a signal that there is more pain to come. As a result, bearish sentiment may build and compound AUD/USD’s losses.

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or@ZabelinDimitrion Twitter