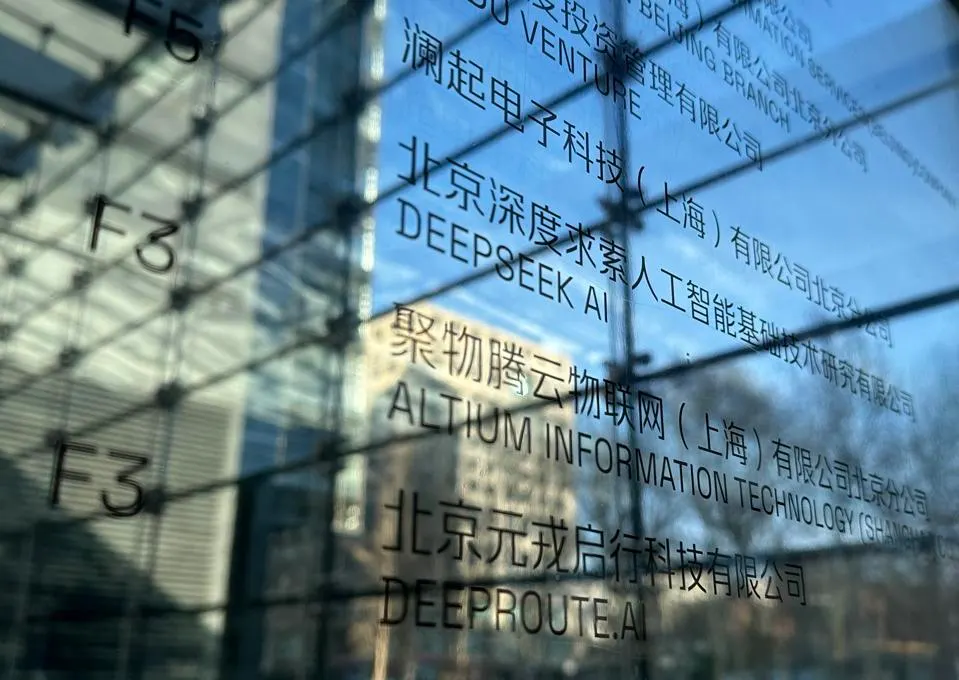

Will The Chinese Win The AI Race?

Chinese startup DeepSeek has taken the tech world by surprise with its new R1 artificial intelligence model. Traders, analysts, and major tech companies are all watching closely as this development roils share prices and challenges long-held beliefs about AI investment. While many see R1 as a sign of progress and innovation, others warn of data theft, hidden costs, and risky global competition.

Below, we explore R1’s impact on financial markets, the technology behind it, and the controversies swirling around DeepSeek’s parent company, High-Flyer Quant. We will also look at why some experts doubt DeepSeek’s claims and how open-source AI models like R1 might change the industry. Finally, in our ‘What’s Next’ section, we discuss the likely consequences of R1 for investors and regulators worldwide.

The Shock to Global Tech Stocks

DeepSeek R1’s official unveiling on 29 January 2025 caused an immediate stir across markets. According to news reports, Nvidia’s share price plummeted by 17% in just 24 hours, wiping out USD 600 billion from its valuation. This drop came despite Nvidia’s warm public support for DeepSeek’s technical achievements. A representative from Nvidia stated:

"DeepSeek represents a significant advancement in artificial intelligence and exemplifies the concept of Test Time Scaling... The work by DeepSeek demonstrates how innovative models can be developed using this approach".

Still, shareholders saw the R1 announcement as a threat. DeepSeek claims it trained R1 using 2,000 Nvidia H800 GPUs, each costing between USD 25,000 and USD 30, rather than the pricier H100 chips that Western firms usually buy for about USD 40,000 each . The fact that R1 reportedly cost USD 6 million to develop, compared to an estimated USD 100 million for OpenAI’s GPT-4, undercut many assumptions about how much cutting-edge AI should cost.

Other big names were not spared. Broadcom shares fell by 9%, while Microsoft and Meta each slid by 4-6%. Investors feared that DeepSeek’s approach could cut future demand for major AI infrastructure. Some argue this is an overreaction, but others see it as the beginning of a wider shake-up in AI investments.

The Debate Over R1’s Capabilities

DeepSeek says R1 matches or nearly matches GPT-4 performance on popular benchmarks like GPQA Diamond. Its supporters point to a 73.3% benchmark score, only a few points behind GPT-4’s 77.3%. R1 supposedly uses Test Time Scaling, which is a method of improving model responses during the inference stage rather than only during training. DeepSeek also claims greater efficiency in its architecture, though it has not disclosed the exact number of parameters in R1.

However, some critics say these figures need independent verification. As one example, they point to GPT-4’s massive training on 25,000 A100 GPUs, while R1 was reportedly trained on only 2,000 H800 GPUs. Some experts find it hard to believe a smaller-scale operation could reach near-parity with GPT-4 without cutting corners. Yann LeCun, a respected AI researcher at Meta, summed up the doubts:

"If verified, R1 demonstrates we’ve underestimated efficient architecture design. However, extraordinary claims require extraordinary evidence".

Critics also cite possible issues with the methodology used in DeepSeek’s benchmark tests. They question the exact training schedule, the data used, and whether R1’s performance was fairly measured.

Accusations of Intellectual Property Theft

OpenAI, the creator of GPT-4, has levelled serious charges against DeepSeek. OpenAI alleges DeepSeek engaged in model distillation by using unauthorised API access to steal GPT-4 outputs, thereby speeding up its own training. Microsoft’s security researchers have provided data suggesting that a group “believed to be connected to DeepSeek” moved large amounts of data from OpenAI’s API, though public evidence remains scarce.

DeepSeek strongly denies these claims. The company insists that R1 was built from the ground up and that it did not rely on competitor outputs or stolen code. For now, there is no final word on the matter, and the outcome could hinge on future legal action and code audits.

Who Backs DeepSeek?

DeepSeek is funded by High-Flyer Quant, a Chinese hedge fund that started in 2018 as an AI-driven trading firm. High-Flyer Quant has around USD 15 billion in assets under management, much of which comes from its early success in quantitative trading. In 2021, High-Flyer Quant moved away from direct finance activities to avoid certain Chinese market regulations. This pivot led to the creation of DeepSeek as a separate AI startup.

Lu Zhengzhe, the chief executive of High-Flyer Quant, spoke about their motivation to invest in new areas:

"We aspire to engage in endeavours of greater significance that extend beyond the investment sector... akin to launching a second startup".

Observers say DeepSeek’s relative secrecy was made possible by High-Flyer Quant’s deep pockets and lack of venture capital backers. They also note that High-Flyer’s experience with large-scale computing in the finance world gave DeepSeek a head start on infrastructure. Whether this internal advantage accounts for R1’s cost-efficiency, however, is still debated.

Claims vs. Reality: The Feasibility Divide

Sceptics insist R1 is too good to be true. They say the model’s reported scale is not enough to match GPT-4, especially with H800 GPUs that have government-imposed performance caps. There is also the question of how DeepSeek accessed such hardware, given export restrictions on cutting-edge chips destined for China.

Those who defend R1 argue that modern AI is about more than brute force. Clever code, data curation, and improved training methods can slash costs. Some open-source researchers have run initial tests on R1’s code and found parts to be highly efficient. They believe R1 might prove the value of novel approaches like Test Time Scaling, which could change the entire AI industry.

The Rise of Open-Source AI

R1 is notable not just for its performance but also for its open-source availability. Analysts say this could mark the start of a new era in AI. With R1 free to examine and adapt, smaller firms might reduce the usual USD 50 million or more required to train large models. This could democratise AI development and let startups compete with giants who have historically enjoyed near-monopolistic data and resources.

- Lower Barriers: If R1’s methods become well understood, any organisation could launch advanced models without sky-high cloud bills or proprietary data sets.

- Specialised Models: Open-source foundations often lead to specialised variants, such as healthcare chatbots or localised models for emerging markets.

- Regulatory Puzzle: Open AI systems raise questions about how to enforce safe usage. Authorities worry that narrower export rules may not stop groups from re-tooling these openly available models.

- Market Shift: Investors might move funds from large-scale GPU clusters to more experimental, architecture-focused AI startups.

The Pressure on Western Tech Giants

With R1 on the scene, giants such as OpenAI, Meta, Google, and Microsoft must show why their multi-billion-dollar infrastructure remains worth it. They also face increased scrutiny around security practices if, in fact, DeepSeek or other groups can glean valuable data from unprotected APIs.

Many watchers think we will see new legal measures to stop or regulate cross-border AI leaks, especially given rising geopolitical tensions. There could also be greater appetite for external audits of large AI models, verifying training data and performance claims.

What’s Next

DeepSeek has hinted at a future initial public offering (IPO) by the end of 2025. If R1’s claims stand, DeepSeek could become a top player in the AI industry. If the opposite occurs, the fallout may be swift and severe, with potential lawsuits or regulatory penalties.

For investors, the R1 launch highlights how quickly AI sentiment can shift. There will be closer attention to smaller, cost-effective projects, and a more cautious approach to expensive GPU deals. Some foresee consolidation, where big cloud providers buy emerging startups that demonstrate efficient AI techniques.

In the meantime, regulators across the globe, including those in the United States and the European Union, are expected to examine if export rules or new AI oversight are necessary. The next few months will show whether DeepSeek’s R1 is a genuine leap in AI technology or simply a short-lived shock to the market. Either way, finance professionals must stay alert to the shifting tides of AI development and the new questions these disruptions pose for investments, intellectual property, and cross-border competition.

World Liberty Seeks Federal Trust Charter

World Liberty Financial, the crypto venture backed by the Trump family, has applied for a US national bank trust charter... Read more

Saudi Banks Tap Overseas Markets

Saudi Arabia’s banks are borrowing from international markets at their fastest pace on record, as lenders try to squar... Read more

Amazon Continues To Cut 16000 Gone

Amazon has announced plans to cut a further 16,000 roles from its corporate workforce, extending the cost and organisati... Read more

The UK May Have A Voice In Ai

Europe’s AI sector has grown accustomed to playing catch-up. Capital has flowed more slowly than in Silicon Valley, va... Read more

Musk Applies Pressure To BT

Britain’s broadband market has spent the past decade locked in a familiar pattern. Incumbents invested heavily in fibr... Read more

Blackrock Sees EMEA Moving Into Private Assets

BlackRock has warned that investors across Europe, the Middle East and Africa are reshaping portfolios in response to wh... Read more