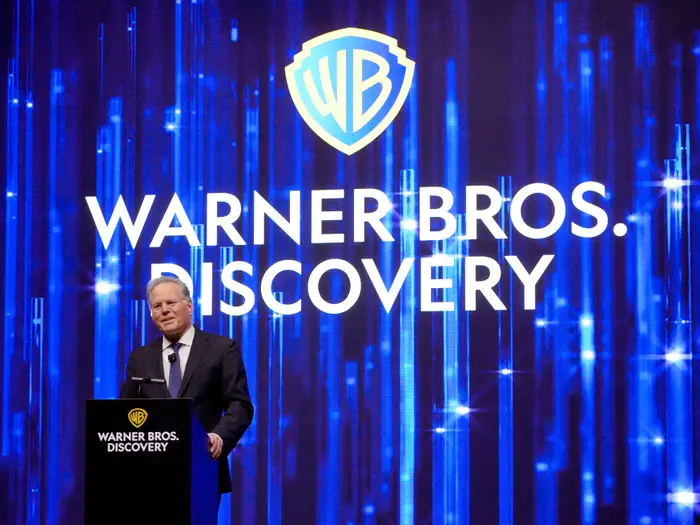

Warner Bros Discovery Weighs Break-Up Plan

Warner Bros Discovery (WBD) is considering splitting its digital streaming and studio businesses from its traditional TV networks. This move could help boost its declining share price. The US media giant, behind CNN and HBO, is exploring options to improve its financial standing.

CEO David Zaslav is looking at various strategies. These include selling assets or creating a new company for Warner Bros movie studio and Max streaming service. This new entity would not carry most of the group’s $39bn net debt. Despite these discussions, WBD has not yet hired an investment bank to start any specific transactions. However, top management is consulting advisers to find the best path for shareholders.

WBD’s major backers include cable tycoon John Malone and the Newhouse family, owners of Condé Nast. People close to WBD have also informally reached out to advisers of rival media firms to gauge interest in mergers and acquisitions involving some of its assets.

Earlier, WBD considered mergers with Comcast’s NBCUniversal and Paramount. Paramount has since agreed to sell itself to David Ellison’s Skydance studio. Both Comcast and Paramount have traditional TV assets and smaller streaming platforms.

WBD has not commented on the matter. Insiders say that while a break-up seems like the best option, the company could still decide to continue its current operations. In the event of a split, most of the debt would stay with the mature pay-TV networks business. This could help the new streaming spin-off achieve a higher valuation, though there are risks involved, particularly with creditors.

Bank of America analysts have warned that such a split could be harmful to bondholders. A recent example is Lionsgate, which faced a creditor backlash after separating its Starz pay-TV network. WBD’s debt was raised under lenient conditions, with few restrictions against such financial moves.

The proposed “strategic spin-off” would form a company with WBD’s traditional TV assets. These assets, despite a decline in revenues, still generate most of its cash flow. The new streaming and studio business would have less debt and more flexibility for growth.

This plan comes amid broader concerns about WBD. Since AT&T spun off Warner Bros and merged it with Discovery two years ago, WBD’s shares have plummeted by about 70%. The company has been hit by a drop in advertising revenue, high streaming development costs, the Covid-19 pandemic, Hollywood strikes, and several costly flops.

Despite cutting costs and paying down debt, WBD’s stock fell 10% in February when its CFO said he could not project free cash flow for the year. Jessica Reif Ehrlich, a BofA analyst, wrote that WBD’s current structure is not effective. She suggested exploring asset sales, restructuring, and mergers, while acknowledging the risk of a creditor backlash.

A split could also bring other challenges. The two new companies would need to negotiate terms for sharing sports rights and other content that WBD currently distributes across both digital and traditional platforms.

Speculation about a potential deal arose from Zaslav’s recent comments at the Allen & Company conference in Sun Valley. When asked about the US presidential race, he remarked on the need for deregulation to allow companies to consolidate and improve their operations.

The coming months will be crucial for WBD as it navigates these complex decisions. The outcome will determine the future of one of the largest media companies in the world.

World Liberty Seeks Federal Trust Charter

World Liberty Financial, the crypto venture backed by the Trump family, has applied for a US national bank trust charter... Read more

Saudi Banks Tap Overseas Markets

Saudi Arabia’s banks are borrowing from international markets at their fastest pace on record, as lenders try to squar... Read more

Amazon Continues To Cut 16000 Gone

Amazon has announced plans to cut a further 16,000 roles from its corporate workforce, extending the cost and organisati... Read more

The UK May Have A Voice In Ai

Europe’s AI sector has grown accustomed to playing catch-up. Capital has flowed more slowly than in Silicon Valley, va... Read more

Musk Applies Pressure To BT

Britain’s broadband market has spent the past decade locked in a familiar pattern. Incumbents invested heavily in fibr... Read more

Blackrock Sees EMEA Moving Into Private Assets

BlackRock has warned that investors across Europe, the Middle East and Africa are reshaping portfolios in response to wh... Read more