UK Inflation Continues To Drop

Lower energy and food price growth have pulled headline consumer prices inflation down. The Office for National Statistics (ONS) reported that easing tobacco prices added to the downward pressure on inflation. Food inflation fell to 2.9%, its lowest since November 2021, down from a peak of nearly 20%.

"Today is a significant moment for the economy, with inflation back to normal," said Rishi Sunak. "This shows the plan is working and our tough choices are paying off. Better days are ahead if we stick to the plan to enhance economic security and opportunity for all."

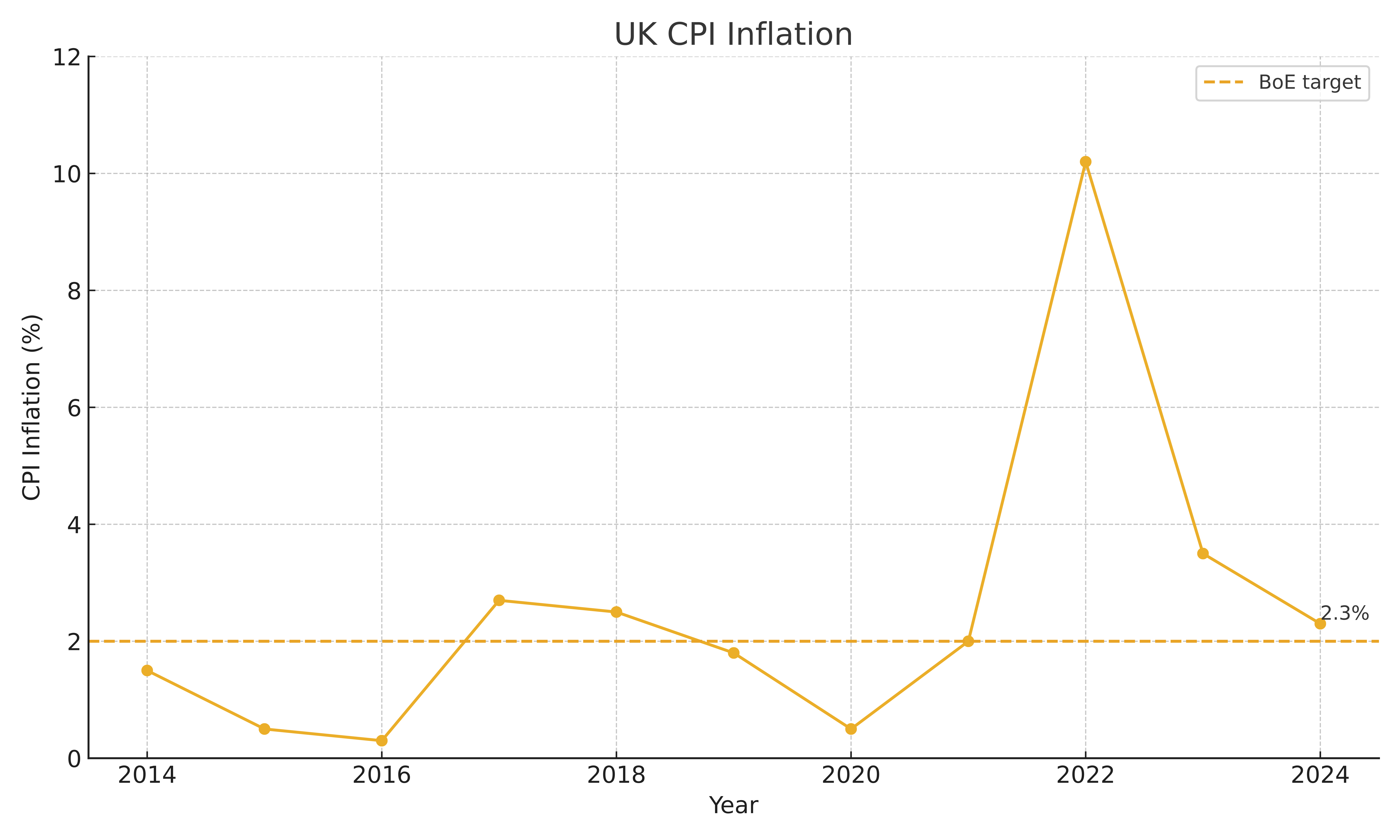

Inflation is now at its slowest since July 2021, down from a peak of 11.1%, a 42-year high, in October 2022. Ofgem, the energy regulator, cut the cap on average annual household energy bills by 12% in April.

Rishi Sunak commented, “Better days are ahead.”

“There was another large drop in annual inflation, led by lower electricity and gas prices due to the Ofgem energy price cap reduction,” said Grant Fitzner, ONS chief economist. “Tobacco prices also helped lower the rate, with no duty changes announced in the budget. Food prices inflation continued to fall, though this was partly offset by a small rise in petrol prices.”

The slowdown in price growth to near the Bank of England’s 2% target suggests an end to the worst of Britain’s cost of living crisis and indicates the economy is picking up speed. The UK emerged from a brief recession early in the year, with growth hitting 0.6% in the first quarter. Sunak aims to make economic recovery a key point in the Conservative election campaign.

The International Monetary Fund (IMF) raised its forecast for GDP growth this year to 0.7% from 0.5%, advising Chancellor Jeremy Hunt not to cut taxes further to avoid straining public finances. The IMF indicated the Bank could cut rates three times this year in quarter-point steps.

The UK’s inflation rate is now lower than those of the US and the eurozone, at 3.4% and 2.4% respectively. The UK saw the third largest price surge among the Organisation for Economic Co-operation and Development (OECD) countries.

However, the new inflation reading exceeded the Bank’s forecasts, strengthening the case to delay cutting borrowing costs until the August meeting. This data caused sterling to rise sharply against the dollar.

Services inflation, closely monitored by the Bank to assess domestic price pressures, slowed to 5.9% from 6% in March, still above the Bank’s forecasts. Core inflation, excluding volatile food and energy prices, fell to 3.9% from 4.2%.

The Bank’s nine-member ratesetting committee has stressed that services inflation and wage growth must slow before it can lower borrowing costs. The base rate has risen to 5.25%, a 16-year high, from 0.1%. The Bank last cut rates in March 2020.

Tomasz Wieladek, chief European economist at T Rowe Price, said: “Though there is some evidence that services inflation is gradually falling, today’s data will likely prevent a cut in June. The MPC has repeatedly said that services inflation will be key in assessing if domestic inflation is sustainably falling.”

Paul Dales, chief UK economist at Capital Economics, stated: “A cut in June now seems very unlikely. Even a cut in August looks less certain.”

World Liberty Seeks Federal Trust Charter

World Liberty Financial, the crypto venture backed by the Trump family, has applied for a US national bank trust charter... Read more

Saudi Banks Tap Overseas Markets

Saudi Arabia’s banks are borrowing from international markets at their fastest pace on record, as lenders try to squar... Read more

Amazon Continues To Cut 16000 Gone

Amazon has announced plans to cut a further 16,000 roles from its corporate workforce, extending the cost and organisati... Read more

The UK May Have A Voice In Ai

Europe’s AI sector has grown accustomed to playing catch-up. Capital has flowed more slowly than in Silicon Valley, va... Read more

Musk Applies Pressure To BT

Britain’s broadband market has spent the past decade locked in a familiar pattern. Incumbents invested heavily in fibr... Read more

Blackrock Sees EMEA Moving Into Private Assets

BlackRock has warned that investors across Europe, the Middle East and Africa are reshaping portfolios in response to wh... Read more