Trump Brings Relief To The Markets

With a 90-day stay of execution, what can we expect from Trump now

With a 90-day stay of execution, what can we expect from Trump nowWhat does Trump’s tariff pause mean for global trade?

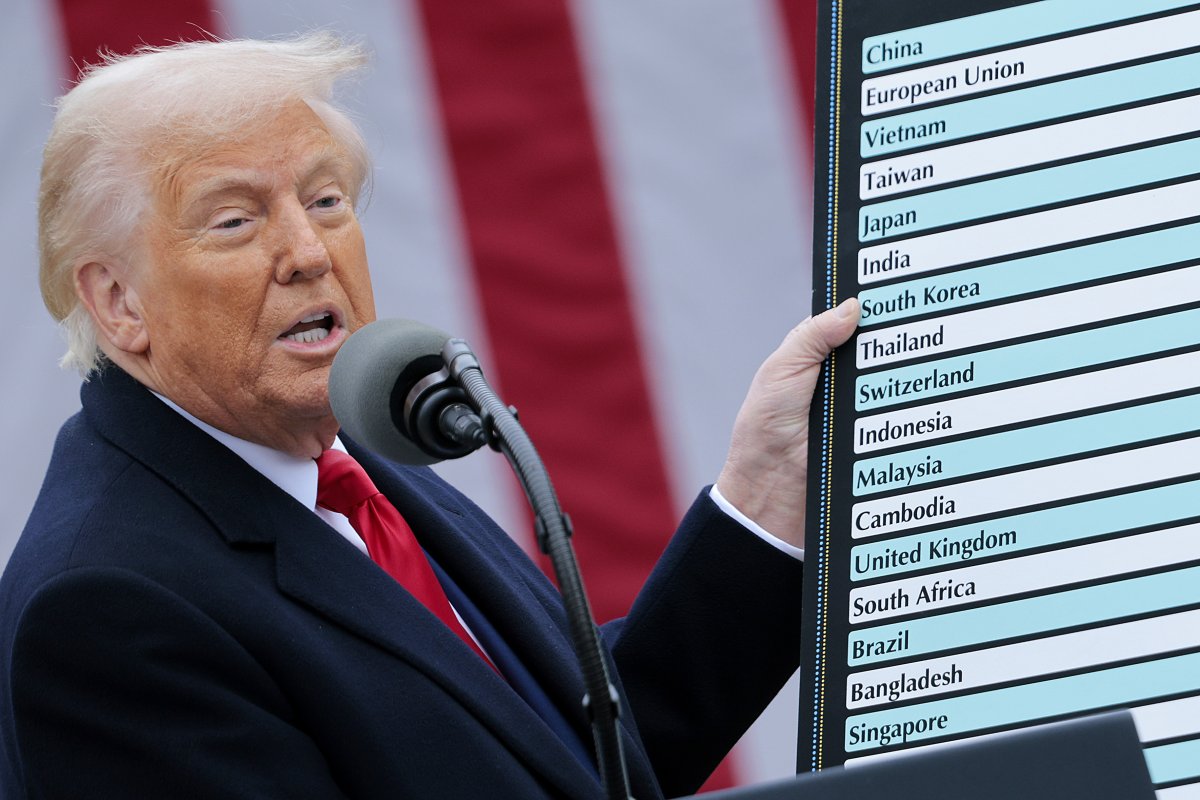

Investors and governments breathed easier when President Donald Trump announced a 90-day suspension of the sweeping tariffs he had imposed on key US trading partners only a week before. This move steadied markets, which feared an all-out trade conflict. Yet, at the same time, Trump hiked tariffs on China to 125 per cent, reminding everyone that his clash with Beijing is far from settled.

This sudden U-turn is part of Trump’s “reciprocal” tariff scheme, which has lurched repeatedly since he took office. Now, with three months of breathing space, politicians, businesses, and investors wonder if a lasting shift is possible or if another jolt awaits.

Why did Trump pause the tariffs?

The sweeping duties on US allies sparked a global sell-off in equities, drawing rare rebukes from top Republicans on Capitol Hill. Some billionaire donors, who usually back the party, also raised alarms. Explaining his about-face, Trump cited stock market turmoil and said investors were on edge. “We need some flexibility,” he told reporters.

His announcement hit as Jamieson Greer, his chief trade negotiator, was testifying to lawmakers. Caught by surprise, Democratic representative Steven Horsford shouted, “WTF, who’s in charge?” Greer’s response was blunt: “The president of the United States.”

Which tariffs remain?

A 10 per cent baseline tariff now applies to imports from all countries, including the EU, though there are exemptions for semiconductors, copper, lumber, pharmaceuticals, precious metals, energy, and certain minerals not produced in the US. Cars and car parts escaped that 10 per cent levy but still face a separate 25 per cent duty Trump introduced last month.

Mexico and Canada initially dodged the worst of Trump’s reciprocal plan, but Washington later slapped a 25 per cent charge on goods from those neighbours if they fail to meet the terms of the 2020 USMCA deal. The White House confirmed this levy remains active.

Also in force are 25 per cent tariffs on steel and aluminium imports, and investigations continue into potential duties on copper and lumber. Trump has hinted at future tariffs on semiconductors and medicines as well.

Will the ‘reciprocal’ tariffs return?

Trump insists more than 70 countries are eager to craft new trade deals with Washington. The White House hopes to close many of these talks within 90 days so the suspended tariffs do not reappear. Affected nations include Japan, South Korea, Vietnam, and Cambodia, among others with large manufacturing sectors.

Allie Renison, a former UK trade department official now at consultancy SEC Newgate, believes so many overlapping negotiations may overwhelm US trade staff. She suggests narrower, product-specific tariffs could be less disruptive, since they would target alleged unfair practices in particular goods rather than slapping duties on entire countries.

Why did Trump not reduce tariffs on China?

While easing the burden for many partners, Trump raised China’s tariff rate from 104 to 125 per cent. Beijing had just imposed retaliatory duties in response to a prior US increase. US Treasury Secretary Scott Bessent pinned the blame on China, noting he warned them not to strike back.

Most countries at least approached Washington for dialogue, but no talks are underway with Beijing. Trump says he does not plan another increase for China and expects a deal in due course. Yet Chinese officials say they will not bow to pressure, and that President Xi Jinping is unlikely to speak with Trump unless officials first narrow the gulf in proposals.

Is the global trade war over?

Economists say Trump’s forceful approach has already caused damage. Even if some tariffs are paused, businesses are wary. They do not want to invest heavily while policies change so fast.

Investors in financial markets share this caution. Steven Abrahams, head of investment strategy at Santander US Capital Markets, says the respite might calm nerves short-term, but “if the White House flips back to a hard line, we could see another sell-off.”

For now, markets have steadied, though many remain on alert for fresh surprises. If trade talks stall or if Trump decides the new deals are not coming fast enough, he may lift the pause and reinstate the wide-reaching tariffs. The White House has been clear that they are merely suspended, not scrapped.

Meanwhile, China stands apart. Trump’s decision to double down on higher tariffs against Beijing has deepened the rift. US officials say China must grant wider market access and improve respect for intellectual property, but Beijing calls the tariffs bullying and vows not to cave. The fact that no talks are ongoing suggests tensions may simmer.

Some analysts see these moves as part of a broader power struggle, with the US defending its long-held dominance of global trade while China climbs fast. The administration’s critics claim Trump wants quick wins by pressuring smaller nations, then forcing China to yield. But so far, Beijing has refused to budge, and the conflict remains unresolved.

Businesses and policymakers hope the next 90 days yield tangible results. If new agreements can be signed, that might reduce friction and restore confidence. But if negotiations fail or prove too slow, the US may revert to sweeping duties, and other countries could retaliate.

The uncertain path ahead worries many who had hoped for calmer trade relations after so many policy twists. While some cheer the temporary halt, others see it as little more than a delay. The final outcome may depend on whether Trump can secure enough favourable deals and whether he sees a tougher stance on China as politically useful. Until then, firms across the globe must plan around shifting rules, bracing for the next shift in a trade saga that remains far from settled.

World Liberty Seeks Federal Trust Charter

World Liberty Financial, the crypto venture backed by the Trump family, has applied for a US national bank trust charter... Read more

Saudi Banks Tap Overseas Markets

Saudi Arabia’s banks are borrowing from international markets at their fastest pace on record, as lenders try to squar... Read more

Amazon Continues To Cut 16000 Gone

Amazon has announced plans to cut a further 16,000 roles from its corporate workforce, extending the cost and organisati... Read more

The UK May Have A Voice In Ai

Europe’s AI sector has grown accustomed to playing catch-up. Capital has flowed more slowly than in Silicon Valley, va... Read more

Musk Applies Pressure To BT

Britain’s broadband market has spent the past decade locked in a familiar pattern. Incumbents invested heavily in fibr... Read more

Blackrock Sees EMEA Moving Into Private Assets

BlackRock has warned that investors across Europe, the Middle East and Africa are reshaping portfolios in response to wh... Read more